Silver Production Takes Big Hit

News

|

Posted 26/09/2017

|

6139

Yesterday we highlighted the incredible amount of ‘money’ that has been created out of thin air by central banks. We use the term ‘money’ in that sentence loosely as that very same practice of the central banks undermines the ‘intrinsic value’ fundamental of what constitutes real money.

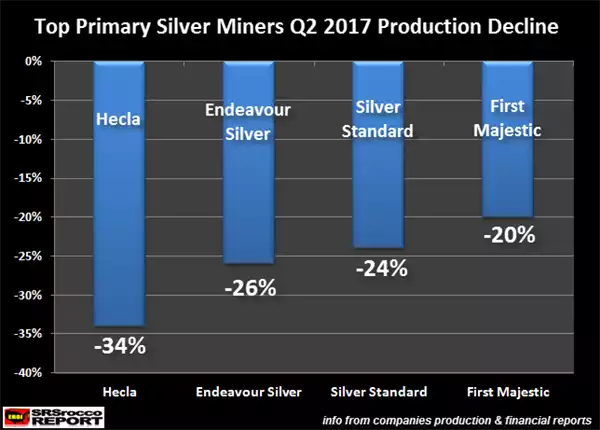

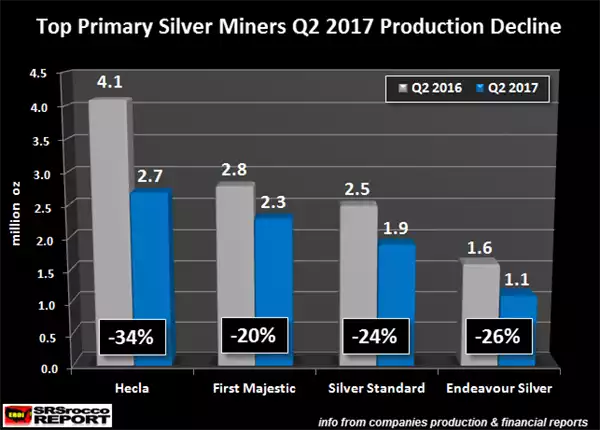

In contrast, silver has intrinsic value by virtue of its rarity and how difficult and expensive it is to mine. We recently were reminded of this when 4 of the world’s biggest primary silver producers saw huge production reductions in the second quarter of this year per the charts below:

The reasons are mixed and varied but they largely come down to falling yields, the ramifications of budget cut backs when the silver price was barely above production cost just a couple of years ago, and the labour and environmental challenges many of these mine experience in their remote and undeveloped locations.

Of course this is not really reflected in the price at the moment as our new ‘paper’ world doesn’t care for such fundamentals as supply and demand… until the day when everyone wants the real thing and there simply isn’t enough. There are only 3 variables in the supply/demand/price economics 101 equation. Unlike central bank money you can’t simply add silver supply out of thin air. Silver supply is slow and constrained. When demand overcomes the paper trades or faith is lost in those paper contracts, that only leaves one variable… price.