Margin Debt

News

|

Posted 15/04/2014

|

5533

Markets can remain "irrational" far longer than would otherwise seem logical. This is particularly the case when, despite clear signs of overvaluation and excess, central banks worldwide are dumping liquidity into economies in a desperate attempt to "resolve a debt bubble with more debt."

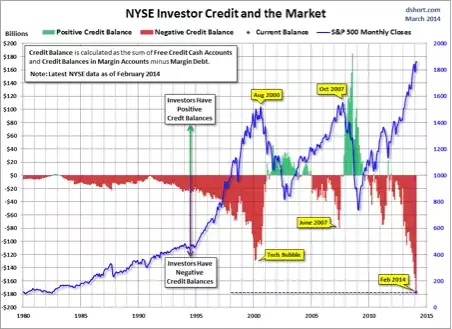

There was never a clearer sign of excessive bullish optimism than what is currently found within the levels of margin debt. Even as the markets sold off sharply in February, investors sharply levered up portfolios and increasing overall portfolio risk.

The chart below shows the S&P500 (in blue) now at record highs, also at record highs is Margin Debt (shown in red). Money borrowed to buy shares and the US sharemarket are now both higher than before the GFC. Were there no lessons learnt from 2008? Once again this could end in tears. We all saw the fallout from Storm Financial.