What’s Driving the Gold Price?

News

|

Posted 28/01/2020

|

15170

On Friday we touched on the World Gold Council’s 2020 forecast. Today we provide more of this report and an interesting thesis on valuing gold through demand and supply through 4 key drivers.

Firstly, they outline why they believe 2020 is a supportive environment for gold.

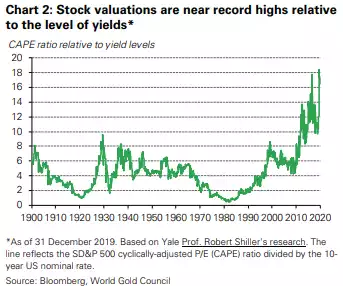

“Looking ahead, we believe investors – including central banks – will face an increasing set of geopolitical concerns, while many pre-existing ones will likely be pushed back rather than being resolved. In addition, the very low level of interest rates worldwide will likely keep stock prices high and valuations at extreme levels (Chart 2). And although investors may not step away from risk assets, anecdotal evidence suggests they are increasing exposure to safehaven assets like gold as a means to hedge their portfolios

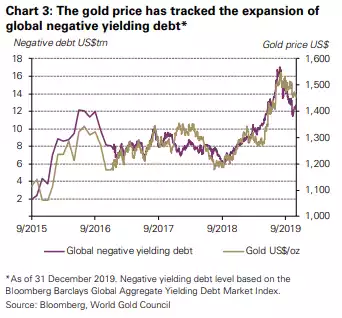

One of the key drivers of gold, especially in the short and medium term, is the opportunity cost of holding it relative to other assets, such as short-dated bonds. Unlike bonds, gold does not pay interest or dividends because it does not have credit risk. This perceived lack of yield can deter some investors. But in an environment where a whopping 90% of developed market sovereign debt is trading with negative real rates, we believe the opportunity cost of gold almost goes away. And it may even provide what can be seen as a positive “cost of carry” relative to bonds.

This is further evidenced by the strong positive correlation between the amount of debt and price of gold over the past four years (Chart 3). To some degree this illustrates the erosion of confidence in fiat currencies due to monetary intervention.

And the low rate environment is unlikely to change any time soon. Many central banks – the highest number since the global financial crisis – are cutting rates, expanding or implementing quantitative (or quasi-quantitative) easing and, in some instances, doing both.

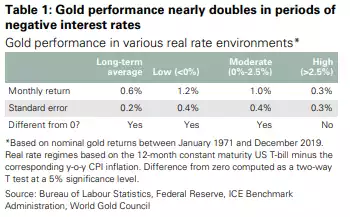

In fact, gold has historically performed well in the 12- to 24-month period following policy shifts from tightening to “onhold” or “easing” – the environment in which we currently find ourselves. And, historically, when real rates have been negative, gold’s average monthly returns have been twice as high as the long-term average. Even slightly positive real interest rates may not push gold prices down. Effectively,our analysis shows that it has only been in periods with significantly higher real interest rates – an unlikely outcome given the current market conditions – that gold returns have been negative (Table 1).

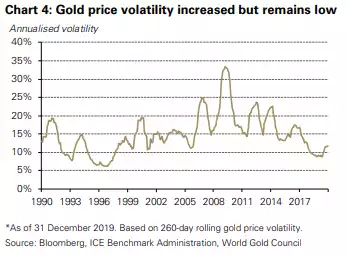

Gold volatility may rise

As the gold price significantly rose in 2019 so did volatility,but, similarly to other assets, it remains well below its longterm trend (Chart 4). And we don’t anticipate a reduction in gold volatility near term. Should the economic and political environment deteriorate, it may even rise, especially as gold volatility historically exhibits a positive skew in such circumstances, tending to increase as stocks pull back.”

Most of the above will not come as any surprise to regular readers but reinforces a lot of what we speak to. They do however have an interesting take on and have developed a model based on the intersection of demand and supply on 4 key drivers.

“Gold does not conform to most of the common valuation frameworks used for stocks or bonds. Without a coupon or dividend, typical discounted cash flow models fail. And there are no expected earnings or book-to-value ratios either.

Its dual nature as a consumer good and an investment means that jewellery demand can be boosted by economic growth even if investment demand may fall amid lower uncertainty or higher interest rates. These seeming contradictions can pose challenges but they can make gold an effective strategic asset.

In fact, our research shows that valuing gold is intuitive. In essence, its equilibrium price is determined by the intersection of demand and supply.

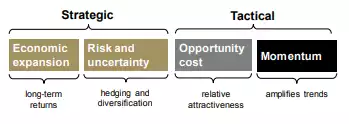

In particular gold’s performance can be explained by four broad sets of drivers:

• Economic expansion: periods of growth are very supportive of jewellery, technology and long-term savings

• Risk and uncertainty: market downturns often boost investment demand for gold as a safe haven

• Opportunity cost: the price of competing assets, especially bonds (through interest rates), currencies, and to a lesser degree other assets, influence investor attitudes towards gold

• Momentum: capital flows, positioning and price trends can ignite or dampen gold's performance.”

Remember around half of gold is used in jewellery and technology, and half for investment hence the dual nature of drivers of demand. The key parameter of supply is what makes it so enduringly valuable as there simply is no means of increasing supply beyond that current near 2% per year from mines and recycling is price driven.