More Pressure on the USD and UST’s

News

|

Posted 18/02/2019

|

4870

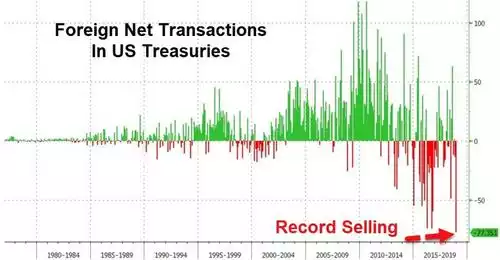

The USD continues to feel pressure from overseas with the latest US Treasury data showing December saw the biggest month of foreign selling of US Treasuries on record. In one month foreign investors dumped $77 billion worth taking foreign holdings to around 36%, the lowest percentage holding in over a decade.

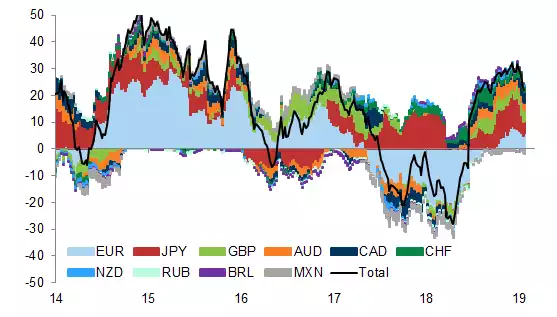

Not surprisingly too, we have seen long positions (bets on an increase in price) on the USD decline sharply over the same period adding further pressure to the USD at these heights.

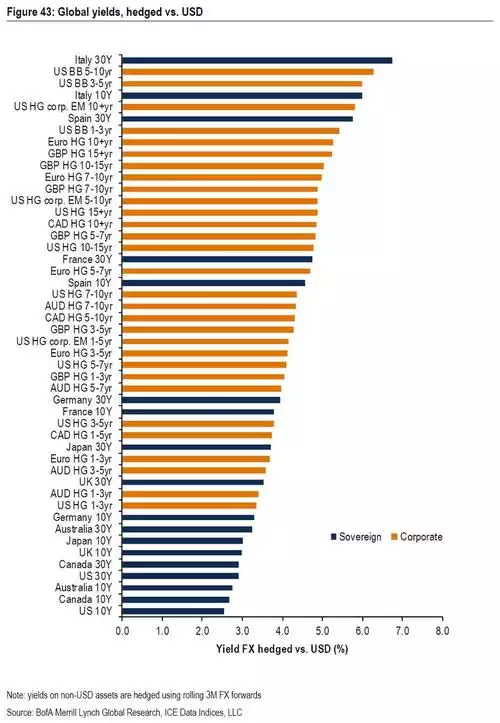

This is not simply a sentiment or political backlash phenomenon though. Hedging costs have risen strongly making holding US Treasuries increasingly costly. Indeed looking at the chart below you can see the 10 year UST is the lowest hedge adjusted yield going, and Australia not far behind.

Keep firmly in mind the Treasury has to sell a LOT of UST’s in the coming years to pay for all the CBO’s projected US deficits. They need all buyers at the table….

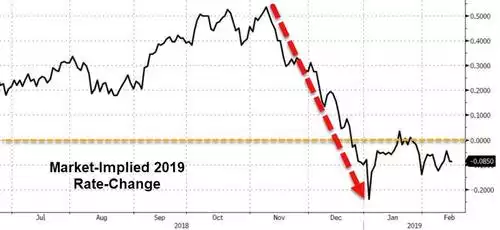

Part of the pressure on the USD too is the seeming capitulation of the US Fed to raising rates and even unwinding their QE balance sheet.

Gennadiy Goldberg, U.S. rates strategist at TD Securities in New York said in an interview:

“Take the world that we were in over the past five years and flip it upside down….For the Fed, the risk that another rate increase could cause significant economic harm outweighs the risk that not raising rates could lead to slightly higher inflation….. For investors, there is a growing opportunity cost to not owning bonds - particularly those that are more sensitive to changes in interest rates - since rates seem more likely to fall than to climb higher.”

And the market is clearly thinking the same:

This has a couple of implications for gold. Most obviously the declining USD is generally wind in the sails for the gold price, though more recently it has been rising in the face of a strong USD. Secondly, we are already seeing more corporate debt on issue, capitalising on this shift in sentiment and the promise of lower rates. The gargantuan scale of corporate debt in America is often on analyst’s top5 of what could cause the next crisis. It just got amped up…