Negative Rates a Positive for Gold

News

|

Posted 08/05/2018

|

6516

We spoke a bit last week about rising inflation rates in an ordinary economic environment. Friday night’s US NonFarm Payrolls report added little comfort as it saw a big miss again with only 164,000 jobs added when 190,000 was expected. The unemployment rate dropped to an 18 year low 3.9% but that was courtesy largely of a 240,000 drop in those participating in the work force. The real concern was the drop in average hourly earnings which was half that expected and down to 2.6% YoY, and barely above official inflation.

Gold loves such an environment. The US continues to pile on more debt and that typically means printing more money to service that debt and pay for goods and services. This leads to rising inflation, as we discussed here recently, which sends investors flocking to the safety of bullion as interest rates rise.

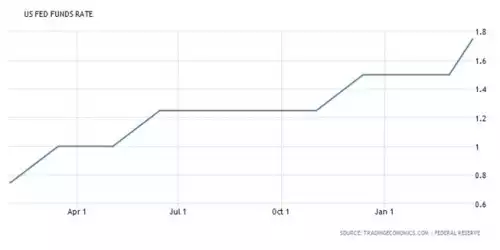

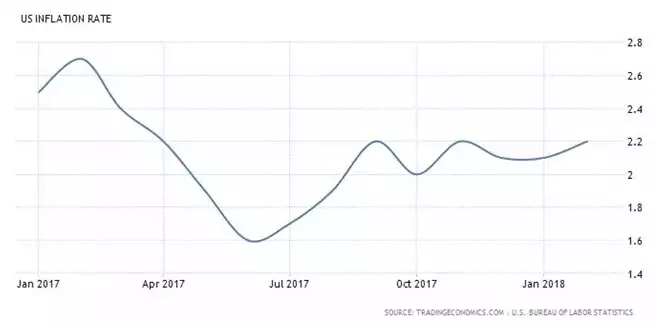

What many don’t realise, however, is that rising “nominal” interest rates do not necessarily result in rising “real” interest rates, and the distinction is an important one. A key driver of gold in 2017 was negative real interest rates, which happens when the inflation rate subtracted from nominal interest rate (in this case the US Fed Funds rate) falls below zero. The graphs below show that this trend is continuing. From April 2017 to present, real interest rates have been negative: -1.2% in April 2017, 0.4% in July, -0.6% in January 2018, and -0.45% in April 2018.

As inflation has been shifting upward, moving from 1.6% in the middle of 2017 to 2.2% currently, investors have turned to gold because inflation squeezes the yield on government bonds, which return the nominal rate. Bonds tend to sell off when investors believe more inflation is coming as further yield will get eaten away. For example, if you own a 10-year US Treasury bill that pays a 3% nominal rate and inflation is running at 2%, your real return is only 1%. The current rates are negative because the nominal rate is 1.75% and inflation is 2.2%. 1.75% - 2.2% = -0.45% (in other words you are losing/paying the government 0.45% p.a. to hold US bonds right now!)

Inflation could climb even higher, for a whole number of reasons we have been discussing recently. If it does, real interest rates will go even further negative unless the US Federal Reserve raises official nominal interest rates to match (which creates further issues in terms of exponentially expanding the interest repayments on government debt going forward). This makes gold look increasingly appealing. Currently, and potentially even more so in the months and years ahead, this challenges the argument of many who claim they won’t buy gold because it doesn’t have a “yield”. 0% for a hard asset with no counterparty risk is still potentially a lot better than effectively ‘paying’ the US government 0.45% p.a. to be a creditor to an organisation owing $21 trillion. And remember that is before taking into account the huge capital upside potential of the yellow metal.