Hard Landing Dead Ahead

News

|

Posted 23/03/2022

|

7413

Last night was another classic ‘buy the bad news’ rally in growth shares whilst both bonds and gold were sold. There is an increasing view that the Fed are going too hard too late and will force a market crash and recession.

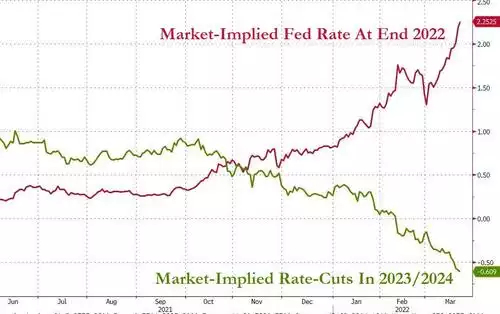

Yesterday we saw a couple of Fed committee members openly contemplate a 50bps rise on the cards. The market is now pricing in 8 rate hikes this year and 50bps hikes in BOTH May and June! At the same time it is pricing in rate cuts as early as next year as the Fed reverses course to address the very recession they caused….

Yield curves across the board are crashing toward zero…

Commenting on these US Bonds Bloomberg analyst Cormac Mullen noted "the chance the Federal Reserve can engineer a soft landing is fading by the week, with the war in Ukraine exacerbating the inflationary pressures." … and .. "even [Fed Chair] Powell himself acknowledged the severity of the test the Fed now faces, withdrawing stimulus as inflation accelerates at the fastest pace in four decades."

The latter was in reference to the Fed Chair stating yesterday “There is an obvious need to move expeditiously to return the stance of monetary policy to a more neutral level, and then to move to more restrictive levels if that is what is required to restore price stability.” He has never used “expeditiously” before… As we have reported previously, the Fed have not hiked by 50bps since 1994..

Carl Icahn has amassed a personal fortune of US$15.9 billion according to Forbes this year. He is one of the most respected voices on Wall Street. Here is what he had to say in an interview overnight:

"I think there could very well could be a recession or even worse……I have kept everything hedged for the last few years. We have a strong hedge on against the long positions and we try to be activist to get that edge... I am negative as you can hear. Short term I don’t even predict."

In terms of how the Fed tries to prevent the ‘policy mistake’ of a hard landing for the economy, he is just as pessimistic:

"I really don’t know if they can engineer a soft landing….I think there is going to be a rough landing... Inflation is a terrible thing when it gets going."

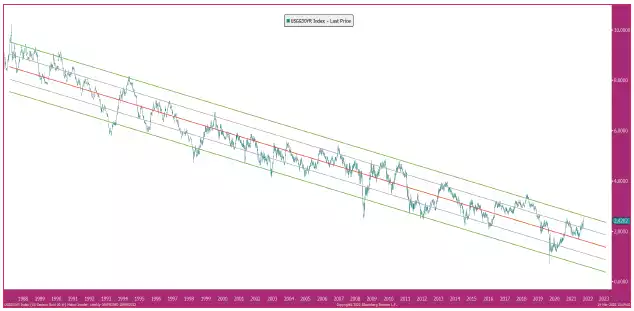

Raoul Pal of Macro Insiders is making the same call. He is bullish on both bonds and gold as this inevitably plays out. Pal famously called the ‘trade of the century’ with bonds last time and is openly calling for another rally to commence soon. He often refers to the “chart of truth” being the 30 year US bond yield chart that has maintained a channel of trade for over 3 decades.

That chart is looking like topping very soon. As yields then inevitably fall (as bond prices rise) on the realisation that there is a recession, financial markets are crashing, and the world’s massive debt pile simply can’t handle higher rates, gold too should be looking extremely attractive.

Many people point out the counterintuitive trade of buying debt instruments (bonds) amid a debt crisis and a USD losing its hegemonic dominance. Gold is the same play as bonds but without the counterparty risk.