Mortgages and Commodities under pressure ahead of Recession

News

|

Posted 07/07/2022

|

9361

Commodity prices are collapsing this week and the Australian dollar plunged to a two-year low as anxiety about a global recession zapping demand for raw materials hit fever pitch. This comes hot on the heels of another 50 basis point rate hike from the Reserve Bank of Australia, with another likely next month ramping up mortgage repayments and cost of living amidst the growing global recession.

Brent Crude Oil has been enjoying a soft landing at US$100. Citi has warned that a near term recession would cause crude oil to drop to $US65 a barrel by the end of 2022 before capitulating to $US45 by the end of 2023. This flies in the face of JP Morgan’s call of $380 oil if Russia slashes output. Recessions often see commodities drop precipitously, but supply demand fundamentals are still the primary mover of markets.

While other commodities have also sold off such as copper down 5%, aluminium 2.9% and tin 2.3%, precious metals also sold off significantly the last few days with gold dropping 3.9% and silver 4.1%. While many of us think of three digit silver as referring to the oz price in US terms, this week has seen the kilo price return to that mark in AUD terms. We’ve had a number of customers coming in to buy silver kilos as the sub 1k price is a long-term bargain price point for many stackers.

Gold has retained support at the mid $US1700s as the yellow metal extends gains in gold-to-silver (GSR) terms. A 90:1 gold-to-silver ratio is reminiscent of the March 2020 liquidity crisis where you’d need 128 silver ounces for each 1oz gold cast bar.

Incredibly, the drop in safe haven metals and commodities wasn’t mirrored by major indexes such as the S&P and Russell 2000 which have stabilised this week after haemorrhaging in the early hours of Wednesday’s open. Pundits have been calling for stagflation as central banks raise rates as the recession heats up. According to the Atlanta Fed, the US economy is set for a second consecutive negative quarter with GDP contracting 2.1%. Pundits are now warning that there will be no ‘soft landing’ for the US… and we all know what happens when the US market sneezes.

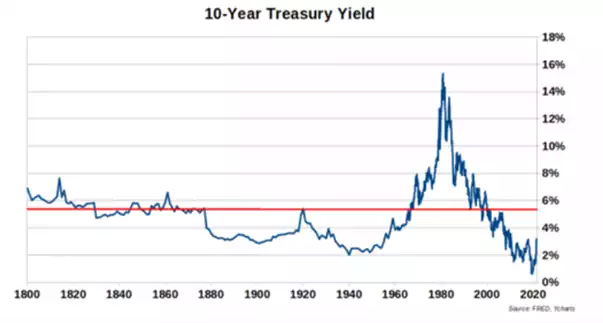

While the US 10-year and two-year bond yields inverted on Wednesday night, and not for the first time but the 10 and 2 inversion is one of the classic recession warning indicators as traders seek to maximise yield over the short term, but see losses over the long term. Ironically, traditional safe haven gold is now on the ropes at traditional support of the mid $1700s.

Australia “The lucky country” may not be in the same dog-house as the US… but with an additional 50 basis points, the pain is growing for homeowners, pulling more into negative equity, potentially causing the wealth effect to go in reverse.

The RBA has raised interest rates to 1.35% as the Australian central bank announced on Tuesday a further 0.5 percentage point rate rise. The last three months has seen the cash rate pushed from 0.1% to 1.35% and some are calling that it won’t stop until the rate reaches the central bank goal of 3.5% sometime in 2023. CBA was the first bank to pass on the full rate increase with ANZ and NAB following close behind. Bank shares have been on the slide over the last couple of months as concerns about their mortgage books have come to the fore.

Three rate rises from May have added a minimum additional repayment of $333 a month to a typical $500,000 mortgage. $499 for a $750,000 mortgage and $665 for a household with a $1 million loan. Australians purchasing property at the depths of the interest rate cycle may be in for a world of pain when their fixed interest periods run out. This comes on top of soaring petrol prices that have made sub $2 a litre look like a bargain in 2022.

Closing remarks from RBA governor portended:

“More rate rises lie ahead. Exactly how many more will depend – a lot – on what happens next to wages, and if the government can stare down demands for increased support in its October budget.” - Phillip Lowe (5th July 2022).

Central banks lend to governments that spend. Ultimately… it is like taking a blood transfusion from the left arm (central bank) to the right arm (government treasury). As governments spend more, they need additional dollars to support ongoing structural deficits.

Precious metals holders have been at times, visibly disappointed by the safe haven monetary metals price action, amidst the doom and gloom of recession and a potential collapse in the Australian real estate market inspired by ramping negative equity. These drops in the short term have been seen prior to major revaluations in the long-term stores of value that PMs represent.

As we say here at Ainslie… “balance your wealth in an unbalanced world”… and while property has been the best game in town for Australians for some time, the cracks are starting to appear for homeowners as many are highly leveraged and will struggle with the continuing interest rate rises.