India Silver Demand Surges

News

|

Posted 16/09/2019

|

7957

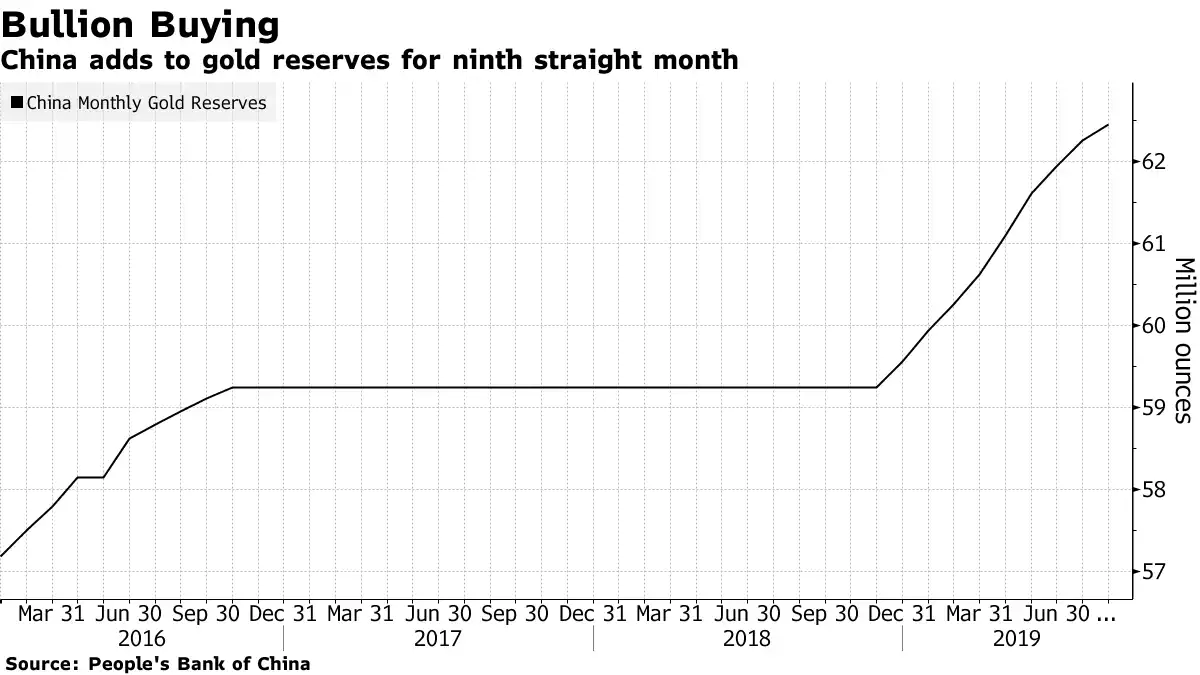

Last week we saw reports of China’s central bank adding 100 tonne of gold to its reserves this year alone with another 5.9 tonne added just in August.

This is of course on top of their non PBOC imports and other reports around Russia’s rapacious accumulation as well as we discussed in the Crypto Koala interview recently.

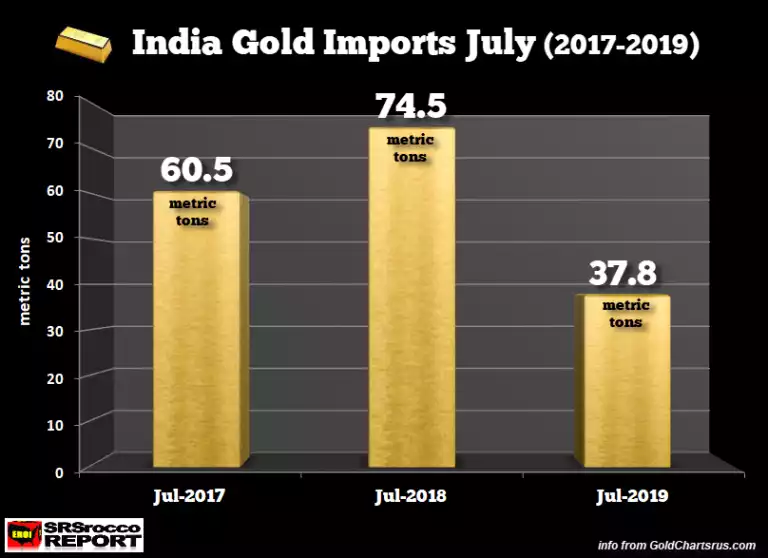

However it wasn’t so long ago that India was the world’s biggest consumer of gold. Whilst they are still a huge importer of gold they are a price sensitive market and with the rise in the gold price from mid this year and new import taxes imposed on the yellow metal, we have seen a sharp decline in gold imports year over year in July when the price of gold really surged.

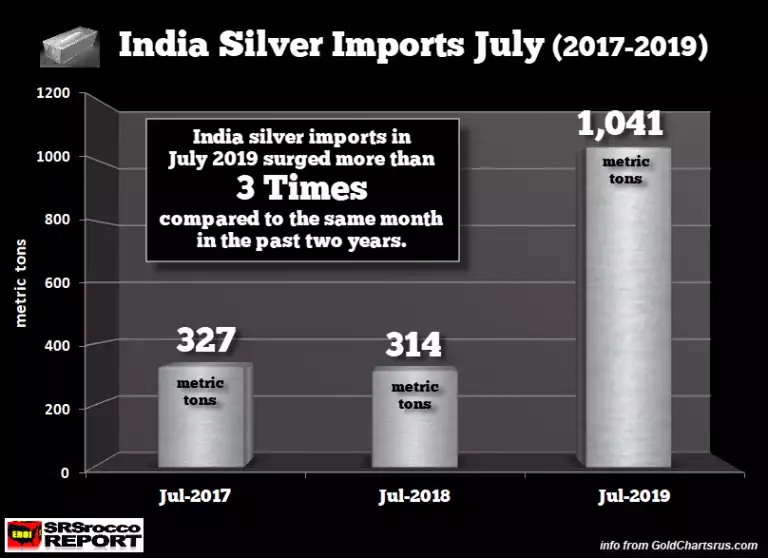

As silver investors will remember, silver was late to the party and did very little in July compared to gold. The Indian’s it seems pounced on that with a 3-fold increase in imports July on July.

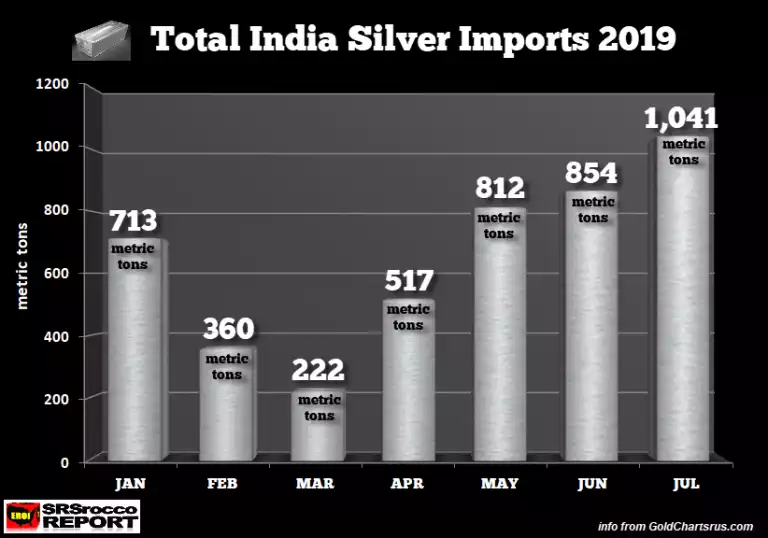

This has been no flash-in-the-pan though with the demand steadily growing this year:

For context that demand represents around 30% of total global mine supply in 2018. Already we are seeing tightness in the silver market off this recent investment demand and should these trends continue that will only get worse and start to put very real pressure on a price still arguably at the whim of paper markets such as COMEX.