Indian demand for gold and gold loans

News

|

Posted 16/11/2020

|

6369

Friday was a busy day in store as our Indian customers and their friends bought gold for the annual Diwali festival. We hope all enjoyed the celebrations and thank you for your business. The Indian love affair with gold is not new news. There is a centuries old appreciation for gold not just as money for all but also as a culturally significant symbol of good fortune and status.

Until China embarked on its massive gold buy up from 2013, India was the world’s biggest consumer of gold. As the 2nd biggest import after oil, the Government was watching helplessly as their currency escaped in exchange for real money and put layers of restrictions in place to stem the flow. A country of 1.4 billion people who all aspire to gold ownership will always be a big force in the gold market regardless. World demand is influenced by the success of the monsoon season in India which dictates the amount of gold being bought from the proceeds of that year’s crop.

Indian households are estimated to hold 25,000 tonne of gold officially and likely much higher in ‘black market’ or undeclared gold. That so called black market gold came to the fore when the Indian government outlawed around 86% of the cash notes in circulation in 2016. Gold became, again, a medium of exchange from that cash ban. An estimated two thirds of gold’s demand comes from the rural areas that live outside the banking and tax system, relying heavily on gold.

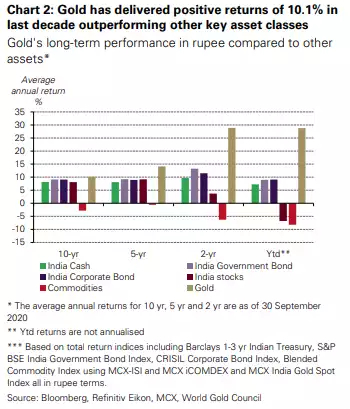

The chart below illustrates gold’s stellar performance over the last 10yrs, 5yrs, and spectacularly over the last couple and ytd.

From World Gold Council:

“Gold is a prominent feature in India’s investment landscape. Our market research indicates that as of Q3 2019, 52% of investors already owned some form of gold, with 48% having invested in the 12 months preceding Q3 2019. The average Indian household holds 84% of its wealth in real estate and other physical goods, 11% in old and rest 5% in financial assets. Dependence of rural households in physical assets such as gold has been a result of not just love of gold, but also poor banking penetration”

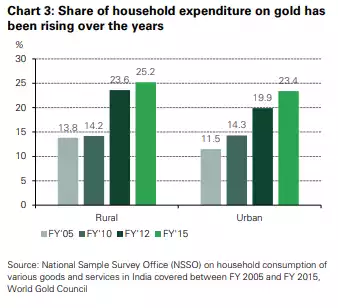

Indeed if you look at the chart below, the percentage of household expenditure on gold has been rising solidly to a now incredible mid twenties percentage:

However it is not just as a store and growth of wealth that gold is shining in India, but also as collateral to access cashflow and working capital. The World Gold Council last week released a report on the surge in gold loans in India:

“Pledging gold as collateral to meet financing needs has been an ever-present feature of the Indian gold market. Indian households use gold loans to meet the financing needs for health, education and marriage, while small businesses use them for their working capital requirement.

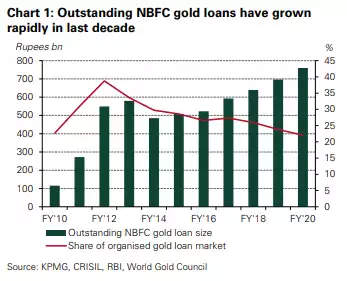

Demand for gold loans, both through banks and non-banking financial company (NBFC) has grown in response to the economic impact of the COVID-19 pandemic. As a result, outstanding organised gold loan is expected to grow to INR 4051bn (US$55.2bn) in FY 2021 from INR 3448bn (US$47bn) in FY2020.”

Whilst the growth of these NBFC’s has been incredible (see the chart below) you will note that as a percentage of the total organised gold loan market, the banks are growing too and as of August, in response to the stresses of the pandemic, have increased their loan-to-value to an incredibly high 90% until March next year which will no doubt increase this further.

One thing is certain, 1.4 billion people understand gold’s role as real money and as a real hard asset and that cannot be ignored.