“Capex Lead Inflation & the Fed Trap”

News

|

Posted 02/06/2022

|

8324

Yesterday we presented the first of a 2 part review of Crescat Capital’s latest research letter that presents a counter position to that presented by Raoul Pal and others on Monday. Yesterday spoke to how grotesquely overvalued US equities still are except for commodities. Today we look at the $300 trillion question of whether inflation is going to stay or quickly disappear as Pal posits.

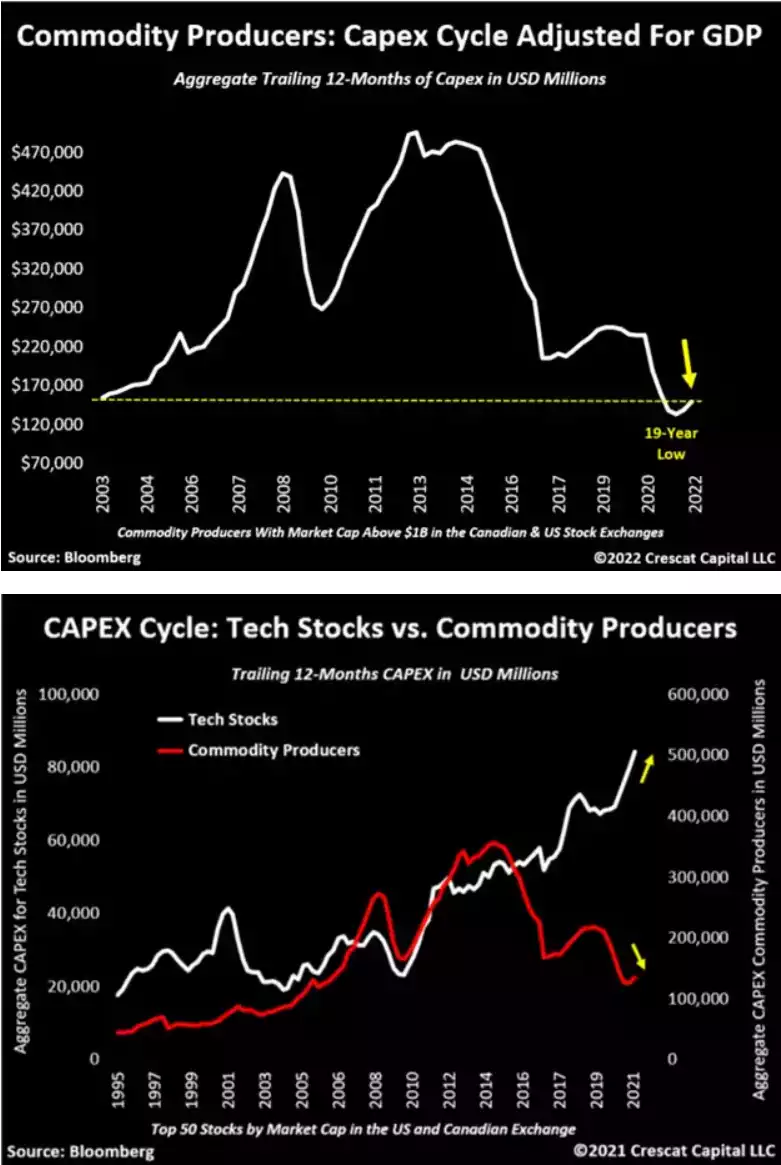

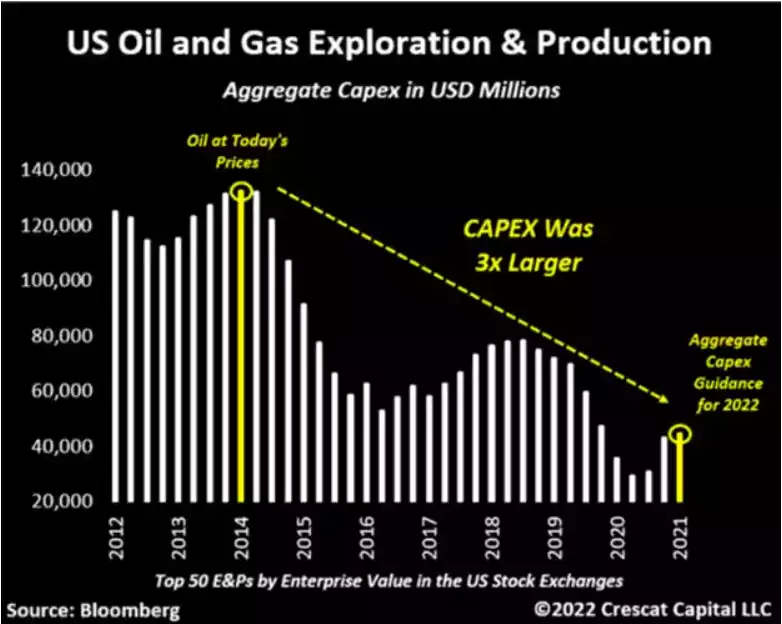

“It is All About the CAPEX Cycle

The macro case for inflation being around at a higher rate for longer and contributing to a further bear market in financial assets is based first and foremost on structural commodity supply shortages today. There has been a multi-year declining investment trend in capital expenditures of commodity producers necessary to boost output. This is in large part the result of a policy error based on an aggressive green agenda that has lacked the foresight and coordination with industry for a viable clean energy transition. Instead of cooperating with companies that produce critical commodities necessary for food, energy, and basic materials, environmental, social and government policy makers have attacked these industries. The onslaught has translated into a multi-year declining trend of investment in these critical sectors of the economy despite ongoing global population growth and inelastic demand for the resources they produce. These industries have long lead times, so output cannot be ramped up without years of increased investment. As a result, the world now faces a commodity supply cliff and likely parabolic increase in energy and food prices. As the three charts below illustrate, the underinvestment in commodities has been a slow-motion train wreck. In our view, it will lead to crippling stagflation over the medium term, and it is only the beginning.

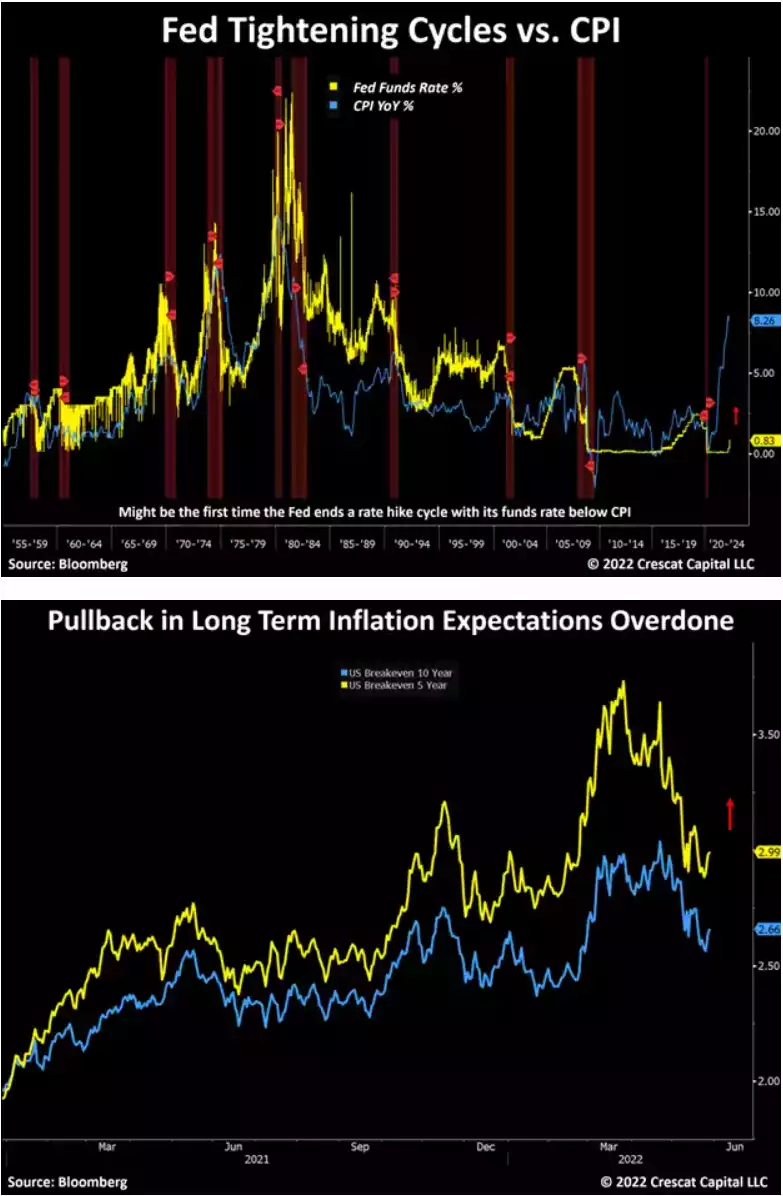

The Fed is Trapped

The Fed’s main policy tool for fighting inflation is to hike interest rates. This reduces the demand side of the economy by tightening credit conditions and causing financial asset prices to decline which crimps investor savings and consumer demand and increases unemployment. But raising interest rates does not stimulate commodity supplies, the core inflationary problem today. In fact, raising interest rates could have the opposite effect because it makes the cost of capital for investment in new commodity production higher.

After years of money printing and interest rate suppression, policy makers have created a historic speculative environment in financial assets. But now, the inflation genie is out of the bottle, and to restore its credibility, the Fed has no choice but to burst the bubble. At the same time, it is powerless to stop commodity inflation. To illustrate just how trapped the Fed is, it has never ended a hiking cycle with the Fed Funds Rate below CPI. But the implied terminal rate in the Fed Funds Futures market is now just 2.9% in early 2023 while CPI is still at 8.3%. If the efficient market hypothesis holds, which it rarely does, CPI must drop precipitously over the next three quarters. Such is highly unlikely based on our commodity supply analysis shown above. There is a much bigger risk based on our work that inflation stays elevated, and the Fed ends up having to hike more and for longer than is currently priced in, as in all past tightening cycles. Alternatively, there is the risk that the stock market correction continues under the existing planned increases and the Fed panics and ends its hiking cycle for the first time with real rates still in negative territory. In all cases, the market seems to be in state of delusion today with the average participant still buying the dip in overvalued tech, crypto, and fixed income assets, hoping for a return to those manias, while underestimating the risk of continued high inflation in valuable, scarce, tangible resources.”

Whilst the two views are quite divergent, both Pal et al and Crescat still end up with the same bullish conclusion when it comes to precious metals. Rarely does an investment asset present such a win win scenario. Digging deeper into precious metals we see Pal more bullish gold and Crescat more bullish silver. As always we believe balance is your friend.