Interest Rates and Gold

News

|

Posted 29/07/2015

|

5577

Gold is certainly on the nose at the moment with many predicting further falls to come. But if the basis for much of those calls is the supposed imminent raising of interest rates by the US Fed then it is worth looking at that a little more factually. The reasoning is that with higher rates your cost of holding the non yielding asset effectively rises and so the market is pricing that in now. It also signals that everything is “OK” now so no need to have a defensive asset. We discussed the ramifications of a rate rise here earlier this month but today let’s look more empirically at the relationship between gold and interest rates to debunk this widely held view that rising rates are bearish for gold.

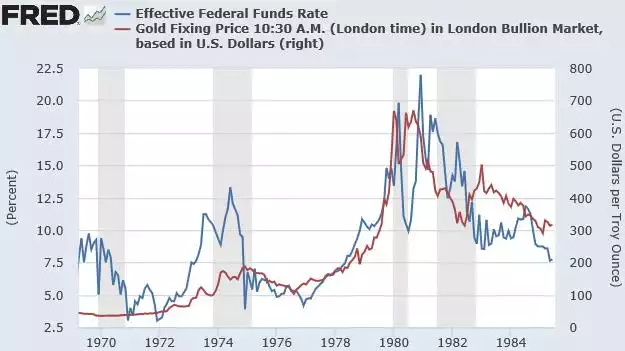

If one goes back to the last big gold bull market of the 70’s the evidence presented in the graph below is pretty clear. Both gold and silver rose (and fell) together with interest rates.

Many still argue we are in the equivalent of the 1976 ‘bear trap’ intra secular bull market phase right now. As you can see above, in 1976 gold almost halved from it’s previous high a couple of years earlier. Upon raising rates gold then commenced its 850% increase to its peak in 1980.