China’s Careful Gold Play

News

|

Posted 22/07/2015

|

4517

There has been much media about China’s disclosed gold holdings as we reported on Monday. What many of the more ‘zealous’ gold commentators miss on predicting an imminent crash of the USD and being replaced by the Chinese Renminbi/Yuan is that China a) has a long way to go, and b) are long term strategic players in the grand economic game. One of the more credentialed currency commentators is Jim Rickards. It’s worth reflecting on what he wrote back in May of this year (well before Friday’s announcement)

“Meanwhile, China will probably announce its increased gold holdings later this year. But don’t expect fireworks. China has three accounts where they keep gold — the People’s Bank of China, PBOC; the State Administration of Foreign Exchange, SAFE; and the China Investment Corp., CIC.

China can move enough gold to PBOC when they are ready and report that to the IMF for purposes of allowing the yuan in the SDR. Meanwhile, they can still hide gold in SAFE and CIC until they need it in the future.”

And when it comes to analysis of China’s gold few come near Koos Jansen who this week had this to say:

“With the US having the power to obstruct renminbi inclusion into the SDR, the Chinese have to play it safe. They are required to be transparent about their true gold reserves, but may not want to upset the US by disclosing an official gold reserve figure at 3,500 tonnes. The 1,658 tonnes figure, which is too little to rock the global financial order, though a sign that China assesses gold to be “an important element of international reserve diversification” may thus be an appropriate figure. It’s not in China’s interest to rush into a new international monetary system as they continue to diversify away from the US Dollar.

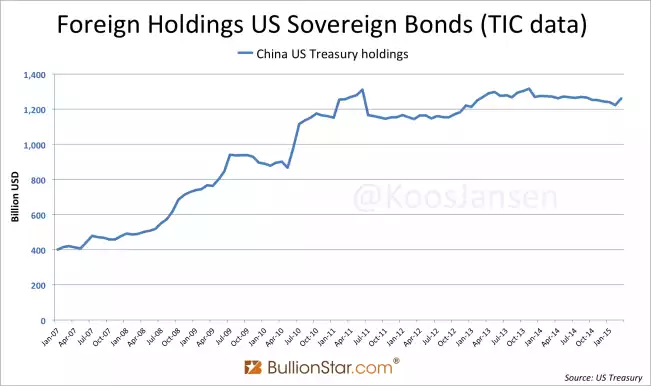

From the above chart, we can see China is not net selling US treasuries, but that they have stopped increasing their accumulated holdings since 2010. The Chinese aren’t ready for a major shift in the international monetary system yet. They are still working on further internationalization of the renminbi, the SDR inclusion, developing their financial markets and opening up their capital account. Only then will they unwind the US dollar. Until then, China will continue to adopt a slow step by step approach.”

There is little doubt in our mind that China has accumulated substantially more gold than that reported, and that at the right time that will be revealed. Monday’s flash crash of 4.2% on only 50 tonne of trade shows the lack of liquidity in the system at present. The whole set up appears to be tinder-box like where those who already have physical positions may well be hugely rewarded on the first real spark.