Black Swan Event Alert

News

|

Posted 14/12/2016

|

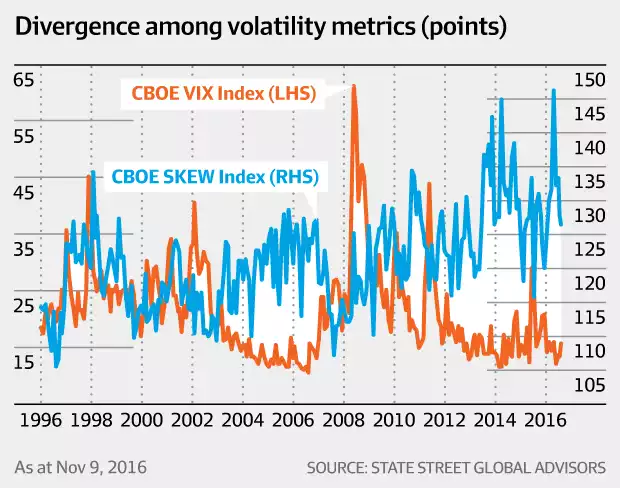

5899

The Australian Financial Review ran a headline yesterday “Investors are on high alert for a 2017 'black swan' event”. As we mentioned in last week’s Weekly Wrap we had the highly unusual phenomenon last week and again this week of both the share indices and VIX (the volatility index) both rising together – it’s like “I’ll buy this rally, but I’m scared”. But the AFR report highlights the VIX is still relatively low as most pundits are buying the ‘everything’s awesome’ Trump-phoria trade with reckless abandon. What the AFR article points out is that the so called ‘Black Swan’ index, the SKEW index, is high and the two diverging. “Indeed, the graph shows that there hasn't been such a divergence between investors hedging against a fall in the sharemarket and those hedging against something more sinister since just before the last financial crisis.”

The AFR describes a Black Swan event as “something that no one has thought of, but which, if it happened, would rock the markets for the next 12 months”.

We often talk of exactly this… they are the unknown unknowns as Mr Rumsfeld would say, and when a system is as strung out as this one is, their number and implications are huge.

SSGA who put that graph together said: "as the current equity bull market is poised to enter its eighth year, it is apparent that investors are willing to pay in order to hedge tail risk".

The SKEW is in effect insurance that you buy, but from which you can profit or at least maintain wealth. You may have heard of another form of insurance you can buy, but one that is a hard asset with no counter party risk, is no-ones liability and is uncorrelated to shares… gold. You may recall the table of the last 5 biggest crashes on the ASX v Gold in those same years. ASX down 24.4%, gold up 38.5% - gold holders 63% better off. Visit here to see the table.

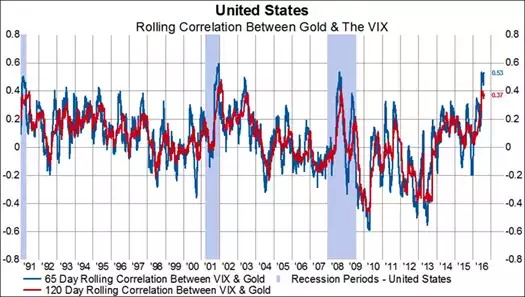

We included a graph here in a previous article showing how gold is generally uncorrelated (negative correlation) to shares. The following accompanying graph shows how positively correlated gold generally is to the VIX. Note the divergence (negative) at the height of the post GFC monetary experiment/stimulus in the US, but now back to correlated and looking very much like those other shaded recessions… The problem is the VIX signals are often too late, its spiking when that brown stuff is already flying off the fan. The SKEW on the other hand sends a clear message. Are you listening or is everything awesome?