Goldman Sachs CEO: Bitcoin Is The Natural Progression from Paper Money

News

|

Posted 04/07/2018

|

8104

Lloyd Blankfein, the CEO of Goldman Sachs, one of the biggest investment banks in the global finance sector valued at $87 billion, has criticised sceptics who believe Bitcoin and cryptocurrency do not have a future.

He has frequently emphasised that investors must consider cryptocurrencies like Bitcoin as an emerging asset class and acknowledge the potential of the cryptocurrency and blockchain sector.

Similar to how paper money was forced to become the natural progression from gold, Blankfein explained that Bitcoin could one day become the natural progression from fiat money to digital money, and thus, although he does not fully understand cryptocurrency and is not convinced that Bitcoin will soon become a reserve currency, Blankfein said he is open-minded about the cryptocurrency market as an emerging asset class.

“A five-dollar gold coin was worth five dollars because it had five dollars worth of gold in it. Then they issue paper money that is backed by gold in the treasury. Then one day, they issue paper money that does not have the backing of gold. There was no pledge that if you turn it in, I’ll give you five dollars of gold. It is fiat money. I say this piece of paper is worth five dollars and so therefore it is five dollars and a lot of people did not take that for a long time. But, now they do without question. If it works, I say maybe it is a natural progression from hard money to digital money,” said Blankfein.

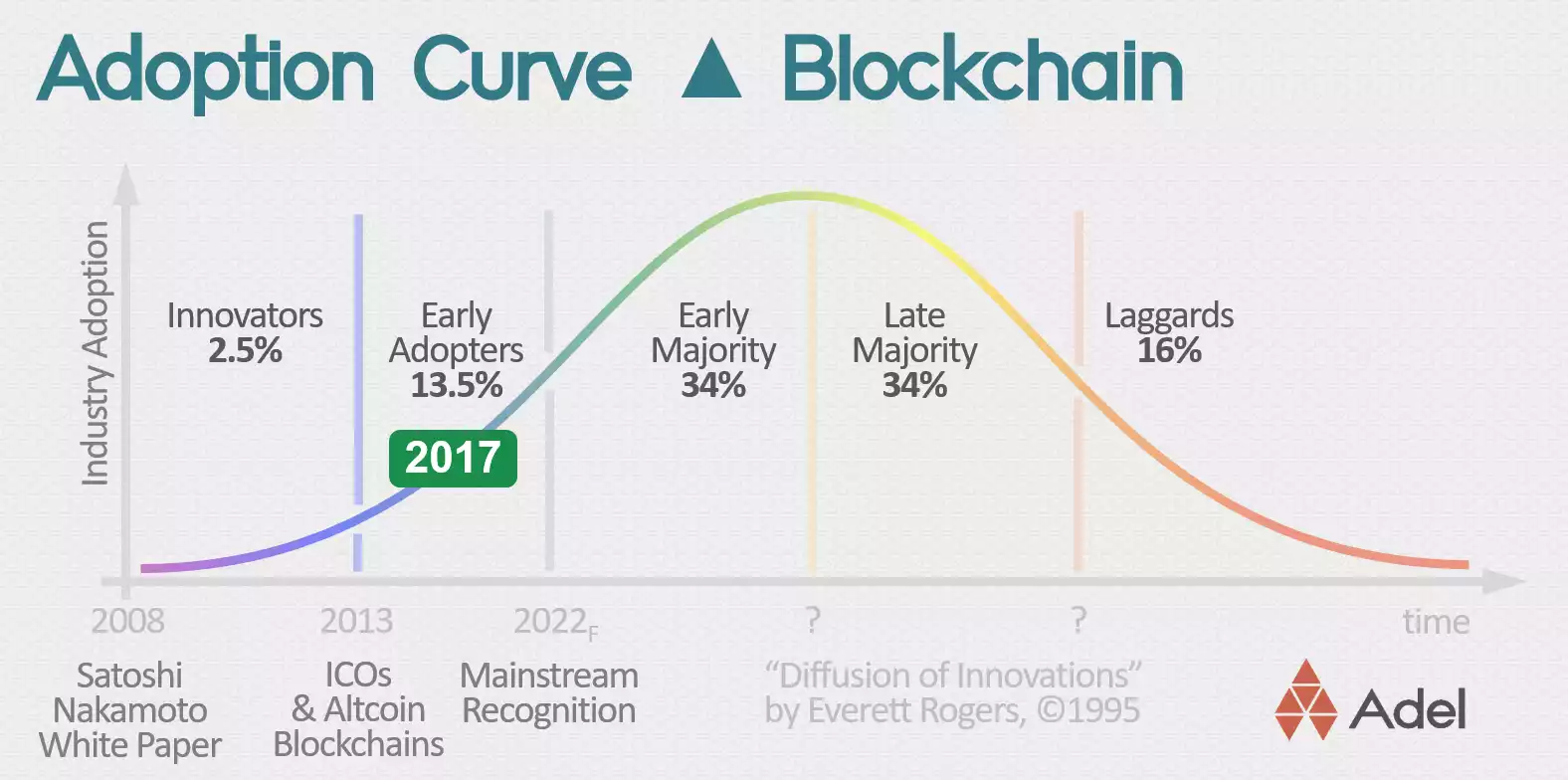

With enough interest from Wall Street and institutional investors wanting to get into the game, there will be a lot of pressure on regulators to NOT try to 'shut down' crypto. It legitimises the asset class. Blockchain technology and crypto are still in their infancy and the open-mindedness of large institutional players like Goldman Sachs goes to show that crypto won’t be going away any time soon. There is still a lot of growth for the sector and every day more companies utilise blockchain to increase efficiency and lower costs.

We wrote about blockchain adoption earlier in the year here which goes further into exploring where we might be on the Bitcoin and blockchain adoption curve.