Gold Smashes US$1800 on Hong Kong Concerns

News

|

Posted 09/07/2020

|

14105

Last night saw gold smash through the much anticipated US$1800 barrier, reaching US$1817 before settling to US$1810 and holding the important breakthrough. Silver rallied even more strongly, up over 2.5% but didn’t quite break through the US$19, sitting at $18.85 at the time of writing. The USD fell and the AUD rose to nearly hit 70c taking some of the shine off the night for Aussie gold and silver holders. The night was also a strong one for bitcoin and other cryptos with the languishing XRP (Ripple) finally leading the charge, up over 11%, matched only by Cardano in the 10 cryptos Ainslie Wealth trade.

The reason as always is not always clear but it did seem to be fuelled by the growing US – China tensions and the threat of the US forcing a de-pegging of the Hong Kong dollar. For those not across this, part of what makes Hong Kong a stable economic powerhouse despite its Chinese ties is that the HK$ is pretty much tied to the USD in a HK$7.75 to HK$7.85 channel managed by their own pseudo central bank (Hong Kong Monetary Authority - HKMA). There are number of means that facilitate this through Hong Kong’s “Special Status” around trade and effectively open swap lines with the US. The Trump administration, in retaliation to the new national security legislation imposed by the CCP, has threatened to revoke this. Without that free access to swap USD and HKD the HKMA would lose the ability to defend that peg. The implications for business and investors alike would be enormous. Markets haven’t gone completely nuts on this as the chances, surely, are still on the side of prudence prevailing. But prudence and Trump are not always bedfellows. The HKMA CEO described this move as “apocalyptic” and one that would hurt Trump as much as China, explaining:

“With Hong Kong’s financial system closely integrated with the global economic and financial systems, any move that hits our financial system would also send shock waves across the global financial markets, including the U.S…… Confidence of international investors in using the USD and holding U.S. financial assets could also be undermined.”

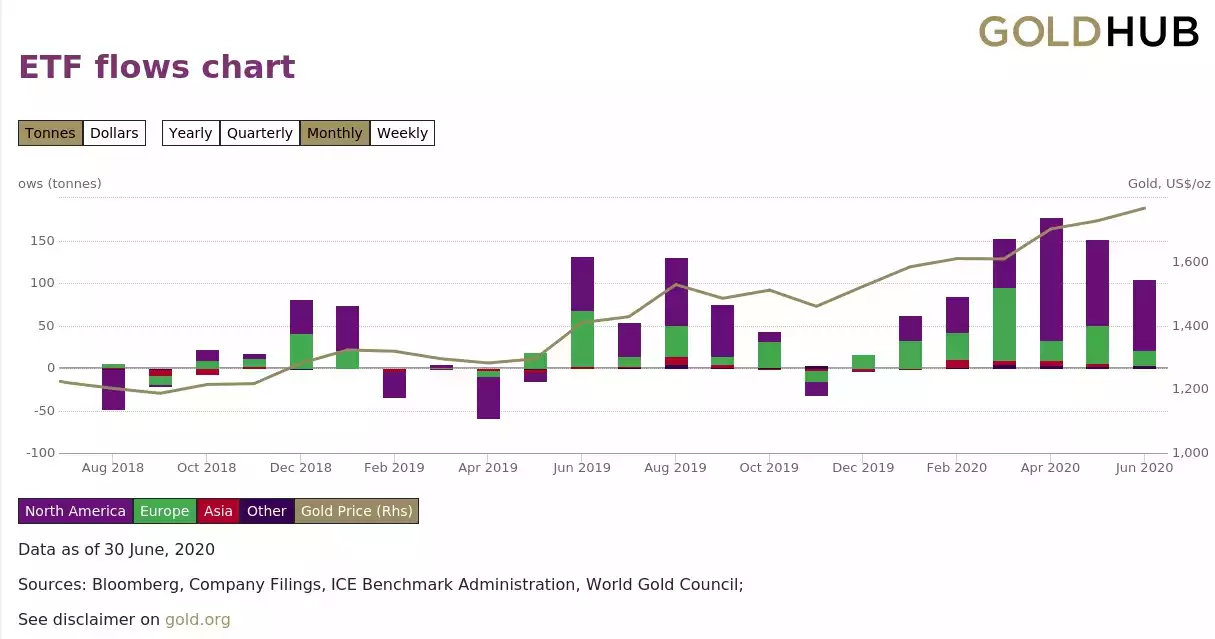

Ultimately this is just one of many drivers for the flight to the safe havens of gold and silver we have seen, particularly since September 2018 when things started to go wrong for the Fed. This all comes in the same week we got to see the World Gold Council’s latest ETF inflows data for June and H1 2020. From their summary:

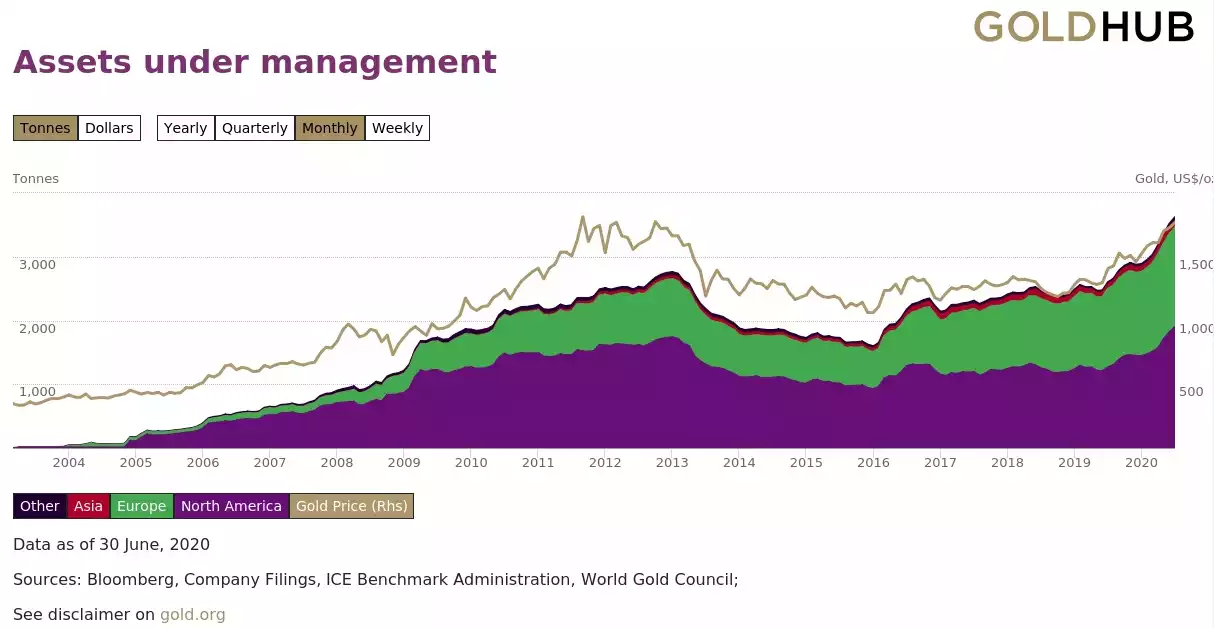

“Gold-backed ETFs (gold ETFs) recorded their seventh consecutive month of positive flows, adding 104 tonnes (t) in June – equivalent to US$5.6bn or 2.7% of assets under management (AUM). This brings H1 global net inflows to 734t (US$39.5bn), significantly above the highest level of annual inflows, both in tonnage terms (646t in 2009) and US-dollar value (US$23bn in 2016). To put this strength of demand into context, H1 inflows are also significantly higher than the multi-decade record level of central bank net purchases seen in 2018 and 2019, and could absorb a comparable amount of about 45% of global gold production in H1 2020.”

The sheer amount of gold that has entered these new vehicles is staggering when looking at since inception, and the parabolic nature of it now even more so.

Can regular customers please note too that we have, after 6 years, today put our freight charges up as we can no longer wear the price increases from the carriers and also the cost of insurance has jumped as well. We are also employing a new calculation method which is as follows:

Gold & Platinum - $15 base charge plus 0.6% insurance on value

Silver - $8/kg base charge plus 0.6% insurance on value but not less than $17.

We also pass on the $10 extra we get charged for deliveries to PO Boxes.

We trust you understand we have held strong for an extraordinary amount of time and we have benchmarked our new rates to ensure we remain competitive with others too.