The Problem with "Wealth Taxes"

News

|

Posted 31/01/2019

|

5896

The IMF reports that over the past three decades, income inequality has declined substantially at the global level. However, within countries, the picture is mixed with some countries experiencing a reduction in inequality while others, particularly advanced economies, have seen a significant increase. Research indicates that increased inequality can erode social cohesion, lead to political polarization, and ultimately lower economic growth.

To tackle the disruptive impacts of increasing inequality in advanced economies, there has been a new wave of discussions on both sides of politics in countries like Australia and the U.S. over the best way forward, and often these discussions end up with solutions involving “taxing the rich” or “wealth taxes”.

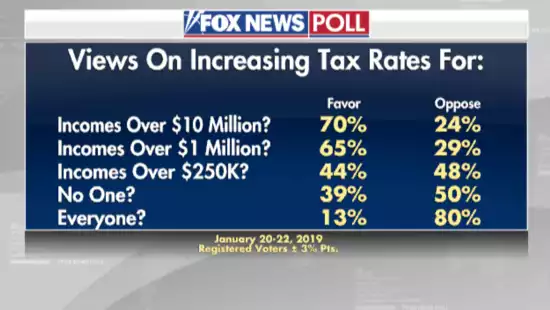

It is easy to understand why this is often seen as the best solution. It makes for good politics and generally receives a lot of support (in principle at least) from a broad cross-section of the community.

A recent Fox News poll highlights the strong support of Americans, for example, in terms of increasing tax on people with income levels higher than $1 Million.

As with all such “easy-fixes” however, the devil is in the detail. When the objective is to increase tax revenues to close the gap on ballooning budget deficits, you need a broader base of people paying more tax than a handful of imagined billionaires that politicians like to convince us will be the only ones impacted, in order to pass legislation that, in fact, has a much wider reach.

A good example is the recent discussion in the Australian media over proposed new “fame and image” taxes. In December, Assistant Treasurer Stuart Robert announced a Treasury public consultation paper to amend tax arrangements for income derived from a person's "fame or image", including money earned through sponsorships, endorsements, paid posts on social media and free gifts and events.

The idea is that rich celebrities, sportspeople and entrepreneurs will be hit with higher taxes on money earned through their "fame or image" as part of a Federal Government crackdown, but tax experts have warned that the truly wealthy people wanting to evade stronger laws could simply move their residency status elsewhere. Meanwhile, the people who are not actually “rich and famous”, and don’t have the capacity to simply set up a more complex tax-structure somewhere else, would remain under increased scrutiny by the new tax focus, despite earning very little. It could even encourage the taxing of minors creating YouTube channels and being sent free products to test, or Instagram famous dead people, according to concerns raised in response to the proposals. This is a long way from the popular claimed objective of only taxing the richest of the rich!

Meanwhile, in the US, politicians with strongly socialist ideals have been openly calling for Wealth Taxes and various other capital confiscation schemes. There have already been rumblings of a 70% tax on individuals who earn upwards of $10M a year from U.S. Representative Alexandria Ocasio-Cortez.

The reality is that many of the world’s economies never really came back as strongly as they needed to from the 2008 crisis. This latest uptick in growth was the result of a massive worldwide push to increase Government spending, not some organic shift in growth. So, with GDP remaining so low relative to newly increased mountains of debt, governments are desperate to get their hands on any additional income stream they can.

Any real structural solution to this (cutting social programs/defaulting on debts) is very difficult to sell politically, which is why we see the tried and true “Robin Hood” arguments (steal from the rich to give to the poor) and quick fixes gaining prominence once again.

It starts with rhetoric around the rich, but doesn’t stop at those with a net worth in the eight figures. The IMF has already proposed a 10% wealth tax on the net worth of everyone. Although this would currently be an impossibly hard sell, it gives politicians confidence to put forward a new round of popular policies designed to “only tax the rich”… (for now)…