Institutional “Diamond Hands”

News

|

Posted 01/06/2021

|

6101

Bitcoin is on track for the second-biggest monthly percentage decline on record, despite bouncing from session lows in Asia. The 37.5% decline in May 2021 is beat only by September 2011's 40%. Let us explain why that may be great for building your portfolio…

BTC changed hands near $36,200 at 9:00 am UTC, representing a 37.5% loss for May. Prices hit a low of $34,195 early today.

The monthly decline beats the 37% drop seen in November 2018 and is just short of the record 40% slide in September 2011. There’s no denying that we are EXTREMELY oversold and sentiment data supports this – with fear indexes at levels we haven’t seen.

Ether, the second-largest cryptocurrency by market value, is on track to end May down 12%, the first monthly loss since September 2020. Meanwhile, gold has gained 7%, its biggest monthly rally since July 2020.

Just for a little context however, even after this correction, BTC is still up 26% and ETH up 261% since the beginning of this year alone.

The bitcoin market looked weak earlier last month as FUD kicked in. The cryptocurrency took a beating after Tesla disowned bitcoin as means of payment, citing environmental concerns. The move dashed hopes for widespread corporate adoption raised by the carmaker’s decision to adopt bitcoin in February.

The market sentiment soured further after China's recent regulatory announcements and on the concern of an early scaling back of stimulus by the U.S. Federal Reserve. All in all, just typical crypto FUD…

Bitcoin slumped from $58,000 US to almost $30,000 in the eight days to May 19 and has traded sideways ever since, with the upside capped by the 200-day simple moving average (SMA) at just above $40,000.

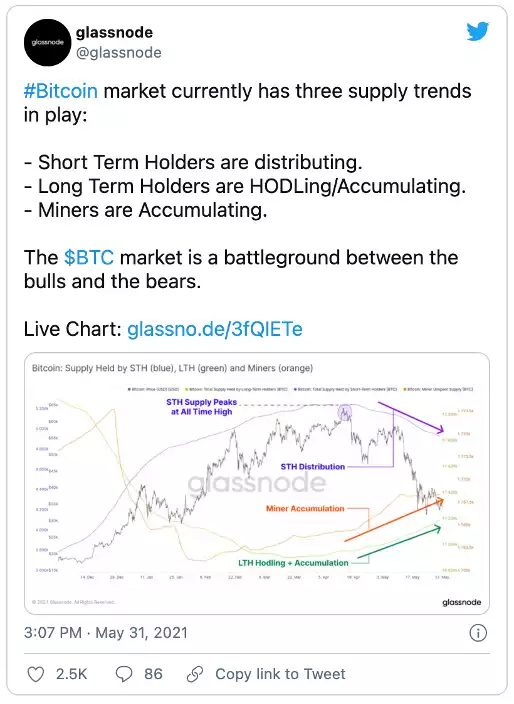

According to blockchain analytics firm Glassnode, the price crash was driven mainly by panic selling by new investors who bought coins during the first-quarter bull run. Meanwhile, holders and institutions have been buying the dip in a sign of confidence in cryptocurrency’s long-term price prospects. Take notes: the smart money is BUYING now.

The supply held by whale entities – clusters of addresses controlled by a single network participant holding at least 1,000 coins – has increased by over 25,000 BTC to 4.149 million BTC since May 19.

Looking forward, a sustained accumulation by large investors might be needed to restore battered market confidence – the big household names will revive retail investors confidence in the crypto market and we will again see prices increasing if that is the case. The number of whale entities rose in tandem with the price between October and February.

Chart analysts foresee a relief rally in the short term, as the sell-off looks overdone.

“Bitcoin is newly oversold from an intermediate-term perspective, and there is a new short-term ‘buy’ signal from the DeMARK Indicators today that supports a two-week rebound,” Katie Stockton, founder and managing partner of Fairlead Strategies, said in a weekly research note published yesterday.

DeMark indicators compare the most recent maximum and minimum prices to the previous period’s equivalent price to measure the demand of the underlying asset.

The overall bias remains bullish, with the likes of Ray Dalio, founder of Bridgewater Associates, preferring to hold bitcoin over bonds in an inflationary environment.

Interpret all of that how you will but it appears that a variety of FUD ‘news’ events spooked new investors out of the market, causing the pullback. That many investors were using leverage just made the situation worse when liquidations were triggered as that initial correction closed out their long positions. The smart money remains bullish and only see this as an opportunity to increase their bags. Nothing has changed in their eyes.