Russia & China “He who owns the gold…”

News

|

Posted 26/02/2018

|

7441

Gold and silver sales are languishing in the ‘west’, no one needs a safe haven in a goldilocks economy… the central banks have our back…

Meanwhile those superpowers a little more sceptical of the mighty USA, it’s infallible Federal Reserve and its USD on tap, are quite clearly getting ready for the inevitable day of reckoning.

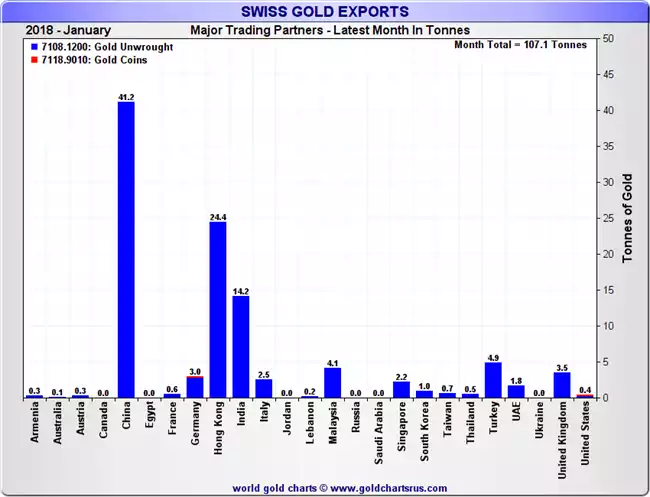

The latest figures are very telling. In January 60% of Swiss gold exports went to China via the mainland or Hong Kong. 3rd place went to India with 13% of that 107 tonne for the month. Check out the graph below… 88% of gold went to Asia and the Middle East.

While China hasn’t updated their gold reserves for some time everyone knows they only tell the world what they want or need to. They are the world’s biggest producer and importer and none leaves their shores. Why bid up the market when you are the biggest at the table?

The other super power stocking up is Russia and they just surpassed China’s official reserves for the first time after adding another 20 tonne in January. That takes them to 1,857 tonne, 15 tonne above China’s ‘official’ reserves. For further context, that 1,857 tonne represents 17% of Russia’s reserves, compared to China’s 2%. Putin, recognised as one of the world’s great strategists, definitely has a plan. He has increased Russia’s gold hoard by 70% since just 2015.

L. Todd Wood, writing for The Washington Times last week had this to say as to why this may be happening:

“However, the current hoarding of gold means that the Kremlin very clearly appreciates the risks of fiat currencies. Moscow understands that competition between nations in the future will not just be on the battlefield, but between central banks. When nothing tangible backs the value of a paper currency, that currency is only worth what people think it is worth.

Economic weakness begets military weakness. Whilst Congress and the White House throw gasoline on the $20 trillion debt fire with the recent spending package, the Kremlin is playing the long game, waiting for the point where the bond vigilantes punish the United States for its fiscal malfeasance and take back control of interest rates from the Federal Reserve. When that happens, it’s Katy bar the door [a phrase meaning to take precautions, there’s trouble ahead] and the U.S. will be in a world of financial hurt.

Many of you may remember the “misery index” under Jimmy Carter — high inflation, high unemployment and 20 percent mortgages. At some point, the market will start to question if the United States has the will or the ability to pay back all of this debt. Interest rates could spike, wreaking havoc on our economy.

The same thing happened to the Romans, to the Weimar Republic, and, more recently, to Venezuela. It’s not a new phenomenon.

And that, my friends, is why Russia is buying gold, lots of it.”

There is a very famous saying - “He who owns the gold makes the rules”….