WGC Gold Demand Trends Update

News

|

Posted 01/02/2019

|

6273

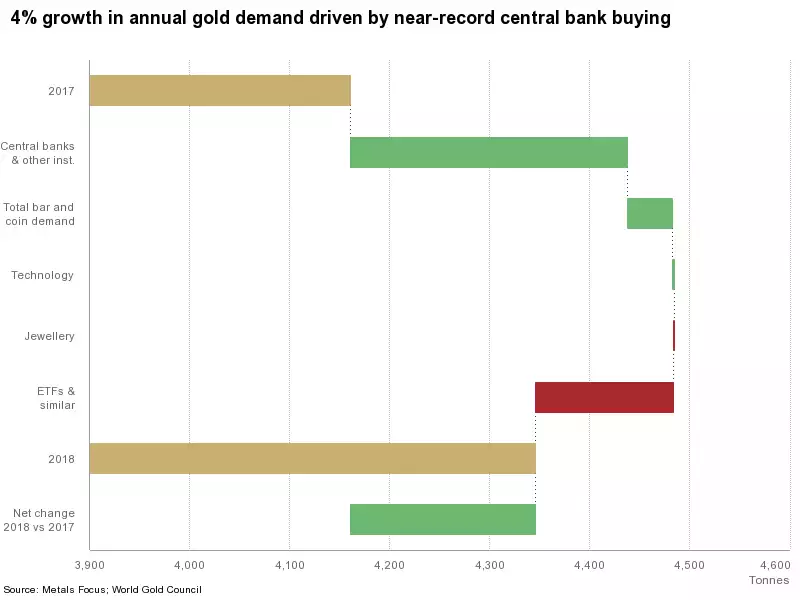

According to the latest research from the World Gold Council, for 2018 annual gold demand gained 4% on the highest central bank buying in 50 years. This is a very constructive sign for the price of gold going forward, as central banks clearly see a need to continue accumulating substantial levels of reserves.

In detail:

“Gold demand in 2018 reached 4,345.1t, up from 4,159.9t in 2017 and in line with the five-year average of 4,347.5t. A multi-decade high in central bank buying (651.5t) drove growth. Demand was bumped up in Q4 by 112.4t of ETF inflows, but annual inflows into these products (of 68.9t) were 67% lower than 2017. Investment in bars and coins accelerated in the second half of the year, up 4% to 1,090.2t in 2018. Full year jewellery demand was steady at 2,200t. Gold used in technology climbed marginally to 334.6t in 2018, although growth ran out of steam in Q4. Annual gold supply firmed slightly to 4,490.2t, with mine production inching up to a new high of 3,364.9t.”

The key highlights:

Central banks added 651.5t to official gold reserves in 2018, the second highest yearly total on record. Net purchases jumped to their highest since the end of US dollar convertibility into gold in 1971, as a greater pool of central banks turned to gold as a diversifier.

Retail investment in gold bars and coins posted annual growth of 4%. Coin demand surged to reach a five-year high of 236.4t, the second highest on record. Demand for gold bars held steady at 781.6t, the fifth year in succession of holding in a firm 780-800t range.

The other highlight of particular relevance to investors was the use of gold in technology. 2018 saw healthy gains in the volume of gold used in technology during Q1-Q3. This slowed in Q4 on the back of a combination of slowing smartphone sales, the trade war and mounting uncertainty over global economic growth, however most of these factors also resulted in market uncertainty which kept the price of gold strong as investors looking for a safe-haven more than made up for the drop in technology/industrial demand.