India Opens doors amid tight supply

News

|

Posted 01/12/2014

|

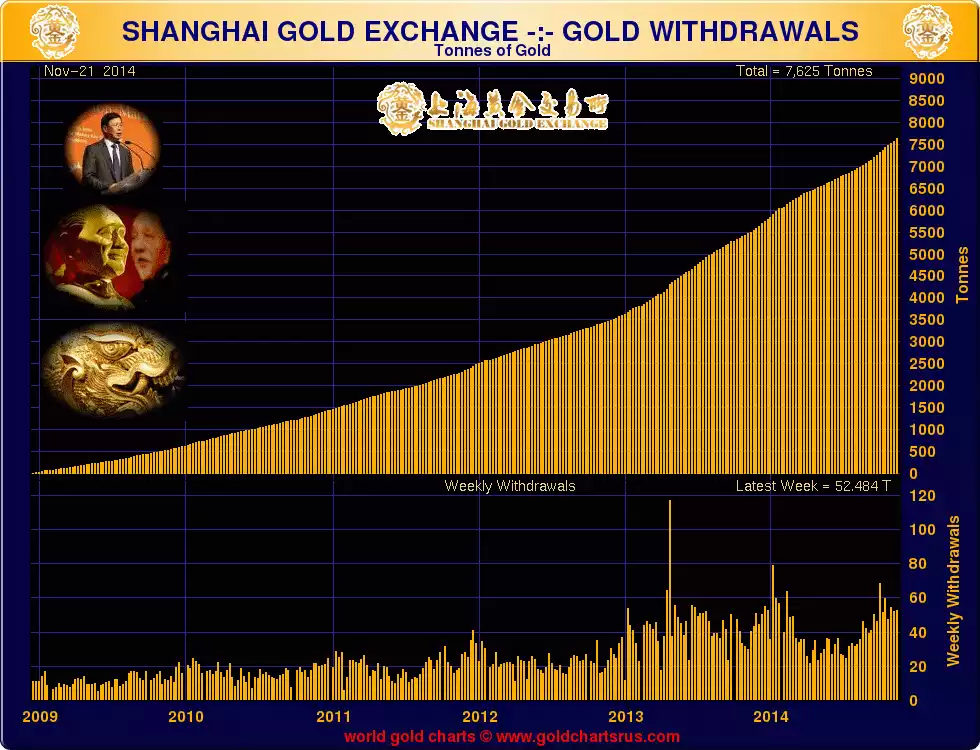

4271

Firstly, if you haven’t heard already, the Swiss voted down the gold referendum by 78% after a torrent of propaganda against it at the end. But countering that, news broke over the weekend that in a surprise move the Indian government removed the 80:20 import export restriction on gold just as speculation circled on an increase in restrictions given recent demand. Whilst the 10% duty remains, the removal of this restriction could well see demand jump in India (though countered in part by an expected reduction in smuggling). For this to come as expectations for November of a 3rd straight month of 100t plus imports into India and at a time when China is still rampantly buying (see the graph below which now includes another 52.5t in the week to 21 Nov), and the GOFO rate hitting new records with 1 month rate the most negative since 2001, 2 month negative, 6 month negative for the longest stretch in history, and 1 year, which has never in history been negative, sitting at just 0.027%, simplistically meaning investors will pay for something that normally pays them as there is a concern about it actually being available.