Diamond Hands

News

|

Posted 20/05/2021

|

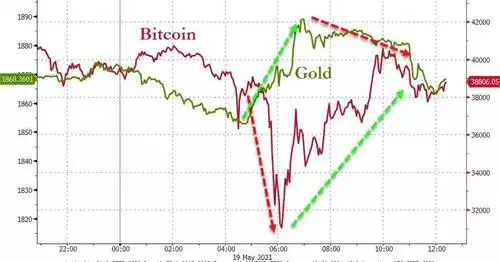

6397

Unless you live in a cave you might have heard of a bit of ‘bearish’ action in crypto markets. Last night BTC crashed to just US$31,000 taking the total correction to just under 50% from the 10 May high of US$59,200. Whilst bouncing strongly back, at US$39,500 now it is still down 33%. Ethereum hit US$2000 overnight, also down over 50% from its 12 May high of $4357. Conversely from 7 May when gold finally broke through US$1800 it has rallied to be now US$1870, barely unchanged in last night’s session after reaching US$1890 overnight amid all the market chaos that also saw US shares in the red again. Indeed the only thing demonstrably in the green last night was the USD after the Fed spooked the market with hints at possibly tapering stimulus.

The chart below shows the session through the eyes of bitcoin and gold which curiously saw them act in opposite action.

We have been watching this play out all week through the trade of our Gold Standard (AUS) and Silver Standard (AGS) on CoinSpot as heavy trade volumes would indicate people exiting crypto assets into gold and silver through our tokens as they take profit, park funds in a safe (and strengthening) haven and await to see where the bottom may be before potentially rotating back into crypto or keeping it in gold and silver seeing those as the better bet going forward.

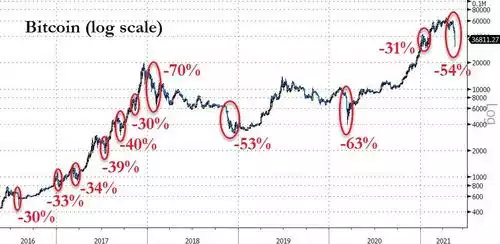

The market reaction to even a hint of tapering talk by the Fed last night highlights again how trapped they are. And so, in an environment of forced continued monetisation when you look at the chart below showing all the major Bitcoin corrections since 2016 (i.e. the last 2 cycles), it is heartening to see this isn’t unprecedented and certainly not in an environment of such fierce currency debasement and inflationary pressures.

Whilst yesterday’s renewed selling was off the news (which really wasn’t new) of China warning investors against speculative crypto trading and banning financial institutions and payment companies from providing services related to cryptocurrency transactions, it was Elon Musk’s tweet on Tesla not accepting Bitcoin for environmental reasons (whilst pumping DOGE which uses the same power) that started this correction. You will recall that Tesla also bought $1.5b of Bitcoin not that long ago. Musk also tweeted last night that Tesla has ‘diamond hands’ on its holdings meaning it is a holder. A cynic could surmise he has orchestrated a wonderful buying opportunity to top up with more…

We have always maintained that gold and Bitcoin are complimentary assets not competing assets. Whilst they share many of the same monetary store of value principles, one is 5000 years old and relatively stable and proven, the other barely over a decade old and finding its stable value at a time of simply unprecedented currency debasement and accumulation of debt.

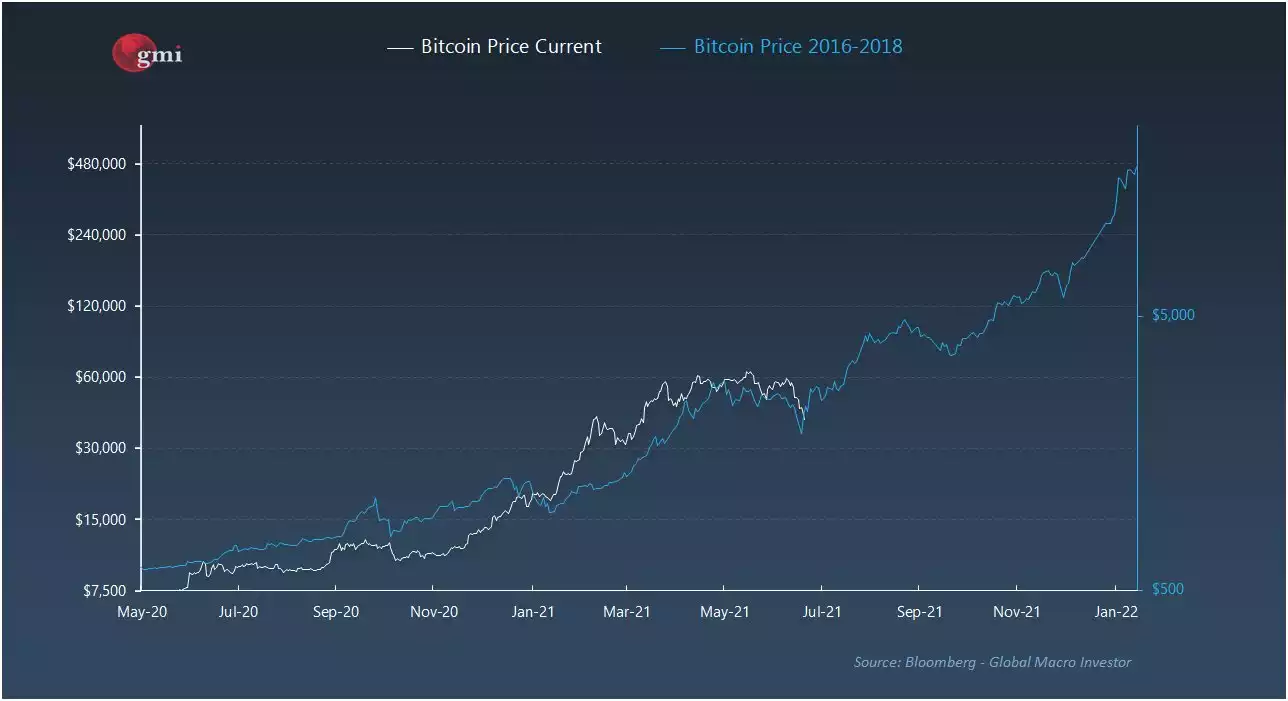

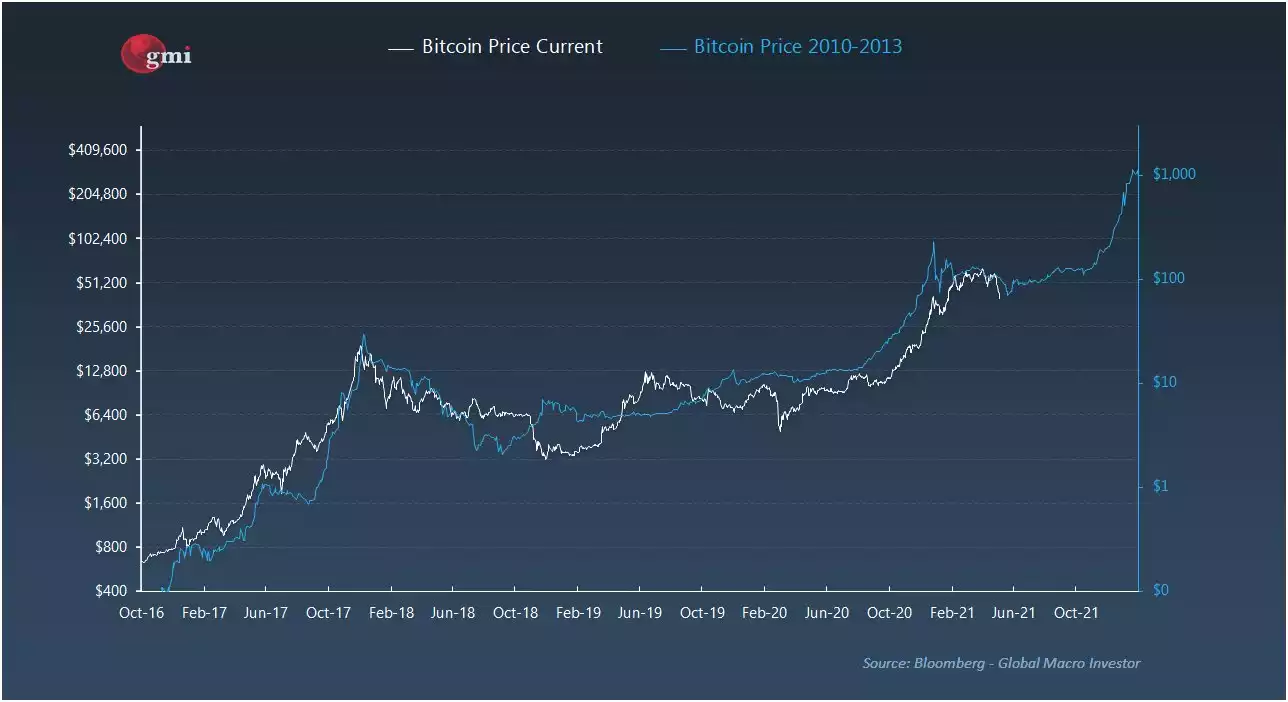

We have shared recently the technical set up for gold and silver looking very bullish right now. Below puts the current correction in bitcoin into perspective against the 2016 to 2018 bull market and the same for 2010 to 2013. What this still unresolved market action proves is that having both adds much needed balance.