Italian Aftermath

News

|

Posted 06/12/2016

|

5384

Yesterday Italy resoundingly voted No in the referendum on constitutional reform. Most commentators however acknowledge this was more a vote against the status quo establishment then the question itself, as Renzi made the fatal mistake, as did David Cameron, of pegging it to his tenure as Prime Minister. And so we had another one bite the dust. Just hours ago Renzi accepted the President’s request to delay his resignation until the Senate Budget Law is passed. This may not be over just yet folks…

But it is the broader implications for Europe that has authorities worried although clearly not the market as it essentially shrugged off the news yesterday. Banks are a key concern and the CEO for Europe’s biggest, Deutsche Bank last night said “Europe is endangered” after the Italian result. Italy’s most precarious bank, Monte Paschi (MPS) dropped to the extent that trade was limit down halted and more broadly the Italian credit risk index hit a 3 year high. And yet the Dow hit a new all time high last night and Euro shares rebounded? Well the market may well just be seeing this as all the reason the ECB needs when it meets this week to extend it QE program, with a new focus on buying Italian bonds perhaps…

This however could well be way beyond such short term market machinations in the now all familiar ‘central banks to the rescue’ narrative the market has come to rely on. This is yet another example of the populism/anti-establishment phenomena that saw Brexit and Trump and to an extent our Senate. The No vote came in a huge 5% above the polls at 59%, voter turnout was 10% higher and the No vote was stronger in the more disadvantaged regions. Sound familiar?

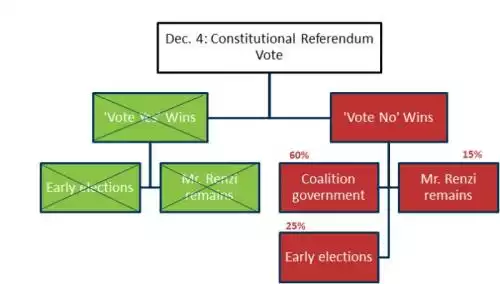

Italy, and indeed much of the EU, needs serious economic reform. Italy’s economy has stagnated since entering the EU and its government debt risen to 133% of GDP, the second highest after Greece. The most recent poll has 48% of Italians wanting to leave the EU. Italy is the 3rd biggest economy in the EU. Should it leave, no amount of ECB bond buying will fix that. Goldman Sachs have updated their flowchart and odds on ‘where to from here’ now we know the result. It’s a precarious situation.