JP Morgan loses 45% of gold stock in 1 day

News

|

Posted 17/09/2015

|

5228

COMEX data is a regularly featured metric in our daily news articles and this is partly due to the fact that it helps to illustrate investment behaviour. Of late, the decline in COMEX inventory seems to be getting particularly dire and main stream reporting on this topic is near invisible.

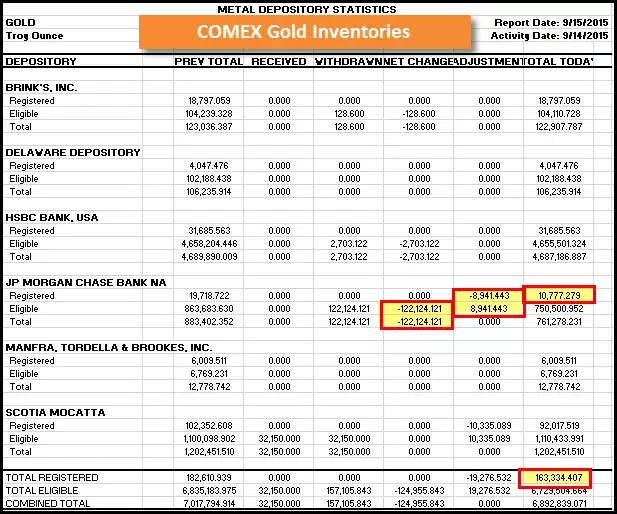

Of particular interest was the category adjustment reported yesterday (Australian time) to JP Morgan’s COMEX gold holdings. As the spreadsheet below highlights, the bank lost 8,941oz from its registered stockpile representing just over 45% of the bullion that it has available for delivery. Readers of last Friday’s news will recognise this as exactly the type of adjustment referenced by David Morgan. Astute readers will notice in the below spreadsheet that JPM additionally suffered a 122,124oz withdrawal from its eligible stocks. This is not the first time that a significant daily withdrawal from JPM’s eligible category has been observed with the 30th of July this year being one example. Then, according to the CME Group an impressive 200,752oz of gold was seen removed. At that time, JPM’s registered category clocked in at 115,754oz of gold compared to the current 10,777oz highlighted in the spreadsheet.

As a consequence of this latest adjustment, total COMEX registered gold tumbled to its lowest in history. Currently, the COMEX holds 163,334oz or just over 5 metric tons in its registered category for all banks.

Just days before this data was available, Canadian economist, author and metals expert Rob Kirby of Kirby Analytics was interviewed regarding the COMEX inventory situation and that interview raised an interesting perspective on how easily current COMEX registered stock could be consumed. At the time of the interview, the inventory levels were higher so the following figures have been adjusted for accuracy. The concept however was that although 5 metric tons may sound like a significant amount, one must keep in mind that with only 163,334oz remaining and the fact that 1,000oz isn’t a big deal to a rich individual, at current pricing it would only take around 180 millionaires (or equivalent) to wipe out the COMEX completely. Rob points out that this calculation is based on the assumption that the COMEX actually holds what they report to, referring to the rather suspicious disclaimer relating to numerical accuracy that accompanies these inventory prints. Furthermore, there is also the fact that these ounces may have any number of claimed owners. Rob also states that “it’s just a matter of time before the paper markets declare force majeure and settle in fiat currency” which is precisely as predicted by Michael Pento.

To view the 5 metric tons from a different perspective again, year-to-date India has imported around 666 metric tons of gold which is a 69% increase year on year. Annualised imports are on track to hit 998 metric tons (as an aside, this is the second highest amount recorded and roughly one third of world production).

We mentioned yesterday that this week’s FOMC announcement is looking to be one of the most anticipated in terms of media commentary and these developments in COMEX inventories are interesting to observe at this time; perhaps indicating that the smart money is searching for protection. As such, we’ll leave you with an overnight quote which is actually the title of an article by Jeffrey Snider. “The World Isn't Crazy, It Just Has To Live In 2015”.