Greek default & German Gold

News

|

Posted 02/06/2015

|

3890

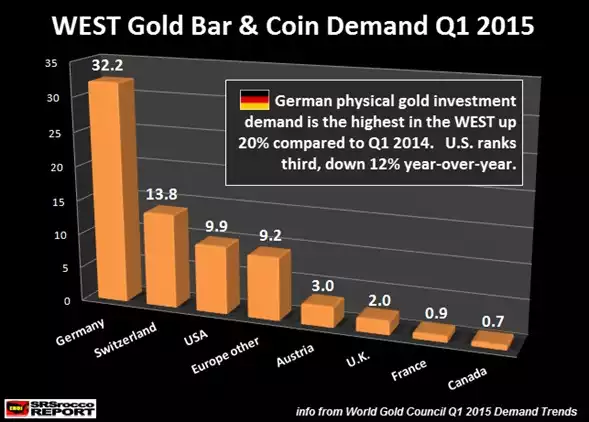

Germany is the Eurozone’s biggest economy. It is arguably the most exposed to a Greek default or exit from the Euro. Last night the German Chancellor Angela Merkel joined IMF chief Christine Lagarde and ECB president Mario Draghi in crisis talks in Berlin just 3 days before the next debt deadline for Greece as talks continue to fail to reach a resolution. Last week a senior lawmaker within the Greek government said they are simply unable to pay the smallest of the payments due this Friday of just $300m. They are now saying they can pay Friday but they still have another $1.5b to pay by the end of this month, at the same time as EU bailout package expires. So if you are a citizen of the biggest sovereign creditor to a bankrupt state where would you be investing your money? Maybe the next graph provides the obvious answer… gold.