Grank Run - Ainslie Bullion News

News

|

Posted 23/06/2015

|

5730

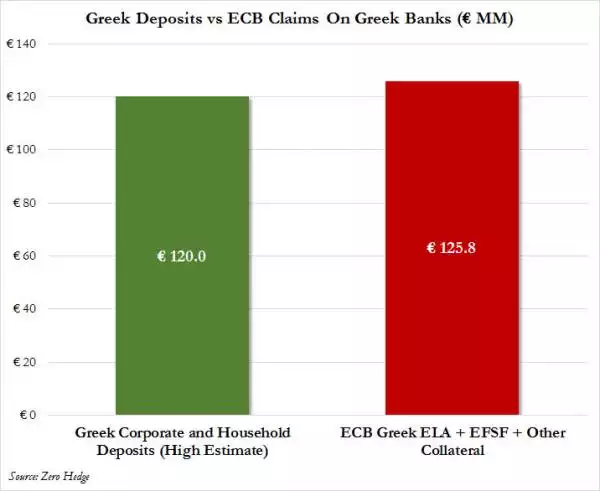

Reading the paper today you’d think the Greek default ‘can’ has been kicked down the road with another 6 month extension and after another EUR1.8b ELA (Emergency Liquidity Assistance) on Monday after another EUR3.2b in cash was withdrawn from Greek banks over Friday and the weekend. But the problem with papers are they lock one bit of news in for 24 hours and this keeps changing. It seems now that Germany’s Merkel is less confident, saying there is no consideration of an extension yet. This will continue until it doesn’t, and probably with little warning. There is plenty of speculation in the market, some by none other than Goldman Sachs, that Germany et al may not care about a Greek default as it will conveniently weaken the EUR and the ECB will just fix it all up with even more quantitative easing (money printing, on top of its current EUR1.4 trillion program). You know, just like the US did after the GFC… But what of the Greek people and the unintended consequences on derivatives and the like? On the former, the graph below tells a scary story… its Cyprus all over again when/if the ECB pull the ELA support net. You see there are now less deposits than ECB support. Remove that support and the banks have no choice but to “bail in” ala Cyprus and take all the deposits. Classic catch 22 wherein that is the very reason why everyone is pulling out their money in the first place. The graph below paints a sobering picture. On the latter, it’s the unknown ramifications on the $710 trillion derivatives market that has some very scared. We’ll touch on that in another post soon…

PS – all the talk of “money” above is actually currency. It highlights the difference between gold (money) and cash (currency) in this new crazy global economic experiment.