Money printing gone mad

News

|

Posted 11/02/2015

|

4270

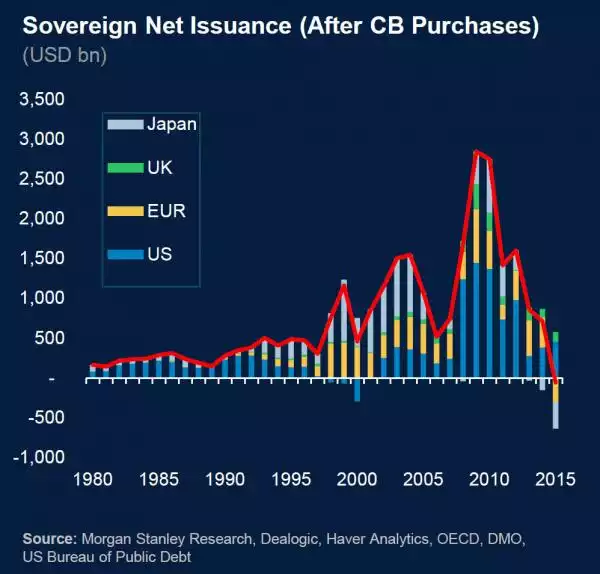

Yesterday we discussed a few graphs that question the so called global growth engine of the US. Today we provide 2 graphs that give further insight into what’s going on globally. Firstly, for the first time in history the 4 largest western economies are monetising (printing money to purchase their own debt) more than they are issuing sovereign debt. So strung out is this stimulus that we now have $3.6t or 16% of the total government bonds issued yielding negative returns. And you wonder why shares are at highs in a sick global economy? Money literally has nowhere else to go in a search for yield. Have a look at what has just driven the Aussie stockmarket to a 6 year high… there is now a preoccupation with yield over company fundamentals.