Visualising Silver Price Against the GSR

News

|

Posted 12/10/2020

|

6527

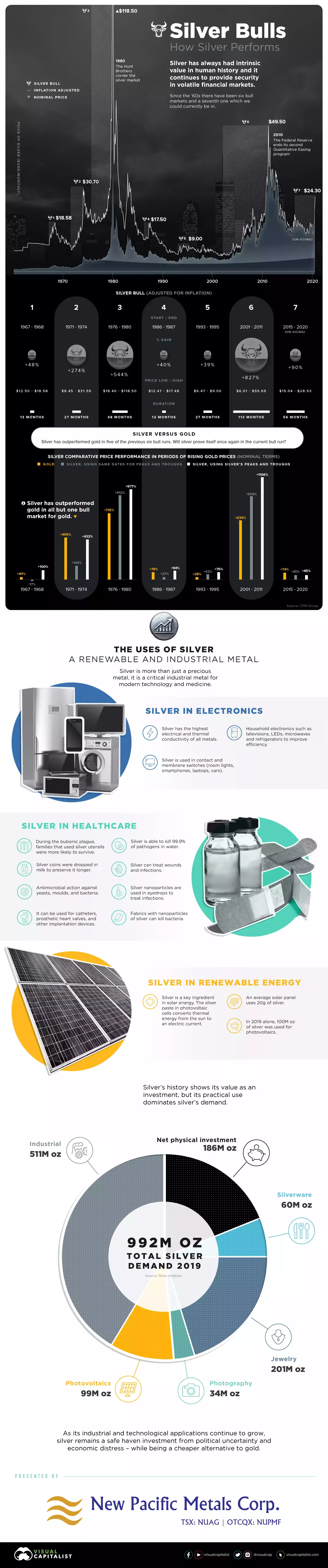

In 1967 silver was on the way out in use in coins as currency and so began, again, its life as a monetary metal as it has done for 5000 years. Its unique properties have made it the go-to metal for a number of specialised industrial uses meaning its monetary metal use presently only accounts for around 20% of its use. And thus is the allure of silver in that it wears 2 competing hats and hence presents an each way bet, all in an incredibly small market.

The guys from Visual Capitalist present below an excellent visual summary of silver’s price journey since 1967 and remind us of its various uses. Click on the image to go to the better quality source.

And so whilst silver has had a stellar run this year, historically, particularly in the context of a gold:silver ratio (GSR) still high at an historically very high 77:1, there can be plenty for this bull to run from here. When you look at each big peak in the silver markets above, consider that in 1968 the GSR was less than 16, in 1974 it was around 26, in 1980 it was around 15, and in 2011 it was 31.

Even at an average of these of 22:1, from the current 77:1, the silver price would go to $121/oz if gold didn’t move at all. But remember, nearly every time the GSR is falling, gold is also generally rising as well. That means even that $121/oz would be very conservative. For example if gold went to $3000 in the same period, silver would rise to $136/oz at a GSR of 22.