Gold & Silver Holdings Surge on NFP & Oil

News

|

Posted 06/04/2020

|

14573

The Aussie weekend saw a couple of significant events globally that potentially have huge implications for gold.

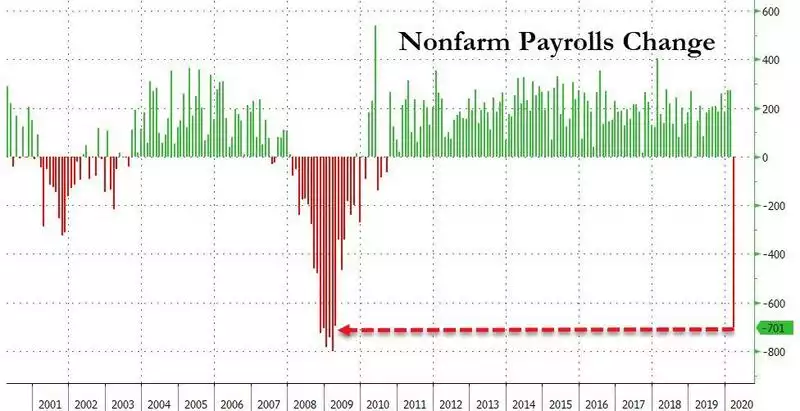

Firstly Friday night saw the all important NFP official employment figures for the US. The experts were predicting 100,000 fewer employed but the official print was an incredible 701,000 drop from the month before. Last week we reported the nearly 10m jobs lost over the 2 weeks according to the initial jobless claims report, so 700,000 may not seem that bad? The latest NFP report only covers up to 12 March and so missed a lot of that. From Bloomberg’s economists:

“Workers who were paid for just a few hours during the early part of the month were still counted as a nonfarm payroll, so the March data are only an early snapshot illustrating the start of unprecedented job losses -- in terms of both speed and magnitude -- in the economy. April job losses will be at least 30 times larger, in the vicinity of 20 million. Unemployment will soar toward 15% next month.”

Needless to say that is a massive number and one that will likely see even more stimulus unleashed by the Fed and the White House, further flooding the system with freshly printed USD’s.

Secondly, the much anticipated truce amongst OPEC, Russia and the US broke down. Whilst that might seem like good news for lower oil and fuel costs, the reality is that the agenda of the Saudi’s (and Russia?) to crush the expensive US shale oil industry is still in full play and the implications for all the junk debt on issue to support it as well.

Putin came out and straight out called the Saudi’s on it, saying:

“This was apparently linked to efforts by our partners from Saudi Arabia to eliminate competitors who produce so-called shale oil….To do that, the price needs to be below $40 a barrel. And they succeeded in that. But we don’t need that, we never set such a goal.”

That this could come from the supposed US ally of Saudi has far reaching implications.

This is not getting the mainstream press attention it deserves and sits as one of the many new Black Swans to land in addition to the virus. On opening in Asia this morning Brent plummeted 12% after having rallied to $35 on expectations of the truce.

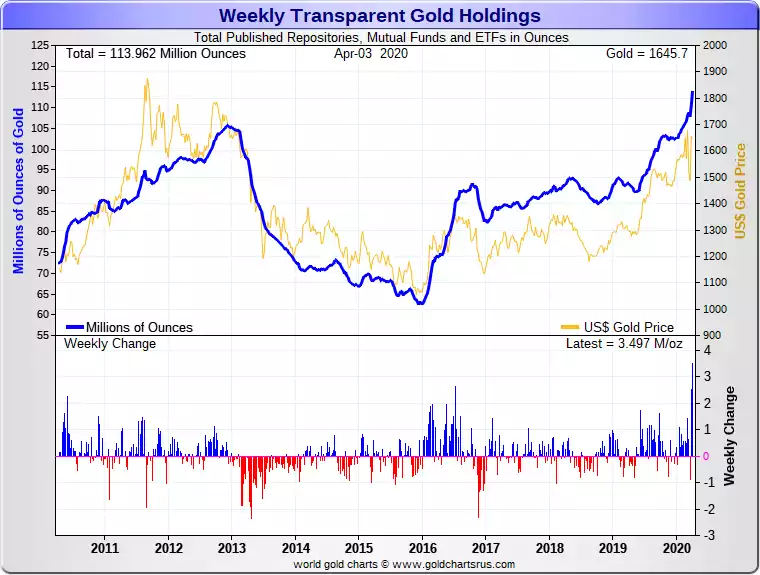

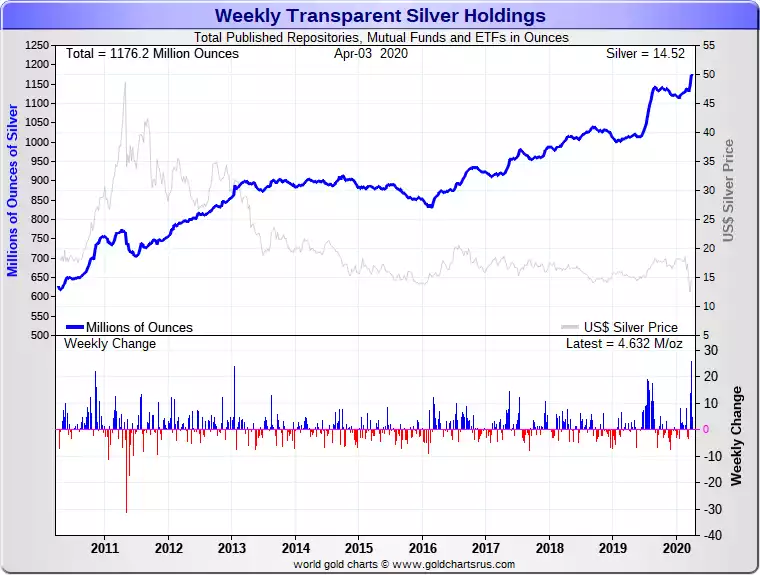

Not surprisingly then we have seen more and more money pour into gold and silver. The 2 charts below map the total holdings in all known depositories, mutual funds and ETFs, as of the close of business on Friday for both gold and silver. In just one week we saw 108 tonne of gold and 144 tonne of silver added. For context 108 tonne of gold is 4.4% of the total global mine production for 2019. In one week…