Gold Smashing ATH in Japanese Yen

News

|

Posted 21/04/2022

|

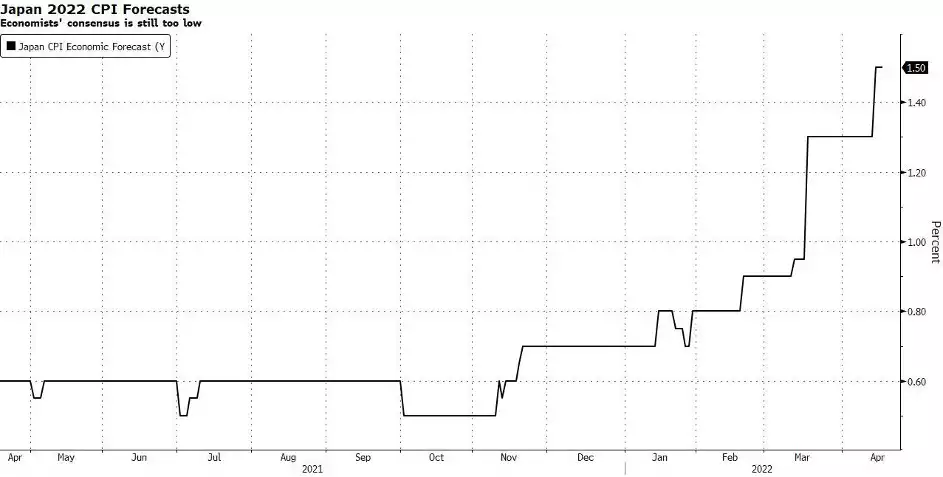

8593

The Yen may be one of the first dominoes to fall as the Japanese fiat currency has nose-dived in terms of gold purchasing power, even since the August 2020 highs. Japan is considered by many to be a test case for Modern Monetary Theory (MMT), where central planners decide whether free markets are allowed to liquidate. The 1989 Japanese Bubble high has been followed by persistent low economic growth. 30 years into the monetary experiment, quantitative easing has seen intermittent deflation and a culture of suppliers struggling to justify any price increase of any description. That has all changed post-pandemic, with CPI forecasts ramping up significantly since the start of 2022.

While in USD terms, spot gold has held back shy of all-time-highs set in August 2020, Gold has blown through previous technical barriers when denominated in Japanese Yen. There’s not a cup and handle to be seen in the land of the rising sun.

Japan is hardly an isolated case. There is evidence of monetary and fiscal regimes reaching breaking points all across the globe.

Following on from major downgrades from the IMF and World Bank covered in the news yesterday, Sri Lanka has defaulted on US$35.5bn of foreign debt as sharp commodity price rises lead to massive social unrest. Official sources report that the International Monetary Fund has begun bailout talks for Sri Lanka on Monday. Moodys has now downgraded bonds issued by the sovereign nation, and government officials are in Washington this week in crisis talks with the IMF.

Beset with food and petrol shortages, Sri Lankans have taken to the streets to protest. Protestors are decrying power cuts, expensive staples, driven by the lack of imports of basic supplies that the country relies on to maintain their current standards of living. Drivers are waiting for hours in line to fill up at the bowser. While reports from the peak medical body need to be taken with a grain of salt, there are warnings that lack of medicine will lead to widespread and easily avoided deaths in the South Asian nation, if the shortfall in supplies is not addressed.

In Europe, the Netherlands Chief CPI statistician blames high energy prices on ‘Putin’. Peter hein van Mulligen, the government official notionally in charge of reporting on CPI for the Dutch set out a number of reasons fuelling the recent 12% price increases felt across the national economy. The first was that “inflation data is hard to compare over time because of changing spending habits”. It may also be of course, that people eat more chicken when they can no longer afford beef. The second rationale was stated as the high inflation is due to individuals having different energy spending habits. One wonders how differently Dutch nationals choose to have their refrigerators turned on or their computers plugged in. Finally, despite inflation in the orange nation breaking multi-decade annualised monthly records of 7.6% in January, the current rates are blamed on Putin. According to the Dutch, the Russian leader is now one of the greatest climate activists in the world as he is pressuring individuals to reduce their consumption.

Ultimately, we are blessed/cursed to be living in ‘interesting’ times. Prices are changing in relation to one other at rates that few of us are used to dealing with. Gold remains as a transcendent store of value buffeted by the waves of the currencies that buoy it. While fiat currencies issued by various nation states will always have their time in the sun, only precious metals stand the test of time.

As an update on the launch of our own gold and silver backed NFT’s yesterday, we saw Gold Silver Pirates claim the top trending spot in all categories on the world’s biggest NFT marketplace, OpenSea, and sits at 29th on the 24 hr trade volume with over $1m worth being sold yesterday. You can learn more about this exciting new way to buy gold and silver here > https://goldsilverpirates.com/