King of Debt’s “Recipe for Disaster”

News

|

Posted 12/09/2019

|

8603

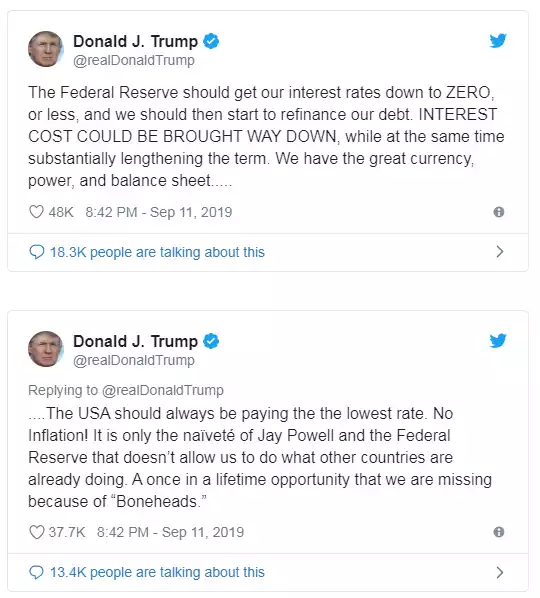

Just ahead of the ECB meeting tonight where markets are pricing in a 100% chance of Draghi cutting rates by 10bp at an absolute minimum and wide speculation or expectation that he will unleash more QE and other instruments amid a Euro economy struggling to stave off a recession, Trump is feeling left out and hence upped his anti Fed campaign sensationally:

Trump desperately wants a lower USD which is sure to jump tonight unless Draghi disappoints the market with less stimulus than expected. He also has $20 trillion of government debt to service. The problem is the self proclaimed “King of Debt” is missing the nuance of refinancing personal or corporate debt versus government debt with 30 and 10 years bonds at play. It simply isn’t that easy and for the Fed to drop rates by the extent he is demanding would more likely have dire consequences for markets spooked by “this is worse than we thought”, banks who have to manage interest for depositors and loans in an upside down yield environment, and of course inflation isn’t the zero he implies but already over the Fed’s 2% comfort level. To flare up inflation amid a weak economy heralds a stagflationary mess. And yes he wants a lower USD but let’s remember there is already growing distrust and moves away from it. Deliberately weakening it further will hardly engender more confidence at a time it really needs a boost.

The Congressional Budget Office projects the US will post another $1 trillion deficit next year. Trump would love to have a lower interest bill on all of that, but the Fed is unlikely to kowtow less it completely lose control. The last time the Fed cut rates when markets were at all time highs was 2008…

Gold looked to turn a corner last night after the correction over the last week, potentially off the market seeing these implications.

From Bloomberg:

““This is a recipe for disaster,” said Roberto Perli, a former Fed economist and partner at Cornerstone Macro in Washington. “If a central bank starts financing debt spending without constraints, interest rates will end up being anything but moderate. Just look at Zimbabwe.””