Money Printing & Inflation

News

|

Posted 26/06/2014

|

3066

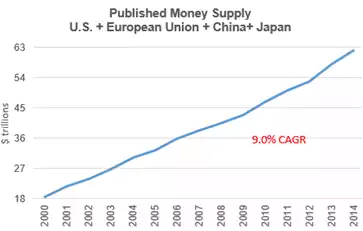

Logic dictates that the more money in the system the more prices rise as that money competes for the same amount of goods. Whilst we commonly talk of money printing, the likes of QE are more accurately termed money creation as it is done by a keystroke digitally crediting the central bank’s member banks in exchange for bonds (debt). If the banks lend this all out the velocity of money increases which is normally inflationary. We haven’t seen this to date as the banks aren’t lending the money. They are either using the near zero interest rate cost to get a small yield on depositing it (hence the ECB introducing negative deposit rates to discourage this) or buying higher yielding assets themselves. This effectively means there is a pent up supply of available ‘money’ sitting in these banks that if unleashed could lead to skyrocketing inflation. Hence as we discussed yesterday the sudden jump in the US CPI figure shocked many and potentially lead to the jump in the gold price. It also explains a bubbling stockmarket and why Wall Street is going great whilst “Main Street” continues to struggle in the US. It’s also not contained to the US as the bank’s search for yield saw them investing heavily in emerging markets and why the leaders of those EM’s were so vocally against tapering QE and their economies are now struggling too. It also had the neat effect of “exporting inflation”.

And is it working? Last night the US revised down (again) their first quarter GDP figure to MINUS 2.9% annualised largely because of, you guessed it, weaker household consumption! Per our last Weekly Wrap they just revised their 2014 GDP to 2.2%. To get to this they would need to average 4% annualised growth from now on, a feat they have achieved in only 4 quarters of the last decade, all of them before the GFC.

To blindly ignore all of this and not balance your portfolio with precious metal bullion is looking more and more “adventurous”…