Record Silver Inflows v Smart Money Equities Exit

News

|

Posted 25/01/2021

|

7574

Whilst the price of silver has been chopping between US$23 to US$28 since it’s big surge from US$18 to US$29 last July and August, total holdings backing all derivatives have likewise been reasonably flat with inflows only just outpacing outflows. However now that we have the certainty of the US election result behind us and the economic reality of MOAR fiscal stimulus, expectations of reflation and inflation, and green initiatives needing silver’s unique properties, we have seen large precious metals inflows recommence, particularly into silver.

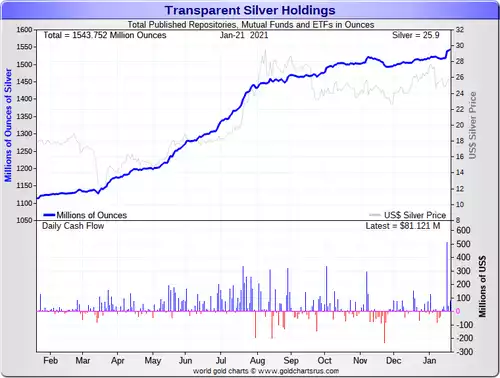

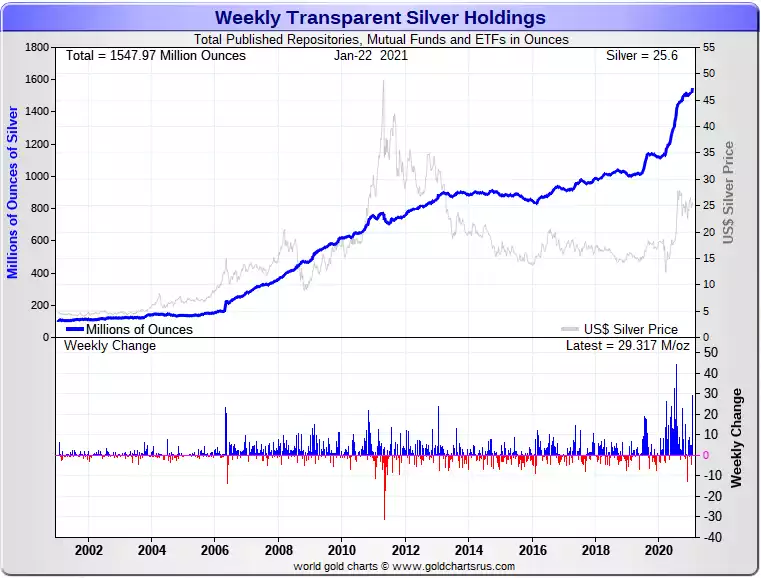

Last week saw the largest one-day derivative capital inflow in over eight years, mostly into the silver ETF giant SLV. Half a billion US dollars or around 20 million oz or 600 tonne in one day. For perspective, global silver production equates to around one tenth of that figure per day. For the week the figure was a staggering 29.3 million oz or around US$750 million.

The chart below shows both the holdings for these funds and the price of silver. You can see the correlation.

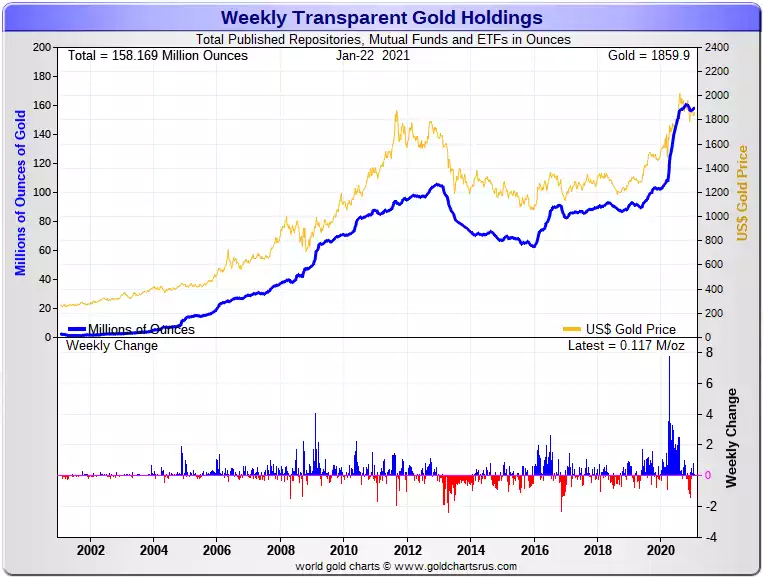

Gold saw 117,000 oz of net inflows worth around US$220m by comparison but again showed an uptick in net flows since coming off last year. To put these both into perspective the following are the charts going back to when ETF’s etc were born.

And gold:

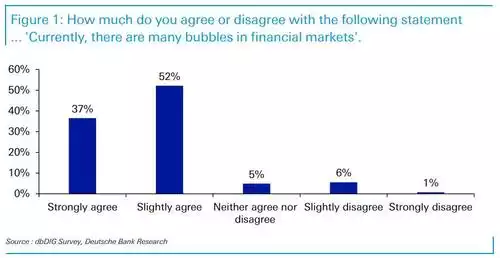

So who is buying all this silver and gold? There is a growing concern amongst the investor space about the sustainability of this global, but US in particular, sharemarket bubble. Deutsche Bank’s latest investor survey paints a clear picture with 37% of respondents ‘strongly agreeing’ to the statement “Currently, there are many bubbles in financial markets” and 52% slightly agreeing.

The buyers of all this silver might just be the guys in charge of those bubblelicious shares… If ever there was a ‘rubber hits the road’ warning sign then surely the chart below must rank high. This year we have seen a new surge back to near highs of company buybacks on the S&P500. At the same time, the executives running these companies are selling their shares at the highest monthly rate since data began in 1988. They are bailing out personally and buying back with the company account that just inflated the price of these same shares.

As a reminder of some investment fundamentals, when you buy shares in a company you are making a bet on the management of that company delivering future value to you.

- They are bailing out

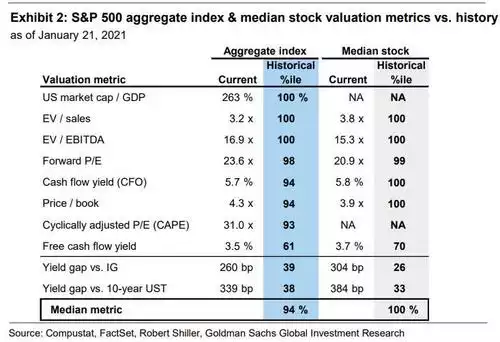

- Those companies are at valuations rarely ever seen before meaning the risk of future earnings justifying your investment are extremely low. Refer the table below:

Previous crashes abound with examples of the smart ‘sophisticated’ money bailing before, and indeed into the hands of, the hapless ‘unsophisticated’ investor.

Don’t be ‘that guy’.