S&P500 Crosses Rubicon – “Investors forewarned”

News

|

Posted 23/05/2022

|

6704

Its now official. After the NASDAQ long since crossed the rubicon, the world’s biggest equities index, the US S&P500 officially turned to bear market having cross the 20% loss line on Friday night. Having reached this juncture after just 2 of the 10 rate hikes predicted and BEFORE any quantitative tightening even starts… the question on everyone’s lips is how strong will the Fed hold its ‘we will not capitulate to save the financial markets’ stance?

Just to put some perspective on this ‘correction’, as at the end of last week the S&P500 had finished down 7 weeks in a row, its longest losing streak in over 20 years, going all the way back to the dot com bubble of March 2001. The less FAANG heavy Dow Jones is also down 8 straight weeks making it the longest losing streak in a century yet still ‘only’ down 13% given it escaped much of the tech carnage that has seen over $2 trillion lost from the FANG tech shares. Industrials, however, are only just starting to feel the PPI pinch, but more on that later.

In years past, and with great certainty, the US Fed would come to the rescue with more cheap money and lower rates to save the day. However, we did not have sky high inflation and their hand and credibility is now forced. They simply cannot ease from here. Or can they…

Importantly too, we are seeing these equities moves before any recession is in play. As we have written repeatedly here, whilst CPI is indeed extraordinarily high, it is still nowhere near PPI, inflation at the factory door, and hence either consumer prices go up more or producers’ margins get squeezed. The latter appears to be already happening.

The former chief economist of Alliance Bernstein, Joseph Carson, spoke to this over the weekend:

“Based on the preliminary data from the GDP report, operating profits fell roughly 10% in Q1 relative to Q4. A decline of that magnitude would drop aggregate company profits back to the Q1 2021 level, or nearly $300 billion below the record level of Q4 2021.

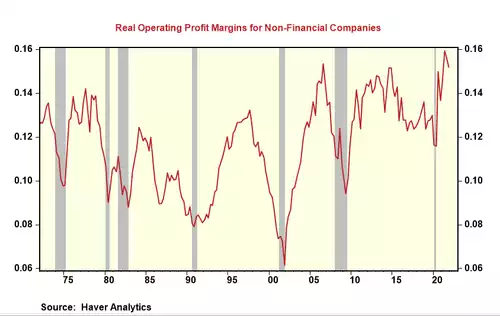

The plunge in operating profits reflects a sharp drop in margins. Real operating profit margins for Non-Financial Companies hit a record high of 15.9% in Q2 2021, dropped to 15.2% in Q4, and probably fell 100 to 150 basis points in Q1 2022. To be sure, Q1 earnings reports from large companies such as Amazon, Wal-Mart, and Target confirm a sharp contraction in operating margins due to rising input costs.

More margin contraction lies ahead, especially if the Fed successfully squeezes inflation to 2%, down from 8%, and limits any significant fallout in the labor markets. For reported consumer price inflation to drop 600 basis points over the next year or so, producer prices for many companies involved in production and distribution would drop twice as much, if not more. And if overall labor costs are unchanged, the hit to profit margins, or the ratio of profits from sales after all expenses, will be significant.”

The chart below depicts just how high margins got prior to the impacts of rising costs really came to the fore post Ukraine (grey bars are recessions).

“The potential disruption to business operations in 2022 is more significant than in 2000 because the Fed faces a bigger inflation problem. That means a substantial decline in operating margins is the most considerable risk to the equity market. Investors forewarned.”

The old saying ‘the higher you go, the harder you fall’ is a simplification of the maths of ‘reversion of the mean’. Valuations, that quite frankly take those peak earnings and multiply them more than ever before (so a double whammy in effect) are still, despite this correction, perversely high.

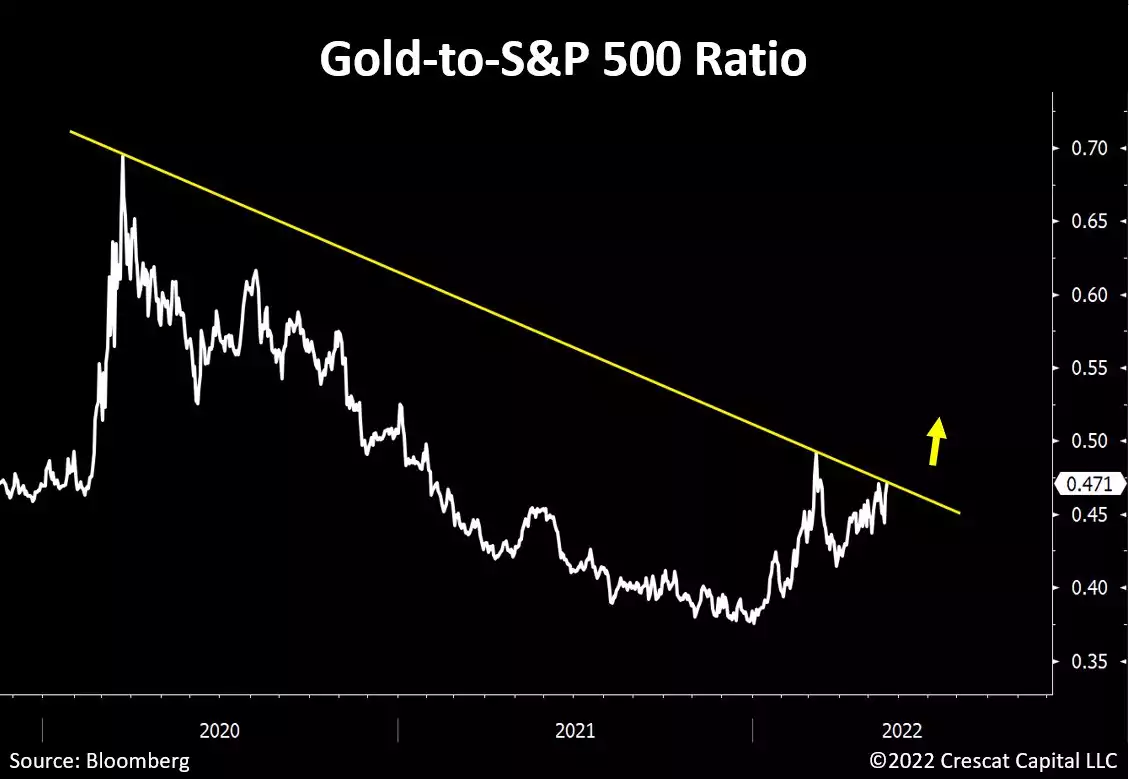

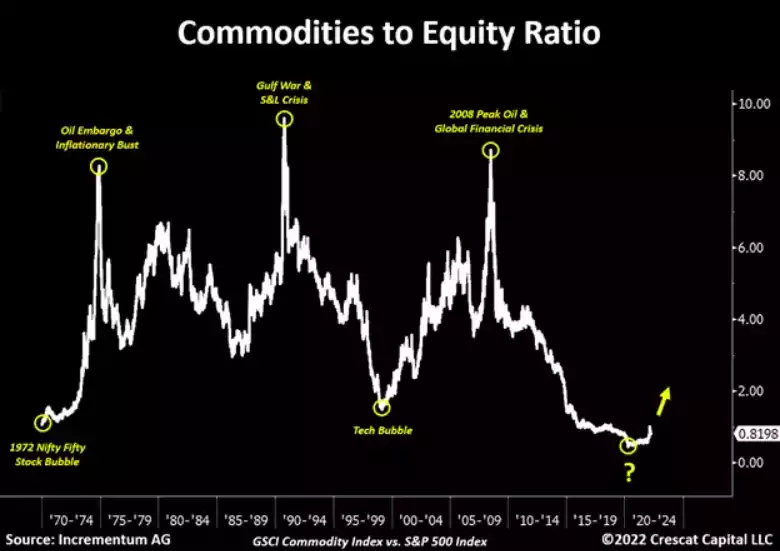

The following two charts give you just a tantalising taste of how this could play out for gold and silver…