Its ALL about Central Bank Liquidity – Why NFP Shows Up the farce

News

|

Posted 10/02/2020

|

11511

If you needed any clearer confirmation of what is driving global financial markets to all time highs (as we discussed last week here) then look no further then Friday night. The monthly US NFP employment figures came out and exceeded expectations considerably, coming in at 225K new jobs and good signs of wage growth. Surely in a market based on fundamentals that’s a great sign for the economy? Instead shares fell and gold rose…. The simple answer is the fear that the Fed may take this as a sign not to maintain or further ease their monetary stimulus. Another possible answer is the market is aware of the dynamics we discussed here last week, and that is a recession usually follows a final melt-up in the employment market, but that is very un-market-like, being realistic. No, the answer is again this is a market based on the omnipotent central banks and their policy of preventing a recession at all costs with ever more money being injected. All that central bank added liquidity needs to find a home…

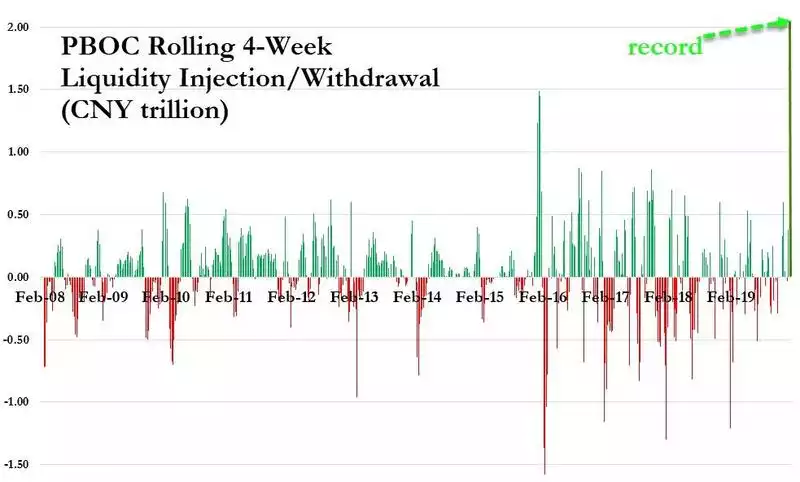

Firstly we have seen China’s central bank, PBOC, inject an all time record amount. The chart below shows how every year the PBOC inject cash before the new year shutdown to provide their banks sufficient liquidity over the break but then take it back at the end. This year you can see they not only didn’t take it back, but doubled down with those huge injections last week to tackle the effects of Coronavirus. As one commentator noted, they seem to think liquidity injections act like immunisation injections…

And now the Fed seems to be jawboning that Coronavirus may see further stimulus defence from them saying "the effects of the coronavirus in China have presented a new risk to the outlook." In the latest semi-annual Monetary Policy Report submitted to Congress they warn the virus adds risk to China’s "fragilities in the corporate and financial sector" and have contagion potential "because of the size of the Chinese economy, significant distress in China could spill over to U.S. and global markets through a retrenchment of risk appetite, U.S. dollar appreciation, and declines in trade and commodity prices.” To add weight to their easing preamble they also focussed on the continuing decline in the US manufacturing sector saying “The slump in manufacturing last year is attributable to several factors, including trade developments, weak global growth, softer business investment, lower oil prices engendering a cutback in demand by drillers, and the slower production of Boeing’s 737 Max aircraft due to safety issues”, and debunking those that argue manufacturing is naturally declining in an increasingly digital world noting "it is important to recognize that this weakness has likely spilled over to other sectors."

So whilst they did blindly acknowledge "asset valuations are elevated and have risen since July 2019, as investor risk appetite appears to have increased" without admitting that was ALL their doing, they are clearly sending a signal to the market that ‘your high risk appetite is fine, we’ll be there for you should it go wrong…’.

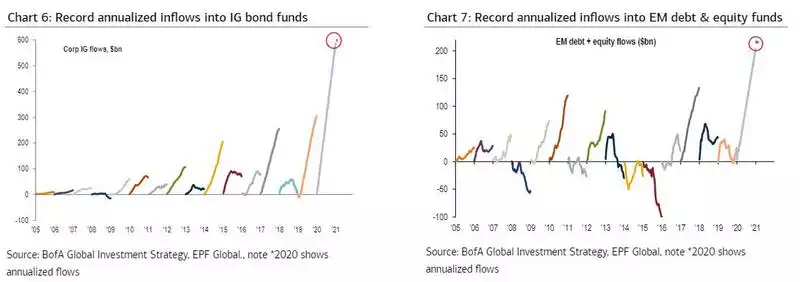

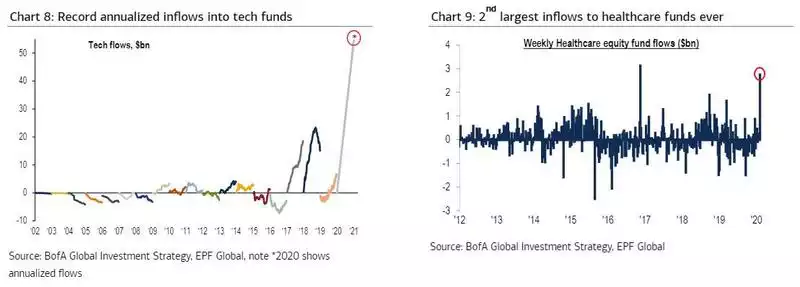

Bank of America Merrill Lynch’s Michael Hartnett outlines how this half trillion dollar injection over the last few months has seen “unprecedented, gargantuan, record” flows into financial markets from UST and corporate investment grade bonds, to emerging market bonds and equity funds, and particularly tech and health shares (maybe seen to be less dependent on the factors the Fed fears). Per BoFAML:

- “bond inflows $918bn (annualized vs. record $481bn 2019)

- IG bond inflow $587bn (annualized vs. record $308bn in '19)

- EM debt & equity inflows $166bn (annualized vs. record $133bn in '17)

- tech inflows $54bn (annualized vs. record $18bn in '17).

That is a massive amount and you can see pictorially below:

So be in no doubt as to what is driving this ‘everything bubble’. It is easy money. This is unprecedented and therefore hard to predict how and when it ends. Maths, Economics 101, and common sense dictates it can’t go forever. By definition all that new money is both debt and bringing forward future gains. Play the Fed Casino by all means, just make sure you have that sizeable allocation in defensive hard assets for when this Ponzi-like house of cards comes crashing back to reality.