In Gold We Trust Report – Initial Takeaways

News

|

Posted 31/05/2018

|

6881

The latest “In Gold we Trust Report” by Incrementum gives another reminder of the lessons of history and where we sit in that stage. There are many many aspects to this report but the following excerpt and graphs caught our eye on the current set up.

Firstly, where are we now and is it different….

“What distinguishes the current phase decidedly from the run up to earlier big stock exchange crashes (1929, 1987, 2000, 2008) is the simultaneously high valuations of stocks and bonds. Previously bonds would help contain any losses on the stock exchange due to the negative correlation of these asset classes. However, bond valuations have climbed into extremely thin air at this point. From a purely mathematical perspective, bond prices will hardly be able to post any further gains unless the Federal Reserve takes a dramatic step towards negative interest rates. A fantastic piece by Deutsche Bank recently showed that an equally weighted index of shares and bonds is currently trading at the highest level since 1800(!). Sooner or later the financial markets will have to bow to law of gravity and embark on the return trip to the mean - which could catch many portfolios on the wrong foot.

So what happens if both shares and bonds dive in a bear market? What will be the safe haven, now that the traditional pattern of negative correlation has changed? Will it be cash, property, Bitcoin, or – yet again – gold? We are convinced in such a scenario, gold will be among the biggest beneficiaries”

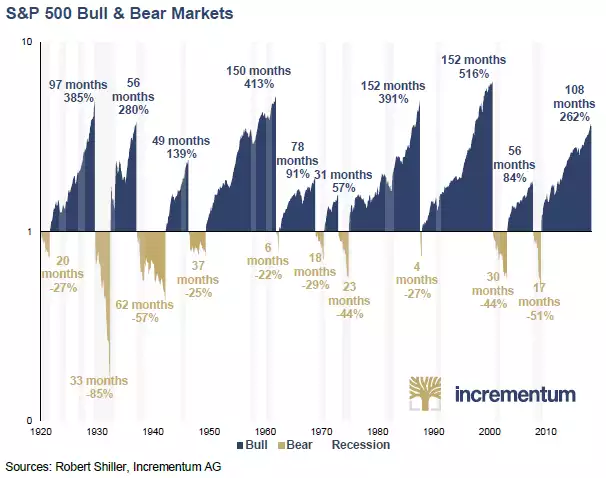

So lets look at previous bull and bear markets in financials and gold. Firstly the graph below shows the performance over each bull and bear market in the S&P500 since 1920.

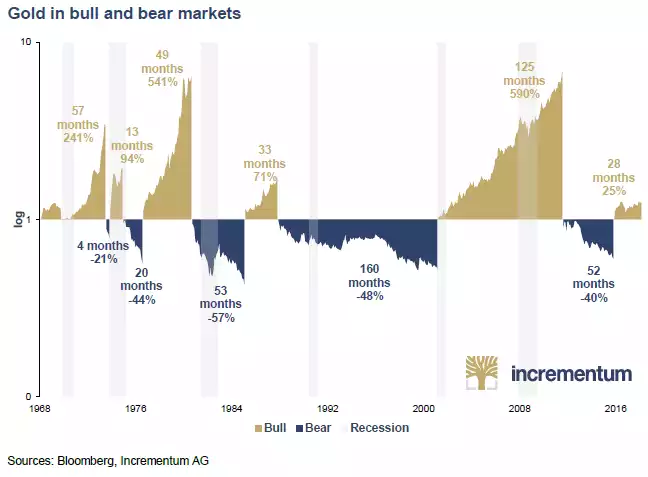

Next, and on the basis they believe we are in the formative stages of the next gold bull run since that bottom at the end of 2015, these are the bull and bear runs for the yellow metal:

“We will stick to our conviction that we are currently in the early stages of a new gold bull market, which has been temporarily slowed down by the election of Donald Trump. The expectations of the political newcomer were clearly excessive – as we warned last year – and continue to harbor large potential for disappointment. As pointed out earlier, we can see significant upward potential, especially in the commodity markets, which now command extremely attractive valuations in historical context, both in absolute and relative terms.”

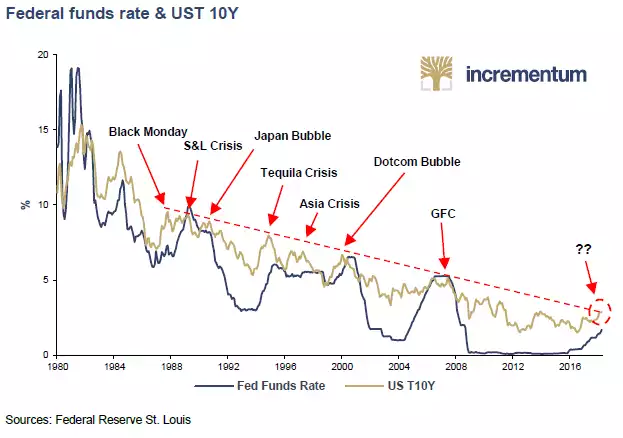

And the catalyst for the next crash? Nothing different really to previous ones. i.e. the Fed raising rates too late and too quick… However they warn this will be exacerbated by what they think is the most underestimated input, and that is QT or the quantitative tightening seeing them reduce that QE balance sheet by $50b/month. In reference to their words above, look below at how low that UST 10year Yield is. That means bond prices are high, reinforcing their correlation call against the high share prices as well.

And finally in reference to the ‘everything’s awesome’ mood out there…

“Contrary to all the optimistic forecasts, some facts currently suggest an increasingly recessionary tendency:

- Rising rates and QT

- Record high consumer confidence

- M&A boom

- Rising default rates

- Rising write-offs on credit card debt

- Weakening consumption rates

- Significantly flattening yield curve that could invert within a matter of months

- Strongly rising private and public debt ratios

- Sharp rise in oil prices”