Only HODLers Remain…

News

|

Posted 05/07/2022

|

8434

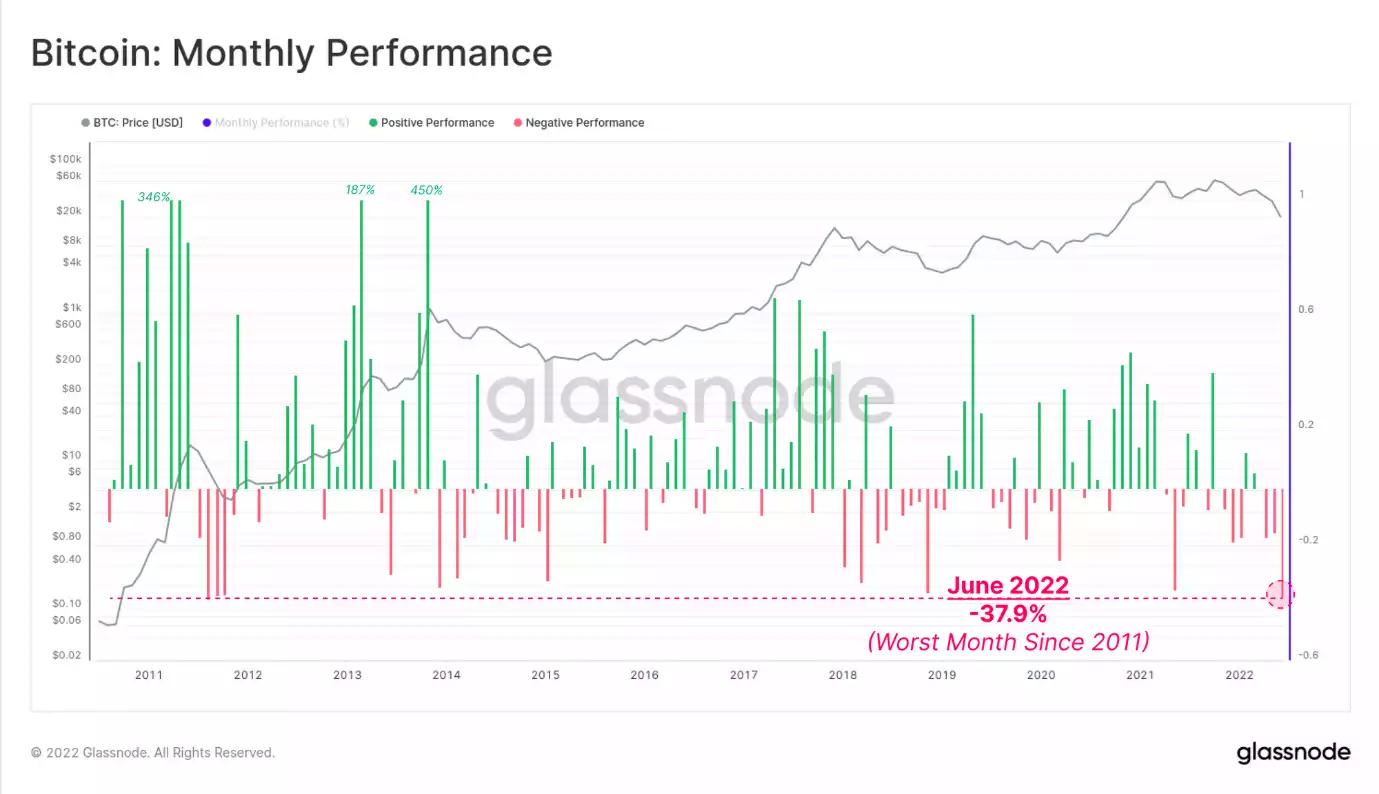

As the first half of 2022 comes to a close, Bitcoin has locked in one of the worst monthly price performances in history. Prices traded down -37.9% over the last 30-days, competing only with the 2011 bear market, for the crown of the worst month on record. For a sense of scale, BTC prices were sub-US$ 10 in 2011.

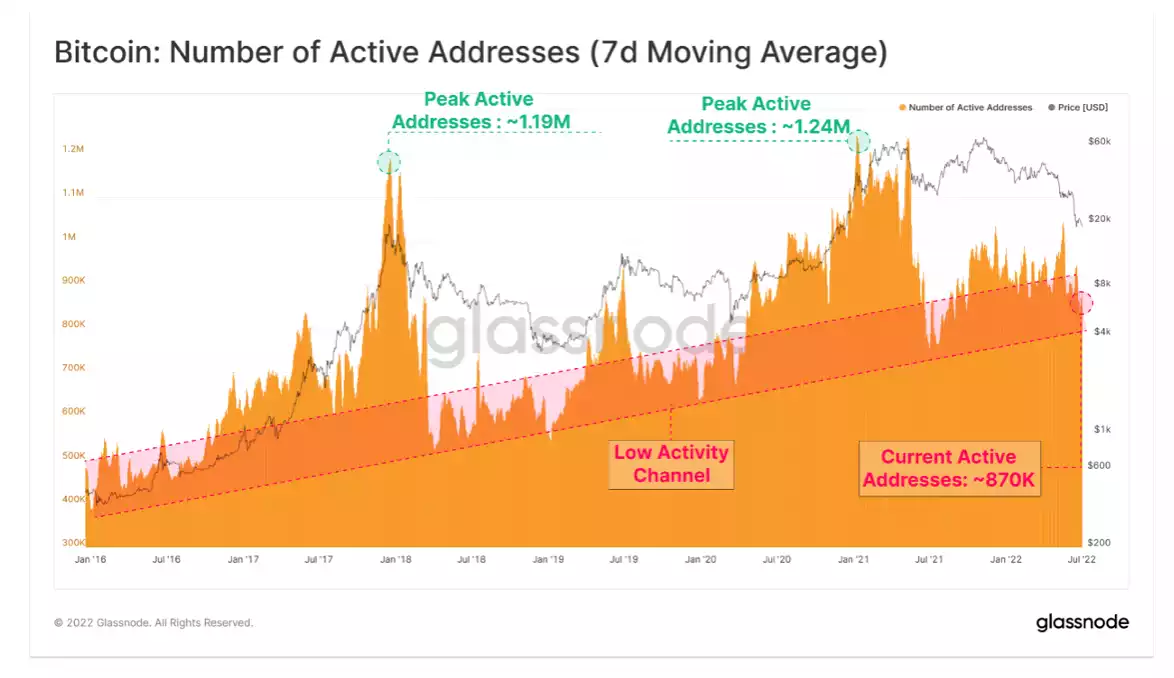

With US inflation estimates for June remaining elevated, and storm clouds of a potential recession looming, the market remains heavily risk-off. This is evident in the on-chain performance and activity of Bitcoin, which has reduced modestly in recent weeks. With network activity now at levels coincident with the deepest bear phase in 2018 and 2019, it appears that a near-complete purge of market tourism has taken place.

The activity that does remain however appears to align with a steadfast trend of high conviction accumulation and self-custody. Exchange balances are draining at historically high levels, and Shrimp and Whale balances are increasing meaningfully.

To give further perspective to the scale and velocity at which the market has exited BTC recently, we look to the Number of Active Addresses. The number and activity of network users are approaching the deepest historical bear market territory. The Bitcoin network is approaching a state where almost all speculative entities and market tourists have been completely purged from the asset.

Address activity for example has declined by 13% from over 1M/day in November, to just 870k/day today. This suggests little growth in new users, and even a struggle to retain existing ones.

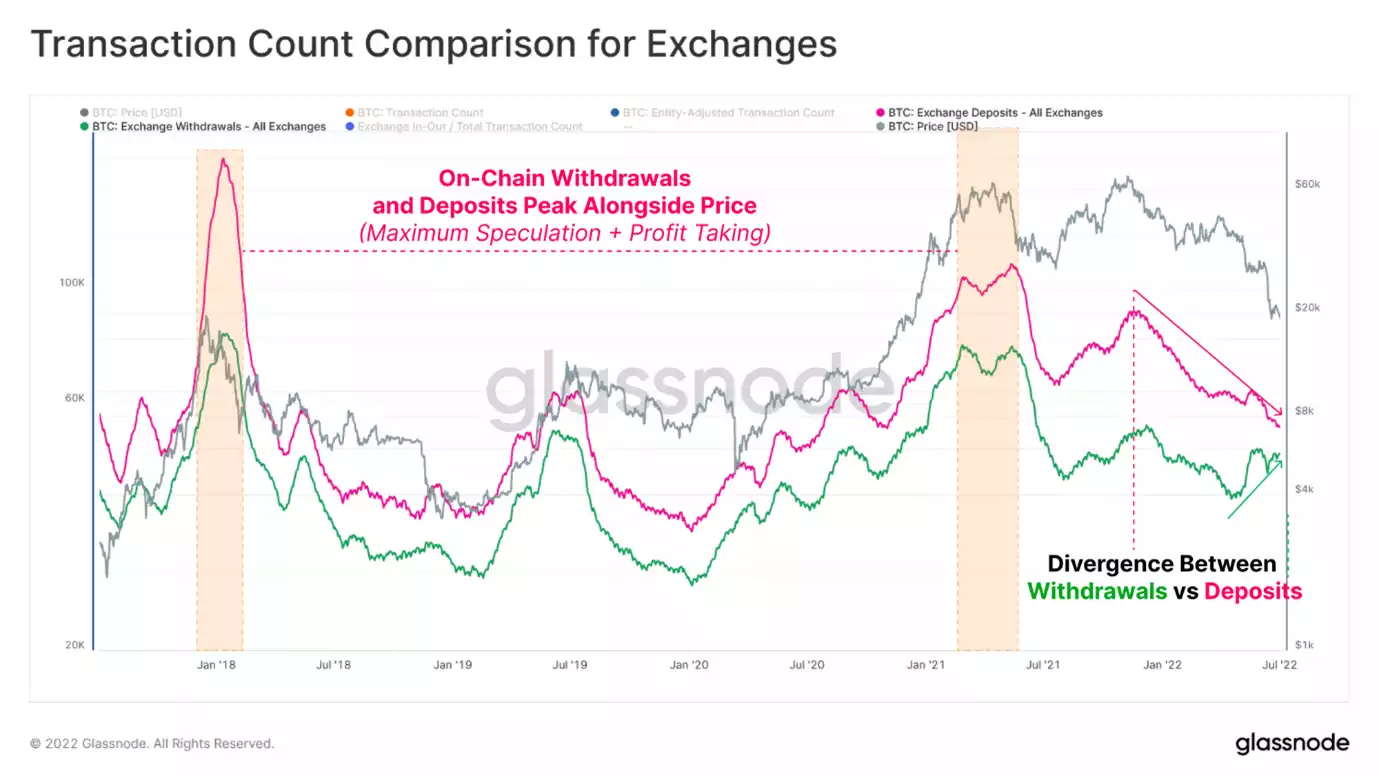

Exchanges remain a centrepiece of Bitcoin market infrastructure, with hundreds of millions, to billions of dollars in Bitcoin value flowing through on-chain daily. The number of exchange deposits and withdrawals, tend to show a high degree of sensitivity and correlation with spot prices.

Generally speaking, both deposits and withdrawal counts trend alongside price, peaking around bull market tops, when the inflow of speculative demand is highest. Withdrawals (green) are often fewer in number relative to deposits (pink). This is due to exchanges processing multiple customer withdrawals in a single transaction, whereas deposits are processed on an individual basis.

Over recent weeks, renewed attention has been placed on the self-custody of blockchain assets, with several lending services halting user deposits and withdrawals. Perhaps in response to this unfortunate occurrence, we are currently seeing exchange withdrawals increasing, whilst deposit counts continue to decline.

This is historically unusual, with few similar examples in the last 5-years. Recent events such as the LUNA collapse, frailty in Celsius and 3 Arrows Capital have spooked market participants. The trend has veered back to "own your keys" with the market preferring coin security over yield. This trend can be seen in exchange outflows. Exchanges have seen the largest monthly decline on record, hitting an outflow rate of -150k BTC/month.

Bitcoin on-chain activity is firmly in the bear market territory, and the most recent network utilization suggests an almost complete purge of all market tourists has occurred. Demand for block space is low, and the growth of network users is lacklustre at best.

However, below the surface, the market is experiencing several very intriguing divergences. Despite a historically bad year-to-date, and now the worst month of price-performance since 2011, strong HODLer undertones persist.

Exchange reserves continue to drain, as participants find renewed momentum towards self-custody. These coins appear to be flowing into wallets with no history of spending, and the balanced growth and exchange withdrawal activity of both Shrimp and Whale cohorts are at historically aggressive levels.

The Bitcoin bear is in full swing, and in its wake, the HODLers of last resort are the last ones standing. Everything is screaming that we are in a late-stage bear market. If the events in the previous few months have taught us anything, it's that you need to have your crypto secured either in your own secure wallets or with reputable custody solutions – like an Ainslie Crypto Storage Account. As the saying goes; “Only when the tide goes out do you discover who's been swimming naked.”

Stay safe in these late-stage bear markets.