Gold Standard & Bubbles

News

|

Posted 24/04/2015

|

4124

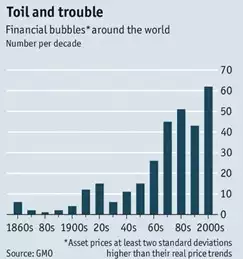

This week we have seen the IMF join the chorus of warnings from billionaires, financial analysts to other world authorities such as the BIS (Bank for International Settlements – which we reported HERE) about the dangers of the financial market bubbles caused by all this money printing and low rate stimulus. We’ve also seen evidence this week of how the ‘bandaids’ of derivatives dressed up as collateral are escalating wildly. The GFC was a crisis born of these very same debt derivatives nearly breaking the system and what have we done to fix it? Add more debt through stimulus. You see you can do that when you don’t have the forced discipline of a gold standard. When we left that gold standard in 1971 governments around the world all of a sudden could create Fiat currency out of thin air to run continual deficits and get re-elected and Wall Street could come up with more ways to financially engineer leverage into markets. This creates financial bubbles, and bubbles always go pop because they are unsustainable. The graph below tells the story very clearly. Just check out what happens when you leave a gold standard..

So whilst we don’t have a gold standard anymore we still have access to gold. Gold is the world’s oldest and most dependable store of wealth. That is why governments of the past used it to back currency and that is why central banks around the world are buying more and more of it (471t just last year) for reserves. If you look at the 5 worst sharemarket corrections we’ve had in the last 50 years, shares have lost on average 24% and gold gained 38% in each of those years. Gold is your hedge against the bubbles going pop and gold is your store of wealth when currency is created on more debt.