Hedging when there’s smoke

News

|

Posted 07/05/2014

|

3455

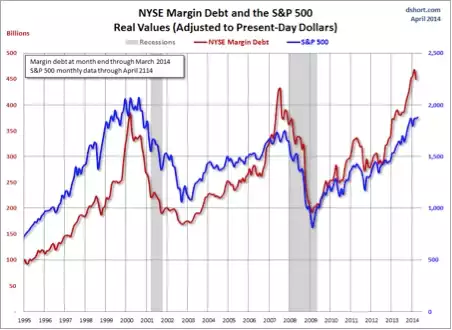

It may look at times like we spruik doom and gloom. We don’t apologise for simply making people aware of facts that seem to get little airplay in a world desperately wanting to recover from the GFC. We also never say sell everything and buy gold and silver – we preach balance. What we are saying however is that there can be no denying there is ‘smoke’ and you have the opportunity to buy ‘fire (maybe inferno) insurance’ at very low prices. Multiple indicators say the highly leveraged global sharemarkets, propped up by central bank monetary stimulus and near zero interest rates could burst at any time. We write every day of the 4 biggest economies of the world, each experiencing serious structural economic stress with fundamentals often worse than the GFC. Today we are posting 2 articles. One gives further scary insight into Japan, the other looks at how cheap the silver price is now. Australian’s, unlike other parts of the world, don’t ordinarily think of gold and silver for their portfolio but elsewhere people see both as the perfect hedge/insurance against what looks more and more imminent in another crash. One more example… Does this look like a flag of a market peak to you?