India imports a record $55.7bn in gold in 2021

News

|

Posted 06/01/2022

|

5430

More than doubling 2020’s haul, and breaking all time records, India imported US$55.7bn in gold in 2021. The total of 1,050 tonnes of gold contrasts with 430 tonnes in 2020. The statistic was leaked by a senior government official speaking to Reuters with anonymity. In contrast to most Western nations, Indians have precious metals ‘front of mind’ when considering long term wealth.

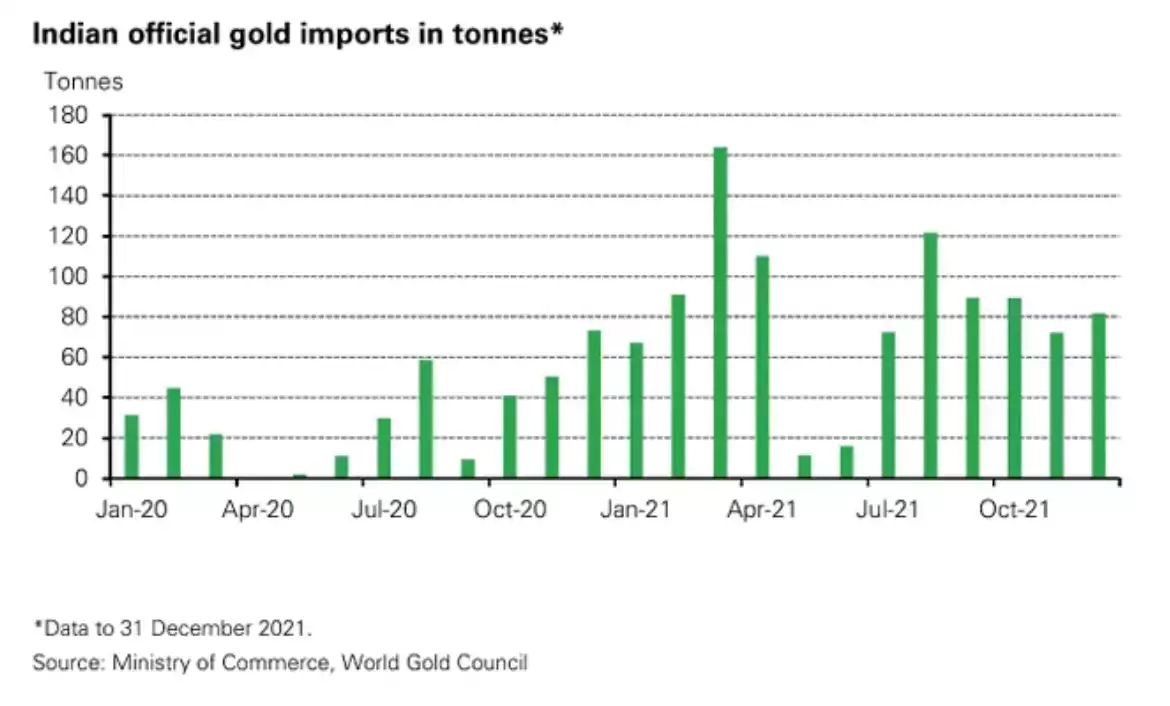

Lockdowns in 2020 leading to postponed weddings have been suggested as one reason for the dramatic up-tick in gold demand. Loss of purchasing power of the rupee and rising living costs may be another. Indian gold buyers took advantage of fluctuations in the gold price, with March-April seeing the largest volume in correspondence with the prices in the low US$1700s before backing off in May-June where local highs checked out north of US$1900. The timeline lines up nicely:

Indians have a history of struggles with fiat currency. Large parts of the country are unwilling to keep their wealth in banks due to the threat of fraud and confiscation, holding large denominations of cash and gold are traditionally very common ways of storing savings. In 2016 the 500 and 1,000 rupee notes were taken out of circulation with a 50 day notice period. The result of the change was long lines at post offices and banks, and citizens looking to gold as a safer form of savings.

As we covered in December, India has been seeing record breaking demand for silver as well with a whopping 747 tonne of silver imported in September alone.

With the spot price of Gold down 5% in 2021 and #inflation trending worldwide, it is certainly not surprising to see the massive doubling of demand from the second largest consumer of the yellow metal. And for those wondering, 1,050 tonnes is roughly approximate to the total COMEX holdings after the 134,552 oz that came out of the vaults in 2021.