IMF Warns of Liquidity Crises

News

|

Posted 20/04/2015

|

4093

In another ironic turn of events the IMF, who promoted the likes of the US, Japan and ECB to implement and continue with QE and low interest rates, is now warning of serious risks to financial markets because of the resulting leverage (debt) and lack of liquidity in global markets. Indeed the levels of borrowing and financial engineering now are similar to or in excess of that seen before the last 2 financial crises. Published in their Global Financial Stability Report they had this to say:

"Margin debt as a percentage of market capitalisation remains higher than it was during the late-1990s stock market bubble. The increasing use of margin debt is occurring in an environment of declining liquidity,"

"Lower market liquidity and higher market leverage in the US system increase the risk of minor shocks being propagated and amplified into sharp price corrections,"

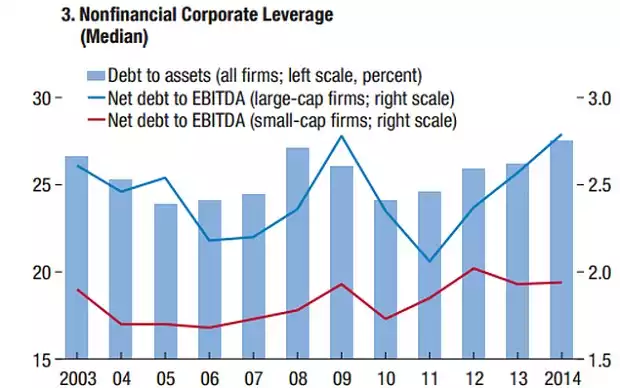

And it’s not just investors, corporations are borrowing more than ever and two thirds are “covenant light” loans similar to those sub prime property loans that triggered the GFC. The graph below shows that the ratio of non-financial corporate debt to asset value has reached 27%, higher than just before the GFC.

Whilst many are enjoying the lower oil price, they warned that distress in the global oil industry could be the trigger for the next crises. Lending to the oil and gas industry reached $450b last year, double the pre GFC peak and new bond issuance graded at `junk' level is nearly 3 times higher at 45pc. The total debt outstanding is now $3 trillion.

Many believe a run on the US dollar like we are seeing now is a sign of an imminent liquidity crisis.