Is Crypto “Dotcom Bubble 2: The Sequel”?

News

|

Posted 04/04/2018

|

8400

The cryptocurrency phenomenon over the past year has seen the prices of some crypto tokens rise to tens of thousands of times their original values. Bitcoin wasn’t the only token to reach an all-time high that would have been unimaginable just months before. The prices of altcoins like Ethereum, Ripple, and Litecoin were all buoyed to new heights by the increased demand from investors seeking a piece of the action. The cryptocurrency market hit a peak total capitalization of $800 billion USD in January.

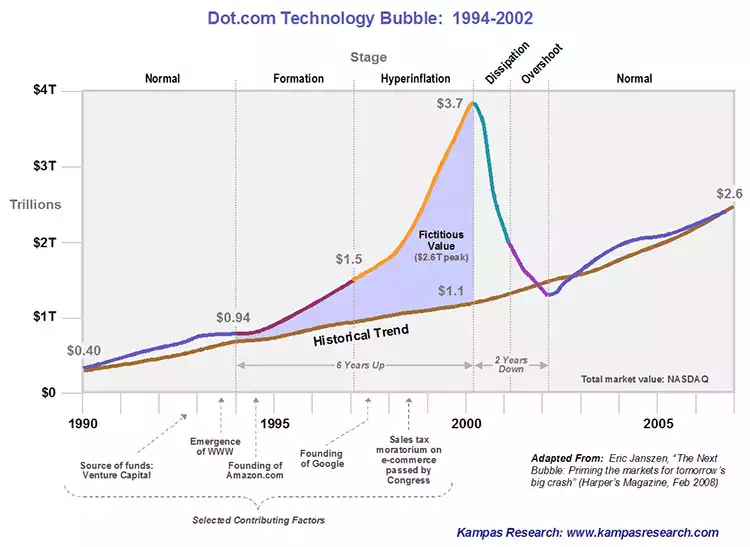

It was not surprising then that the market’s meteoric rise had many, especially those from traditional investing backgrounds, calling it a “bubble.” Since people try to make sense of new events using the past, the crypto space has been commonly viewed through the lens of the “dotcom crash” in the early 2000s. Hundreds of companies met their demise in the aftermath of the so-called “dotcom bubble.”

So, the logical question is whether the narrative for many of the foundation crypto ventures is also heading to the same finale? Certainly, crypto can still be considered a “frontier market”. Blockchain, as a technology, is only starting to see wider, gradual, adoption. There are few regulations to keep projects and participants in check. The market trades heavily on speculation and most propositions behind the growing array of crypto tokens have yet to deliver any definitive real-world value.

By traditional definitions, therefore, a basis exists to call what’s happening to cryptocurrencies a bubble. It is natural that people would then jump to compare it to the dotcom bubble since it’s the most recent one that was technologically based. Both have displayed similarities in the build-up of events. When you consider both have seen the arrival of disruptive innovation, an explosion of projects and ventures looking to capitalise on the new tools and skyrocketing valuations at breathtaking speeds, everything seems to align.

Before settling on this conclusion however, it is important to investigate the reason behind the dotcom crash a little more closely. Hindsight identifies the biggest cause of failure for so many initial Internet companies was that they were attempting to pursue direct-to-consumer e-commerce efforts too quickly. Today we take this model for granted, and rely on e-commerce daily, but at the time poor business planning with unrealistic expectations did not ensure sustainability or profitability. It could be argued that crypto is also seeing similar ill-conceived ventures emerge. However, an exact comparison is not accurate.

Firstly, the logistics are completely different. A lot of dotcom companies were forced to balance running both online channels and their traditional physical shopfronts, and many found themselves overwhelmed by the juggling act and costs. Blockchain projects on the other hand tend to deal with mainly digital transactions and tokenized assets, with minimal and more manageable logistical concerns, including smaller and leaner workforces.

The other big difference is general comfort with the underlying technology. Market-wise, crypto ventures have demographics on their side. Dotcom companies had to deal with allocating resources for client education and after-sales support. Millennials are now the dominant consumer. Participants in the crypto market are at ease using digital channels for big-ticket transactions.

Of course, anyone entering the crypto space needs to proceed with caution, especially when it comes to trading and investing, but it would be unfair to be totally dismissive of the potential Blockchain technology and crypto assets present. We must remember that the aftermath of the dotcom bubble also affirmed that the underlying innovation and technologies not only weathered the storm but completely changed the way our world operates.

Whether or not emerging crypto ventures will share a similar fate to early dotcoms remains to be seen, but at least for now crypto may be writing an entirely new story that is not destined to follow the bubble/crash and disappear plotline of the dotcom episode.