Activity In AUD & Gold Over The Last 24 Hours

News

|

Posted 19/07/2017

|

6982

It’s been an interesting and volatile 24 hours, most notably for the tremendous surge in the Australian dollar yesterday following the release of the July RBA minutes.

Our local currency jumped one cent to hit a two year high yesterday following a 3% rally last week. Tuesday’s move follows the RBA’s suggestion that official rates are currently a remarkable 200 basis points below what’s now being considered neutral (the balancing point between stable inflation and economic expansion) at 3.5% nominal, down from 5% previously.

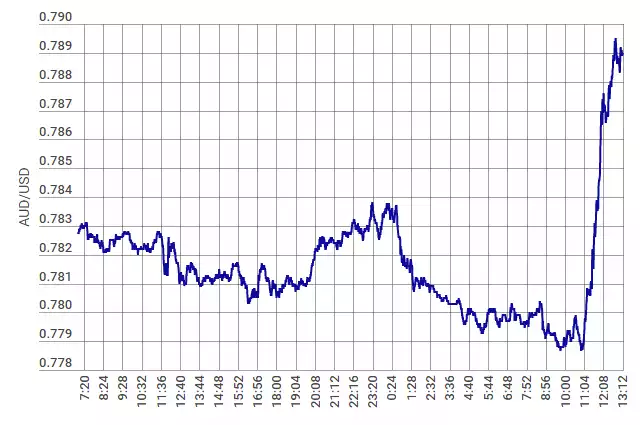

The chart below from the Sydney Morning Herald shows the magnitude of the spike yesterday. Put simply, this means that holders of Australian dollars can, at least temporarily, purchase more.

This move according to a wide variety of analysis yesterday and overnight looks tenuous however. Let’s start with remarks from Westpac’s Bill Evans:

“If the mortgage rate increased by a further 200bps, the evidence of 2011 suggests that house prices would likely fall – hardly what one might assess as a neutral policy stance. Overall, in the current circumstances, this neutral rate looks too high. Arguably, the discussion around the neutral rate can be interpreted as laying the foundation for a tightening cycle. However with uncertainty around wages and inflation; the consumer; and, of course, the labour market and housing it would be inappropriate to over interpret this signal.”

A short translation could be to suggest that the one cent jump in the local currency is based on expectations of rate hikes that haven’t priced in peripheral considerations and hence the sustainability of the jump should be questioned.

Indeed concerns regarding the consumers’ battle with rising electricity prices, underemployment and anaemic wage growth were identified by the RBA and given the high levels of loans issued at the now record low rate; a higher cash rate will exacerbate these stresses for investor and residential borrowers.

ABC’s senior business correspondent Peter Ryan added that “despite the RBA's efforts to manage expectations, concerns remain that anything but a gradual increase would leave indebted borrowers in Sydney, Melbourne and Brisbane struggling to meet higher mortgage repayments.”

In its release, the RBA noted softening in housing recently with Brisbane apartment prices and the Perth market more broadly having fallen further at a time when the impacts of APRA’s recent lending crackdown aren’t yet fully understood.

Notably, local shares fell by over 1.2% yesterday marking the biggest one day fall in 2 weeks and again highlighting yesterday’s comments relating to diversity in equity portfolio allocations.

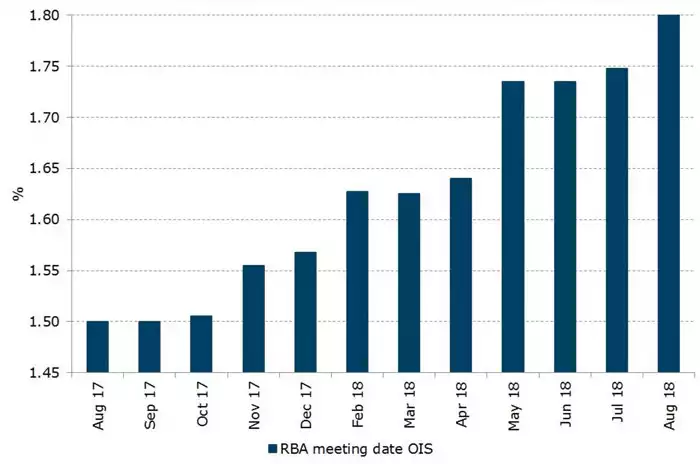

These looming downward pressures on house and equity prices support our recent peak wealth cycle comments and arguably do not support the rate hike timeframe suggested by the following Overnight Index Swaps (OIS) plot which, according to ANZ senior rates strategist Martin Whetton, is now close to fully pricing in a 25 basis point hike by July next year. Martin notes that this is “in stark contrast to that seen only a few weeks ago when a rate hike next year was seen as a marginal possibility at best”.

The question then becomes whether the bigger picture in Australia is supportive of sustaining the Australian Dollar at its current elevated level. If not, we could certainly be looking at a retracement in the currency and a consequential drop in relative purchasing power for its holders.

How then can holders of Australian Dollars benefit from the possibly transient high in the currency now? To answer this, let’s look at gold’s recent action.

Yesterday saw the third consecutive session gain for gold assisted in part by a weakening USD and political issues surrounding President Trump's health care reforms. Gold is now at its highest level for the month and, importantly, looking to have an upward bias given that it is sitting much closer to its next near-term technical resistance level breakout at $1,250 than it is to its next near-term technical support level of $1,200 according to Kitco’s Jim Wyckoff.

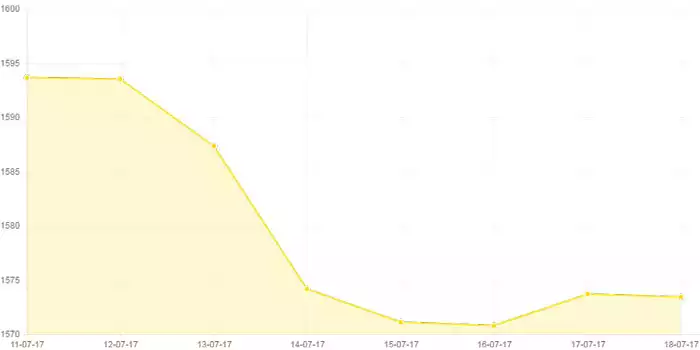

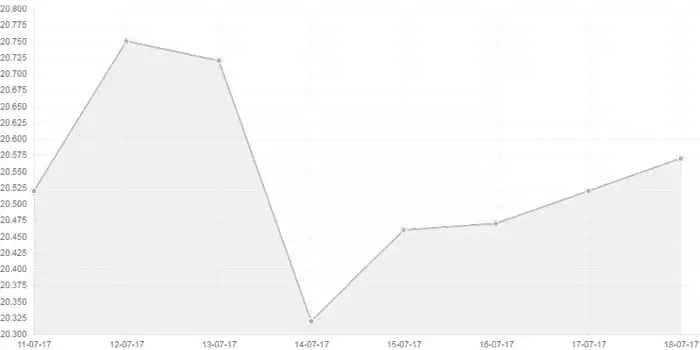

One could make the case that now is a good opportunity to utilise the currently more valuable AUD to obtain appreciating assets. Illustrating this, the combined impact of the rising Australian Dollar along with a falling USD on gold and silver prices can be observed using our charting tool. The first plot below shows the increases in the Australian Dollar over the past week while the subsequent two plots show the dampened impact on AUD priced gold and silver respectively. These dynamics position Australians very well to shift some holdings out of Australian Dollars and into metals given that the former appears to be overvalued while the latter appears to have bottomed.

In effect, the release of the RBA minutes yesterday have placed the three day long gold price increase on hold for Australian Dollar owners allowing for a buy-in at still depressed levels. The same logic applies to silver although its performance has been even more astounding given that it has been appreciating in Australian Dollar terms since the 14th of this month, despite the increases in the local currency.

As we’ve previously discussed, the wealth cycle theory is predicated upon exiting inflated assets in order to enter deflated ones and yesterday’s AUD spike coupled with what appears to be a coincidentally timed bottoming in gold and silver prices may arguably be just one of those opportunities.