Bitcoin’s Santa Rally

News

|

Posted 22/12/2020

|

19112

The bitcoin price, even after slightly falling back to US $22,800, is up 206% over the last 12 months as governments ramp up spending in the wake of coronavirus lockdowns, investors look to bitcoin as a hedge against inflation, and institutional interest in bitcoin rises.

The bitcoin and cryptocurrency community has been celebrating the bitcoin price's return to its all-time highs, with many long-term cryptocurrency investors feeling vindicated after three years out in the cold.

"We're now officially in uncharted territory," Ian Balina, the chief executive of Washington DC-based bitcoin and cryptocurrency data company Token Metrics said, adding he thinks the bitcoin price could climb to around "$50,000 within the next few years."

"I think low $20,000 is just the beginning," said JP Thieriot, chief executive of California-based bitcoin and cryptocurrency exchange Uphold.

"This upward trend is likely to continue for months to come, as investors continue buying into consumer-style digital platforms that offer greater access to these markets than traditional financial service providers do."

"As we come to the end of what has been an iconic year for bitcoin, I can only see more positive growth in 2021," the chief executive of Isle of Man-based bitcoin and cryptocurrency exchange CoinCorner Danny Scott said, pointing to U.S. business intelligence company MicroStrategy adding bitcoin to its corporate treasury and payments giant PayPal rolling out bitcoin buying and spending services as primary drivers of the 2020 bitcoin bull run.

Bitcoin's surge over $20,000 comes after a Reuters report claiming fund manager Ruffer Investment Management has moved around $675 million of its clients' money into bitcoin. Earlier reports had suggested the London-based firm, which manages around $27 billion worth of assets, had allocated a far smaller sum to bitcoin.

"Compared to 2017 when demand came from the retail market, this will eventually happen again, of course, the current demand is coming from an institutional level completely flying under the radar for many people and it looks set to continue through 2021," Scott added.

MicroStrategy has bought around $1 billion of bitcoin so far this year. Other companies have followed MicroStrategy's lead and several high-profile investors have named bitcoin as a potential hedge against the inflation they see on the horizon.

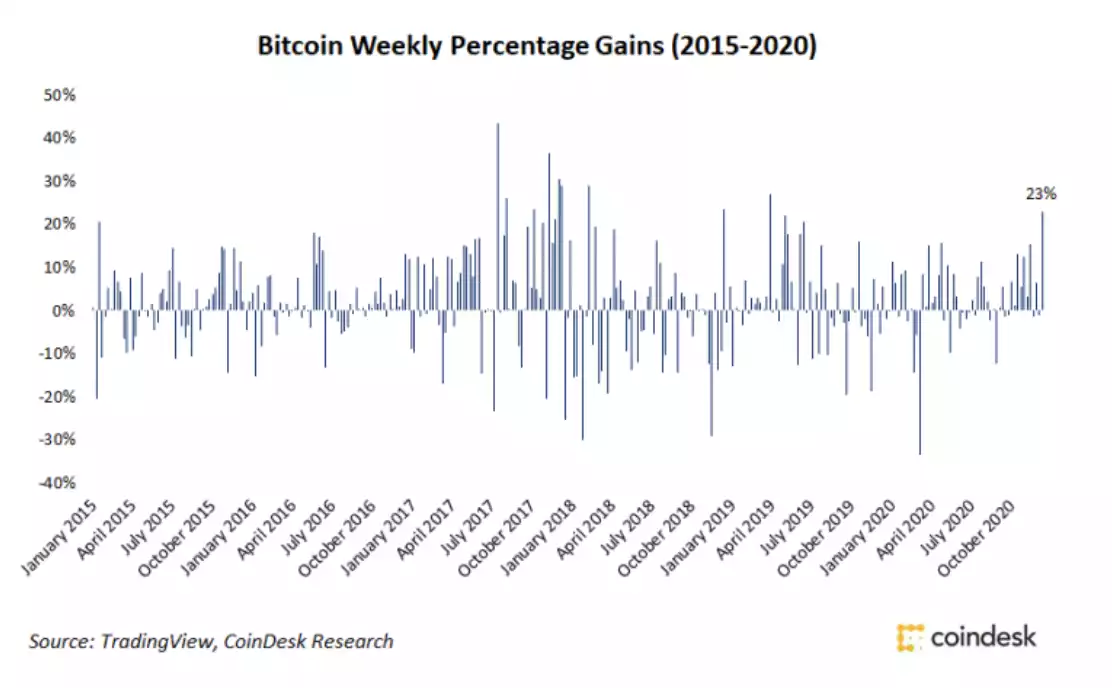

Only nine other times in the past five years has bitcoin seen a weekly gain larger than the one posted this week. As the new trading week starts, CME bitcoin futures opened at $23,600, just over 3% higher than their close on Friday.

Strong weekend buying pressure has caused CME bitcoin futures to open Sunday trading at higher prices than the previous Friday's close for 10 of the past 12 weeks.

Christopher Wood, global head of equity strategy at investment firm Jefferies, is said to have trimmed 5% of his gold exposure and allocated it to bitcoin. Scott Minerd, chief investment officer at Guggenheim Partners, told Bloomberg his firm's analysis shows bitcoin should be worth $400,000.

The sizable year-end move in bitcoin is giving some investors in the space a flashback to the big run-up seen in 2017. Bitcoin prices surged to $17,000 by mid-December 2017, only to plunge to $3,100 or so a year later as speculators were crushed under the weight of their own greed and a raft of unfriendly news.

However, it is unreasonable to suggest that we are in the same market as 2017 – this time it’s the big money buying and we are in a completely different macroeconomic space. Newfound institutional demand for bitcoin, ever-strengthening fundamentals and technicals all make the case that these prices are around to stay.