COVID hits 10m – What Will Trump Throw at This?

News

|

Posted 29/06/2020

|

14222

The world just passed 2 bleak milestones in this pandemic, passing 10 million cases and 500,000 deaths. The feeling of this being ‘over’ is quickly passing as even domestically the surge in cases in Victoria highlight the dangers of relaxing.

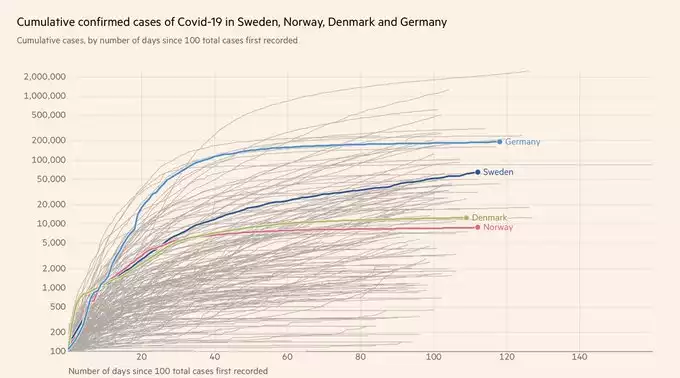

Whilst debate still rages over whether we should have locked down or not, the facts are becoming hard to ignore. The poster child of not locking down, Sweden, has been anything but a success with infections rising compared to their Scandinavian neighbours…

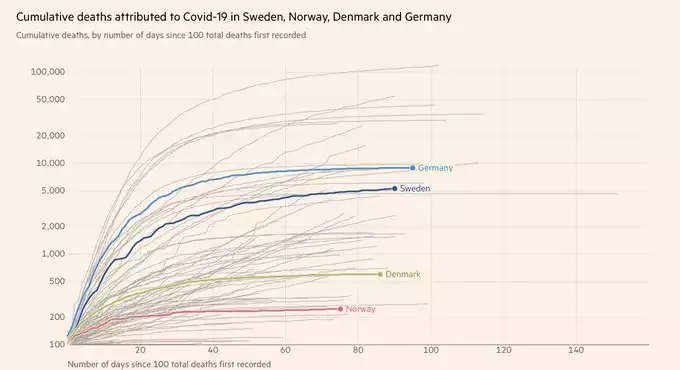

Including deaths rising much more…

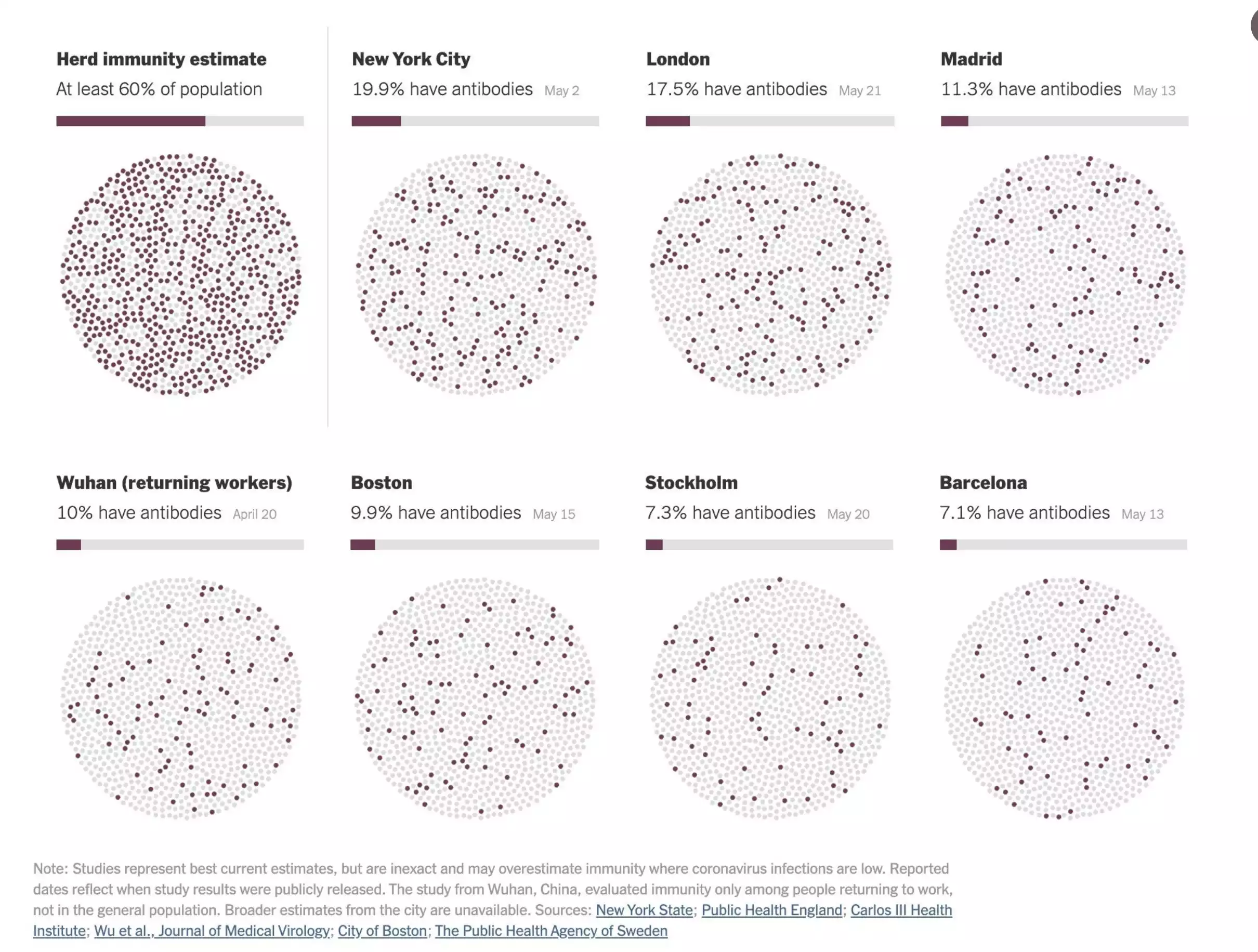

And debunking the herd immunity thesis with their capital Stockholm registering very low antibody counts…

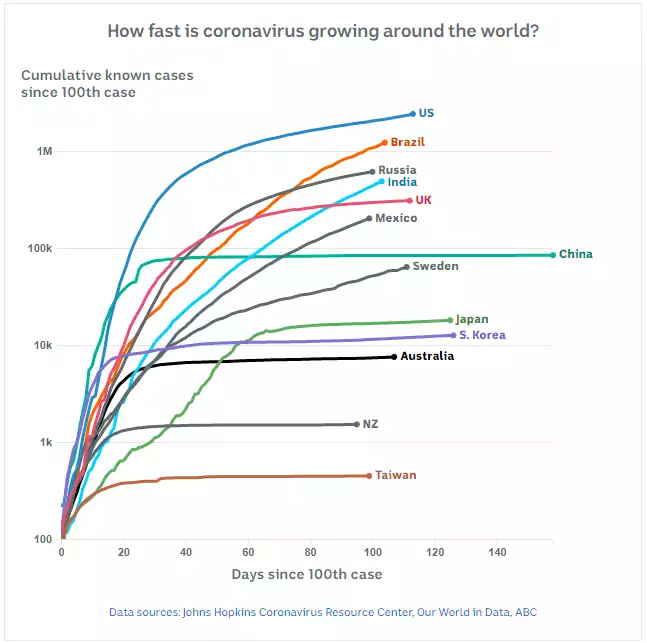

Of course the driver of not shutting down is to save the economy from the effects of that shutdown, yet Sweden has just experienced its largest plunge in GDP in history. As far away as you can get from Sweden is Brazil whose president Bolsanaro also thought this was ‘just a flu’ and wouldn’t hear of shutdowns and the like. As you can see below, that’s not working out so well and their GDP is tipped to fall 7% this year despite deficit spending seeing an 11% of GDP deficit including 17% of GDP on just paying the interest on their massive debt burden.

The chart above is also notable for the rise in the second most populous country in the world, India, and the non-flattening of the worst in class, the US.

The US is where the pain may likely really spread economically. With November fast approaching Trump needed a bounce in the economy. He took the punt and pushed for a reopening before they were ready and the figures speak for themselves. As he conceded, maybe he shouldn’t have tested so many…. Sweden and Brazil give no support that this ends well. The US has now cumulatively seen 40 million jobless claims since the pandemic broke. As we discussed recently here and here, the official unemployment figures hide the true impact as many of those 40m simply ‘give up’ and are not counted in the denominator of the total labour force. With things getting worse, not better in the US, it would be foolish to expect a V shaped recovery. Remember this too is before a lot of the support ends in July, assuming of course Trump doesn’t extend that support ahead of that same aforementioned election. But support is just that, it’s not a normal healthy economy and in no way supports a V shaped narrative. Very rarely in history are markets not strong going into a US election. Presidents usually ensure things are tickity-boo ahead of the polls and Trump will throw everything at doing the same. However he arguably has a harder task ahead than any before him. His crusade to ‘drain the swap’ has also not won him many friends in that swamp and this is the perfect storm to make him the scapegoat.

We have a sharemarket completely supported by Fed stimulus, a Fed he has not been kind to. They are pulling that support away as we speak and US markets continue to speak to that 8 June top being the top we will look back on as when the Hope Phase ended. Regardless, a second wave in the US puts more pressure on struggling businesses and households to meet their debt obligations and that is where insolvency starts to play out. No amount of liquidity from the Fed can change that. Watch, therefore, Trump try and stave off those insolvencies with direct fiscal stimulus. That at a time when US debt is already $26 trillion.

One thing is abundantly clear right now and that is we are going to see desperate actions out of the US, all of which will debase their currency and economic credentials even further. That is extremely supportive of higher gold prices in step.