Gold v Fiat “Money” – Some Simple Math

News

|

Posted 27/09/2019

|

8002

People often forget the fundamental reason gold is the world’s ‘go to’ safe haven is because it has been the pre-eminent uninterrupted form of money for 5000 years. As a reminder, ‘money’ needs to meet 7 accepted fundamental properties:

- Durable

- Portable

- Divisible

- Intrinsic Value

- Medium of Exchange

- Unit of Account

- Fungible

Gold easily meets all 7 and that is why it’s the world’s premier form of money.

Point 4 is arguably the most contentious in modern history and one we refer to frequently when talking about our current Fiat based monetary system. For something to have intrinsic value, that value must be derived in or of itself by virtue of its rarity or replacement cost. It must essentially have no counter party risk, it must be no one’s liability.

Fiat money (but let’s stop using that term as it simply isn’t) or more accurately, currency, has no intrinsic value. It is simple a piece of paper backed by the promise of a government and the counterparty risk that presents.

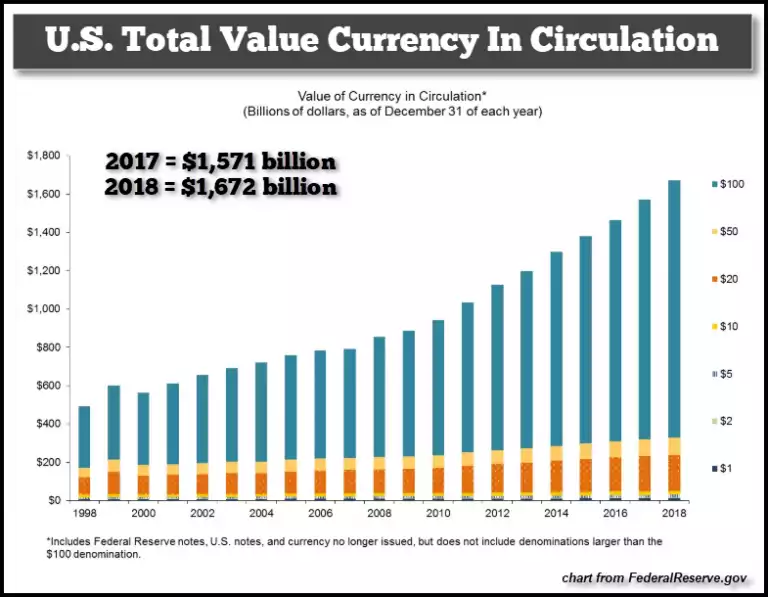

Let’s look at that pragmatically. Last year the US Treasury printed (literally) $243 billion of new notes. After destroying old notes that saw a net increase of around $100 billion.

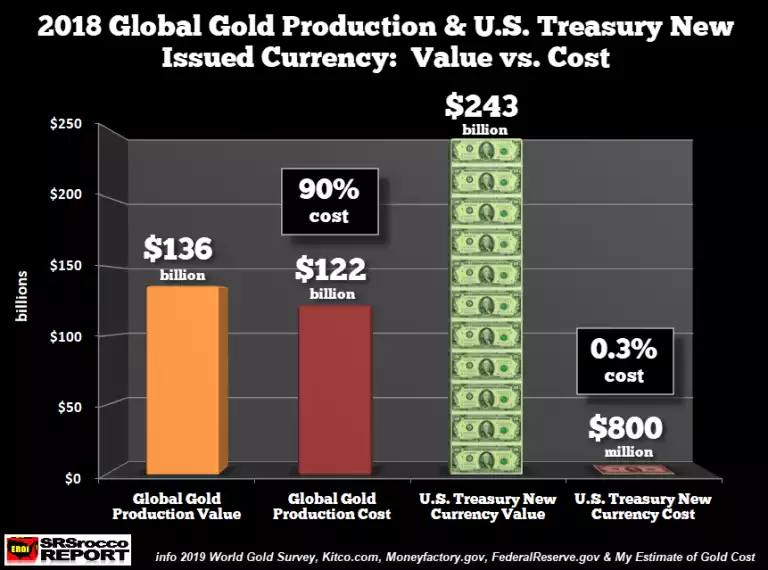

Those $243 billion of new notes, around 2.16billion pieces of paper, cost around $800m to produce (which also includes the cost of destroying the old ones). That is around $300 per note (already more than what they are worth) or maybe more relevantly 0.3%.

Gold on the other hand saw around 107m oz or $136 billion ‘created’ (mined) last year. SRSrocco estimate the cost of production for that last year’s gold was around $122 billion. So graphically the comparison looks like this:

As regular readers know too, this physically printed money pails into insignificance against the amount of digital money the Fed has created since the GFC ($4.5 trillion!). That digital money has largely gone to Wall St not Main St and hence the social divide forming. Note too in the first chart the growing predominance of $100 notes (now 80%) in what is being printed and ask yourself who is holding them. The story goes far beyond the fundamentals of what constitutes money. We are witnessing a well-worn path of abuse of power and privilege which history shows always ends badly for social equity and those ‘all in’ the financial system. At some stage that $300 trillion of financial ‘assets’ is going to rush for the (now) small $1.5 trillion gold space as they see their Fiat wealth disappear. Those who already own that gold will be the beneficiaries.

Let’s finish by revisiting some notable historic observations from a few guys you might know:

J P Morgan - “Gold is Money – everything else is credit”

George Bernard Shaw - "You have to choose [as a voter] between trusting to the natural stability of gold and the natural stability and intelligence of the members of the government. And with due respect to these gentlemen, I advise you, as long as the capitalist system lasts, to vote for gold."

Alan Greenspan - “In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.”