A Historic Week for Crypto

News

|

Posted 19/10/2021

|

6676

It has been an exciting week for Bitcoin investors as the SEC approves the first Bitcoin futures backed ETF product. The market continued to rally on the news from a low of $54,370 US to a high of $62,503. At the weekly peak, prices were within $2,214 of the current all-time-high at $64,717.

The excitement in the market can be seen across several indicators and metrics, both in the on-chain spending patterns and in derivatives markets.

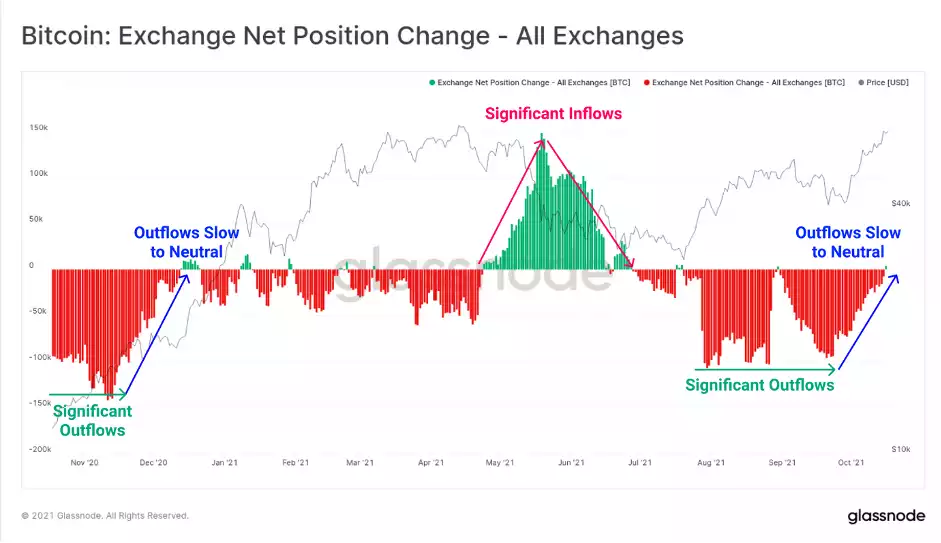

We can look to the Exchange Net Position change metric to see if coins are flowing into exchanges for sale. What we can see is that after an extended period of sustained outflows, the on-net change in exchange balances has returned neutral.

This suggests that over the last 30-days, inflows have been matched with outflows which further indicates that there is sufficient demand at present to absorb the sell-side. It does however indicate fewer coins are being withdrawn and is less constructive for the price than net outflows.

Interestingly, this market structure is very similar to the period in late 2020 as Bitcoin approached last cycles $20k ATH. All in all, the market remains quite bullish, however, it is likely that this early signal of older coins, owned by LTHs being spent on-chain will continue as it has in all previous Bitcoin cycles.

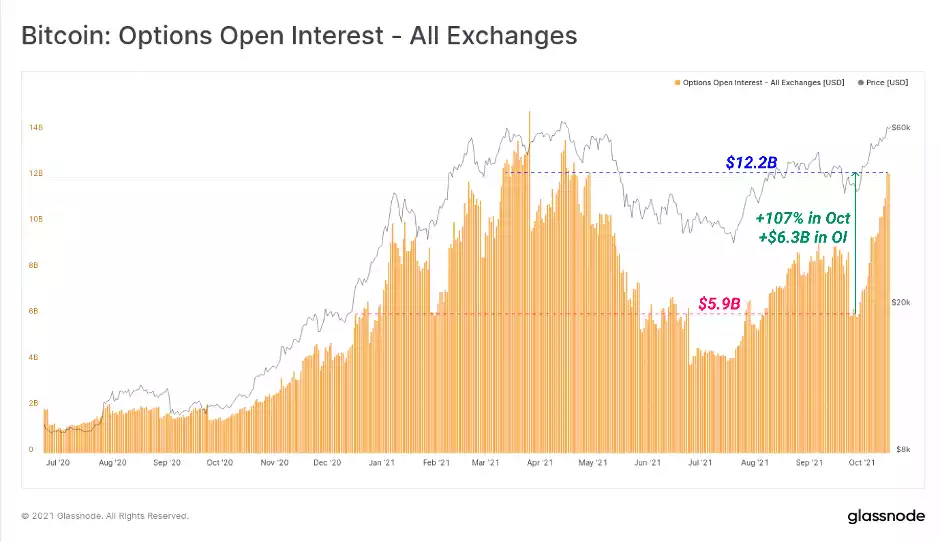

The derivatives markets for Bitcoin have seen marked increases in open interest and volume, particularly in the options space. Options open interest expanded by a remarkable +107% ($6.3B) throughout October alone. Whilst, not an all-time high, it is not all that far away.

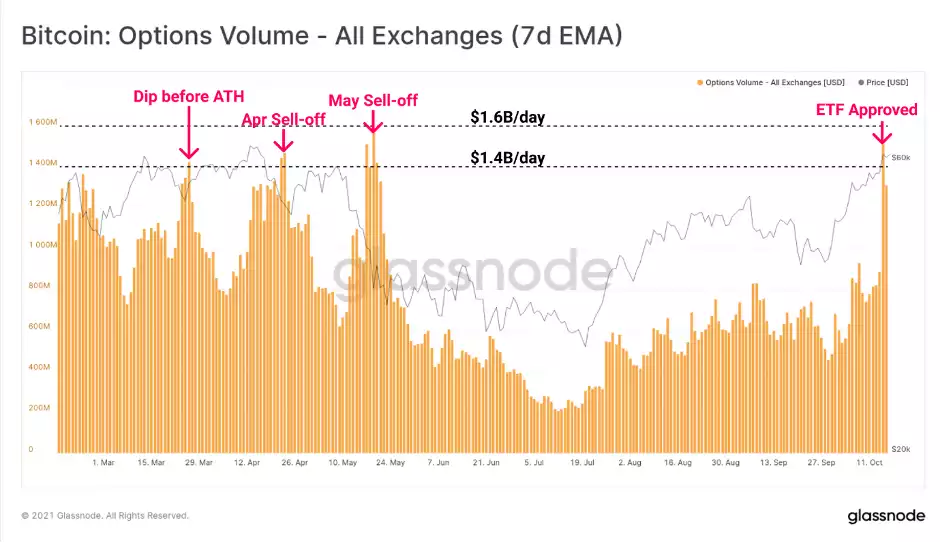

Options trade volume has similarly seen an extraordinary week, rising to $1.5B as Bitcoin prices breached the $60k price level. Options trade volume has only reached levels this high on three prior occasions, all at similar price points between March and May this year.

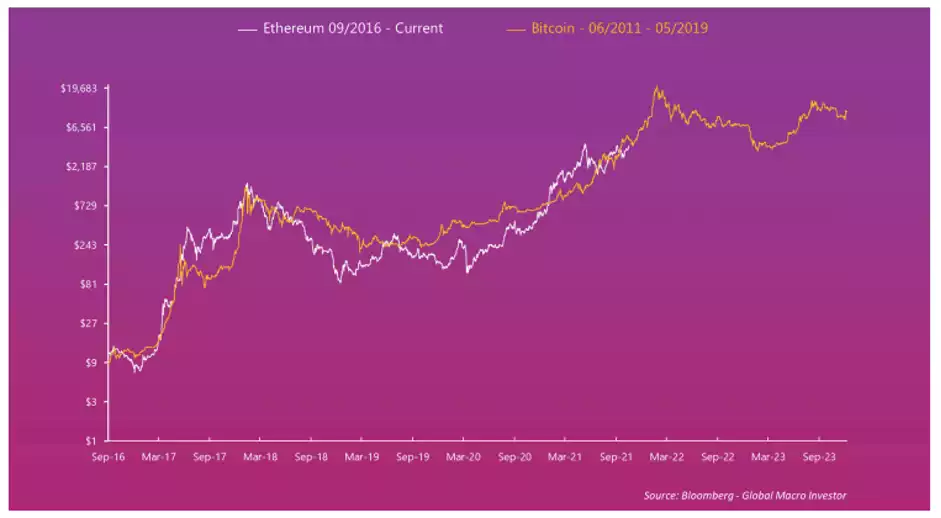

Possibly even more exciting is the outlook for ETH, which one of our favourite analysts Raoul Pal touched on in a Macro Insiders Flash Update yesterday. Let’s see why he’s so excited about the next 6 months…

“The Last Hurrah...

I just want to get out a quick trade recommendation because I’ve discovered a great opportunity!

As you know, I think we are in the beginning of the next exponential up-leg in crypto and my focus is on ETH. The chart is nothing short of EPIC. When this line goes, the next phase will begin...

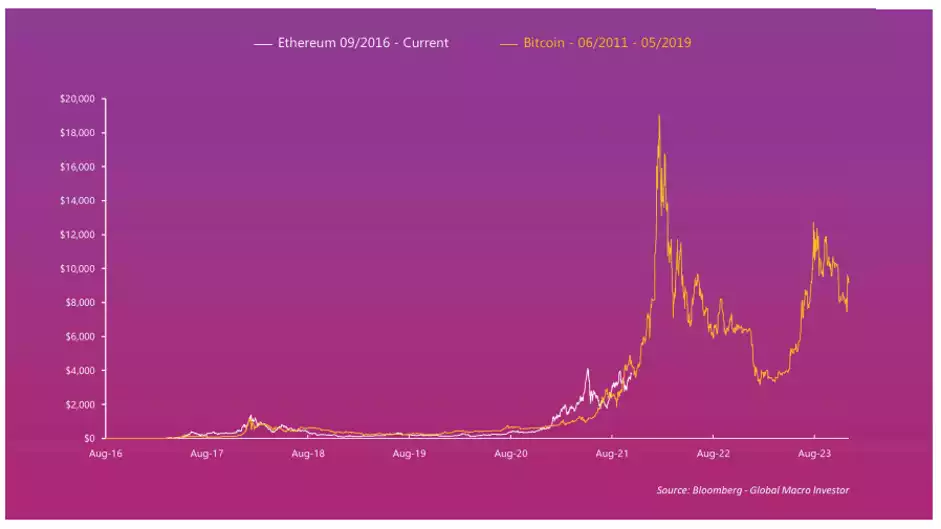

And, using the past history of BTC, we are headed to $20,000 by March...

And with a linear chart that looks like this...

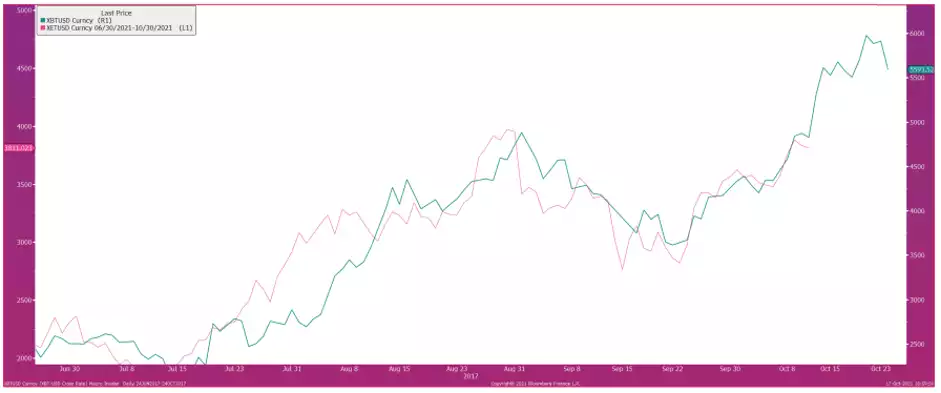

... the short-term chart looks like this (a perfect match) ...

To me, this all gives a target range of $20,000 to $40,000 by end of March.

Why the overshoot vs bitcoin in 2017?

Simple:

- There will be an ETF launched on ETH at some point this year, or early next year. That will bring huge retail flows. The BTC ETF has just been approved and that helps too.

- Secondly, institutions are buying ETH and most asset allocation committees will pull the trigger in Jan.

- Thirdly, ETH 2.0 will come out towards March.

That means there will be a big run into Dec, maybe a pullback as people re-balance or tax profits for tax and then everyone with a shiny new P&L will load up.

There is no supply. The only outcome is exponential price rises. I think it goes on for longer and further than expected.

However, I am fully loaded with almost every penny I have in the crypto trade. I am all in.”