Mainstream Gold Demand Flags Warning

News

|

Posted 12/04/2016

|

4741

Regular readers will already be aware of gold’s impressive performance this year but we have often written about the concept of looking beyond price performance alone in order to grasp an all-important big picture when investing. Few charts paint a clearer picture in this regard than the one below.

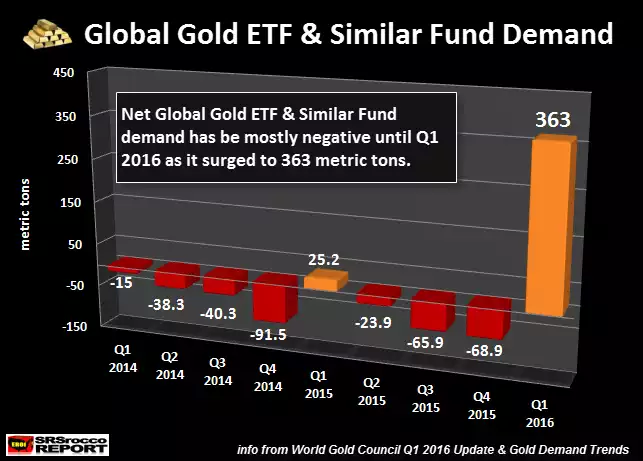

With the exception of a small circa 25 tonne accumulation in Q1 2015, the last few years have seen a loss of metal from mainstream exchange traded funds (ETFs) and related investment funds dealing with gold. This year to date however has seen a staggering reversal of that behaviour with something in the order of a 363 tonne accumulation into these funds. Let’s look at the context of this. This accumulation is the second highest quarterly number on record. The highest was recorded in 2009 as the GFC was devastating markets and investors sought safety in precious metals exposure. That period of time saw a 465 tonne accumulation. This current and sudden spike in metal demand however has happened amidst a backdrop of a Dow Jones level that was within 15% or so of its high. One could be forgiven for conservatively concluding then that the smart money is seeing some instability in current market pricing.

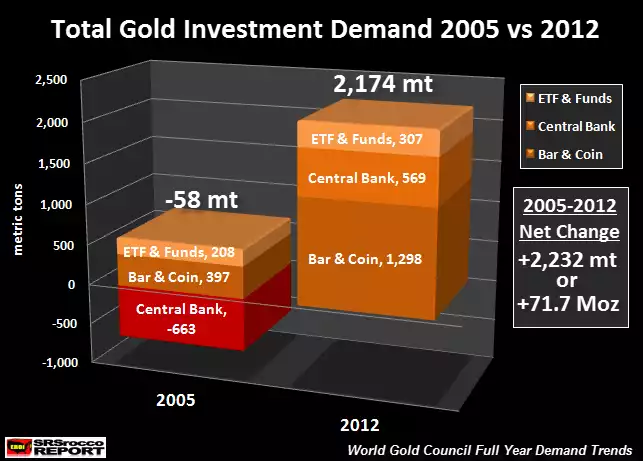

For a broader context, we can reiterate that central banks have for some time reversed the direction of their precious metal movements. Once sellers, they are now strong accumulators as we often report. The following chart allows this to be easily visualised.

For the period of time between 2005 and 2012 we can observe a distinct change in policy regarding global central bank holdings of precious metals from an outflow of 663 tonnes to an inflow of 569 tonnes. ETFs and related funds along with bar and coin demand remained positive but increased in magnitude from 208 tonnes to 307 tonnes and from 397 tonnes to an impressive 1,298 tonnes respectively.

The time period above spans the GFC and amounts to a positive net change of around 2,232 tonnes. Relating that to our earlier graph makes for sombre discussion if the numbers are indicating similar trends unfolding today in the ETF market. As always, the key to dealing with such uncertainty is diversity of assets.