Is Crypto Demand Increasing?

News

|

Posted 02/08/2022

|

6120

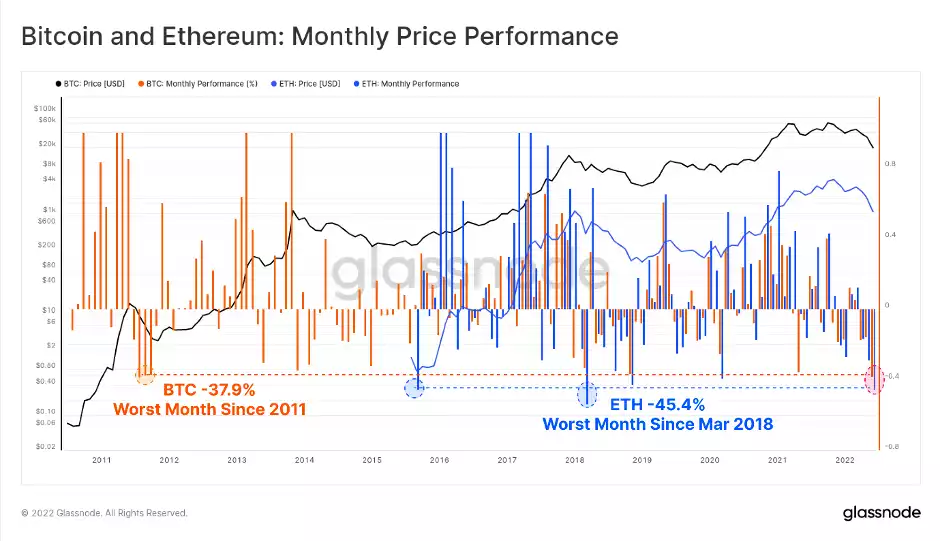

The performance of the digital asset market in the first half of 2022 has been remarkably challenging for investors, seeing BTC prices trade down 75% from the all-time-high, and ETH down over 80%. June, in particular, was one of the worst months on record for both assets:

- Bitcoin traded down -37.9% in June which is the worst monthly performance since 2011, a time when BTC prices were below $10.

- Ethereum traded down -45.4% in June which is the second worst performing month in history, beaten only by March during the start of the 2018 bear market.

However, Bitcoin and digital asset markets responded strongly to the Federal Reserve 75 basis point rate hike this week, with BTC closing up 5.7%, and ETH up 7.6% on the week. Broader markets responded positively to the Fed announcement as Chairman Powell indicated that the current target Fed Funds rate at 2.25% to 2.5% was now considered neutral, and eyes were on developing data on economic slow-down.

In many regards, the recent positive price action for Bitcoin and Ethereum gives much-awaited relief to the bulls, who have weathered almost nine months of a persistent downtrend. The 2022 bear market has been historically negative for the digital asset space. However, after such a sustained period of risk-off sentiment, attention turns to whether it is a bear market relief rally or the start of a sustained bullish impulse. Let's look at the on-chain data.

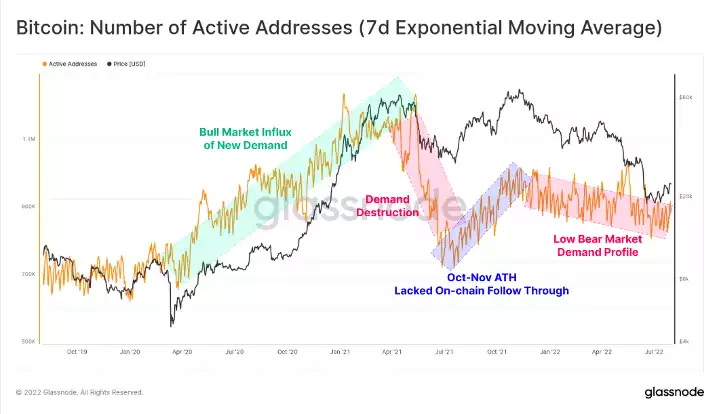

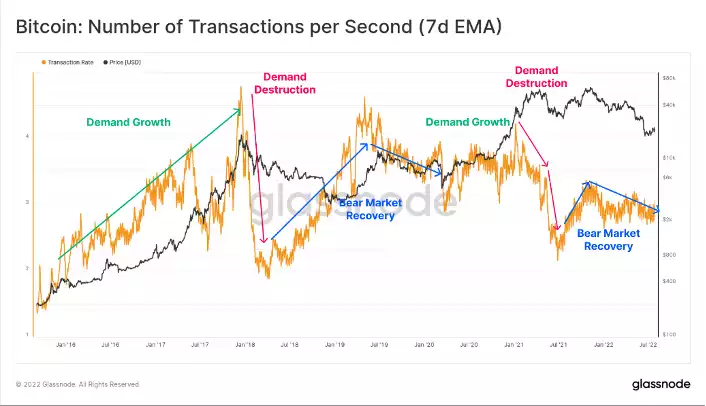

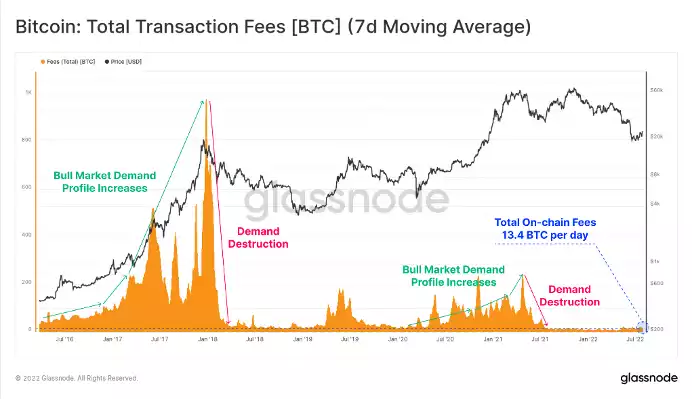

Generally speaking, an influx of new demand into blockchain networks is supported and signalled by sustained upticks in usage on-chain. We can use both on-chain activities, and supply dynamics to assess performance relative to recent comparable history as a guide.

Bull markets typically maintain elevated fee rates, and often are one of the first signals of demand recovery. Whilst we have not seen a notable uptick in fees yet, keeping an eye on this metric is likely to be a signal of recovery.

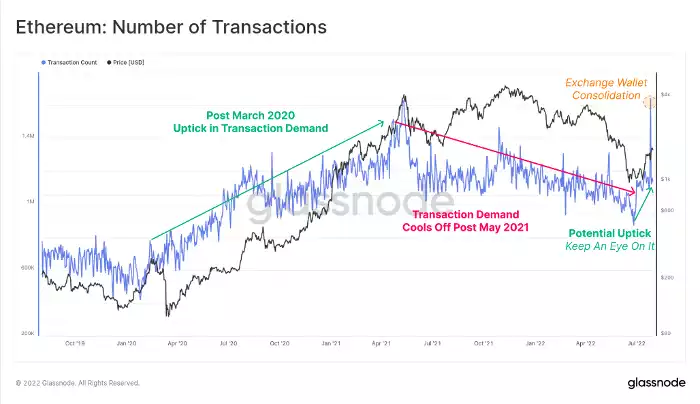

Jumping to Ethereum, it’s been a strong few weeks for the second largest crypto. The Ethereum network has experienced many of the same trends as Bitcoin over the last 12 months, seeing a gradual deterioration of aggregate network usage and congestion. Despite powerful price action over the last few weeks, Ethereum network congestion is the lowest it has been in some time, manifesting as multi-year lows in gas prices paid for confirmation. However, we have seen a potential uptick, which could be a leading indicator for what’s to come.

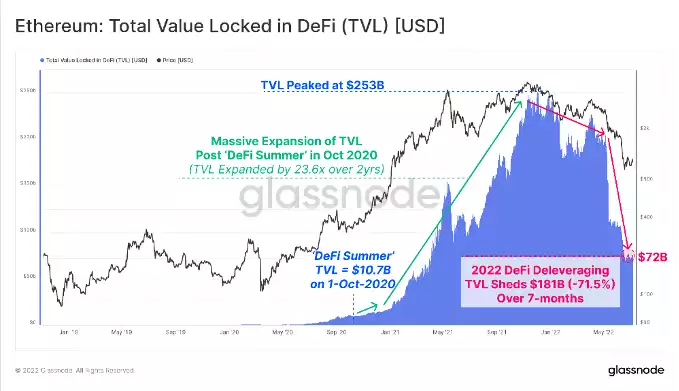

A large driving force of relative ETH weakness is the enormous deleveraging which has taken place in the DeFi sector. In many ways, this is the equal and opposite bear market reaction to the explosive growth seen in on-chain leverage, and yield farming markets over the last 2-years.

The colloquially named 'DeFi Summer' started in Oct-2020 when Compound launched their token farming program, which issued COMP tokens to users of the protocol. This initiated the trend of 'yield farming' within the DeFi sector and emerged across many layer 1 blockchains and DeFi protocols.

Since DeFi Summer, the Total Value Locked (TVL) in DeFi exploded higher, growing 23.6x over 2-years, expanding from just $10.7B to over $253B. However, over the last 7-months, a great majority of this TVL has de-leveraged and unwound, falling by a remarkable 71.5%, and shedding $181B in value.

The TVL decline is a function of both falling token valuations, and the reduction of aggregate leverage (both discretionary and via liquidations). Both have weighed on the ETH price as one of the more liquid exit pathways for investors.

Both Bitcoin and Ethereum have seen a rebound in prices this week, coming off the back of extremely oversold conditions, and spurred on by risk-on sentiment following the July Fed meeting.

There are early signs of profitability returning are encouraging. Attention can now shift to whether these uptrends can be sustained and improve, as a gauge for whether this is simple bear market relief or a more constructive structural shift.