October’s NFP – The REAL Story

News

|

Posted 09/11/2015

|

3526

We warned our Weekly Wrap podcast listeners to brace themselves for Friday night’s NFP employment number fallout and it didn’t disappoint. Printing 271,000 new jobs and a 5% unemployment rate it was a headline that predictably saw shares, bonds and precious metals hit as the USD surged. ‘Good news is bad news’ continues to reign as this is seen as the final straw to a December rate rise. But as usual one need only look behind the headlines to see a vastly different story. For a start the participation rate remains at a 37 year low as 94.5m Americans are not even counted in that 5% because they have given up / officially left the labour force. If you include these “discouraged” workers who have left the market, that unemployment number jumps to 23%.

In the core employment sector of 25 – 54 year olds we actually saw 119,000 jobs LOST. The 55’s and older saw a gain of 378,000 as they apparently took part time jobs replacing those lost. That also isn’t apparently contained to just one each, as there were an extra 109,000 multiple job holders providing a clear indication of stress in the market as people struggle to make ends meet.

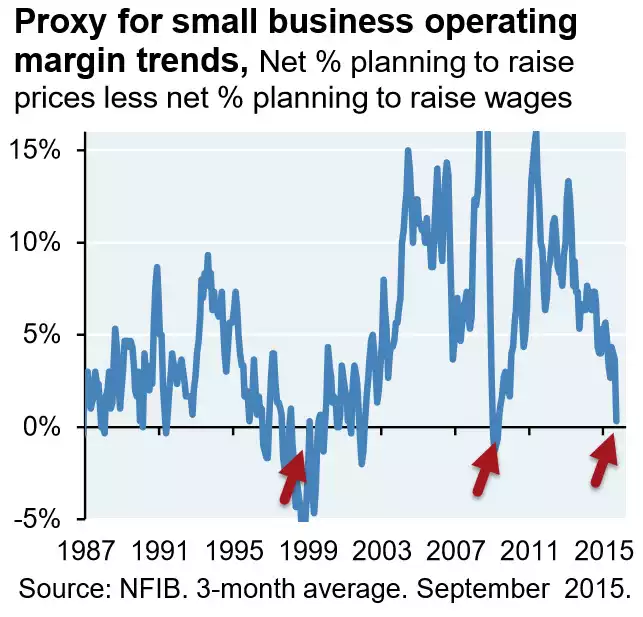

Even more telling is that just over half of that 271,000, or 145,000, of the new jobs are from the ‘dark art’ birth-death model which estimates unreported jobs losses from closing businesses and likewise new jobs in new business openings. Thursday’s Initial Jobless Claims for the week surged 6.15% and so far in 2015 there have been just under 545,000 layoffs, 31% higher than 2014. If you want a clear insight into the reality of new small businesses (and the sustainability of employment) the following chart tells it all. Anyone simply accepting that new startups are miraculously creating or keeping all these jobs might want to reconsider (the previous red arrows are recessions).

All that said, the headlines give the Fed something to hang their hat on for a December rise. Whilst we in no way think it will create a sustainable situation (higher rates on record debt, higher USD forcing the US into recession, and EM chaos) it may represent a point from which gold and silver will be able to truly rally rather than this drawn out jaw boning by the Fed weighing them down. Don’t fear the rise.