Gold Holdings Surge

News

|

Posted 08/02/2019

|

5991

More red on Wall Street last night as markets seesaw on good news / bad news on the US / China trade wars and Brexit. On any level though financial markets are looking concerning. The correlation between ‘concern’ on financial markets and gold flows into ETF’s is strong.

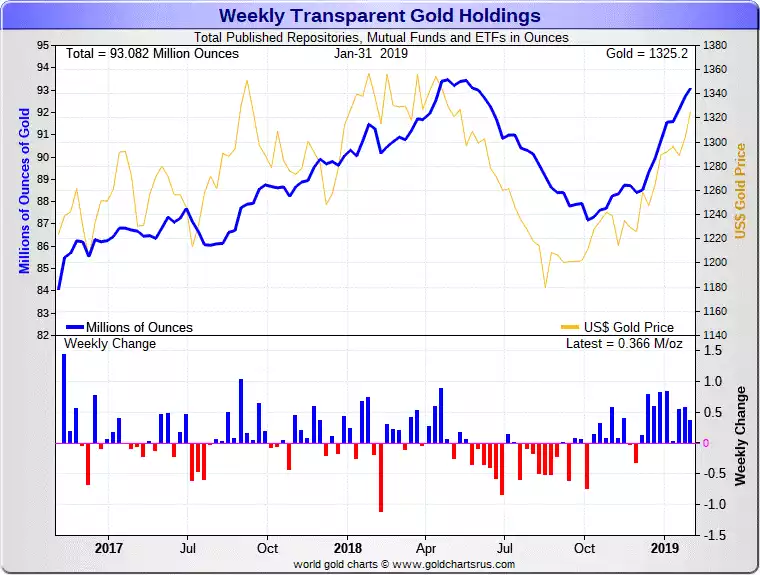

The World Gold Council have just released the monthly flows of gold into ETF’s for January. Unsurprisingly there was strong growth in that month where we saw continued concern around global financial markets despite (and with great scepticism toward) the rally on Wall St.

“Holdings in global gold-backed ETFs and similar products rose in January by 72 tonnes (t) to 2,513t, equivalent to US$3.1bn in inflows, marking the fourth consecutive month of net inflows. Notably, total holdings have not been this high since March 2013, when the price of gold was 22% higher. Global gold-backed ETF holdings have grown 6% over the past two months, driven by market uncertainty and a shift in sentiment that drove the price of gold 3.5% higher in January alone. Global assets under management (AUM) rose by 6% in US dollars to US$107bn over the month.”

“Global stock markets rebounded off the Christmas Eve low and finished the month up ~7% on average – the strongest monthly start to the year since 2003. However, market uncertainty remains a concern, especially as the impact of the US Government shutdown is yet to be assessed, Brexit is far from being resolved and trade negotiations continue. In addition, the Fed has signalled a ‘wait and see’ approach and other central banks may follow suit. We anticipate this will support gold prices”

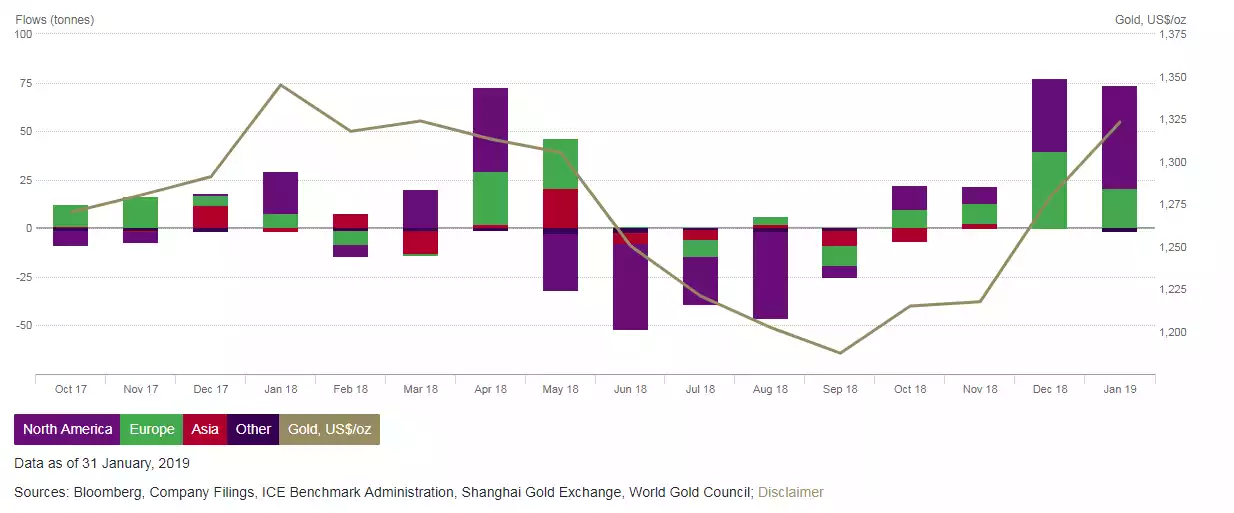

Last time we reported this we noted how Europe was a buyer of gold last year when North America was dumping it as ‘everything was awesome’ on the rally from March to October. The chart below from WGC paints a very clear picture:

Correspondingly, look at the S&P500 over the same period:

Last year we saw markets correct in January and February and correspondingly we saw flows of gold into ETF’s, particularly North America, surge. Then shares took off again, everything was awesome and gold flowed out until America realised things weren’t really that awesome after all, that maybe tax cuts and deficit spending weren’t really a long term strategy, trade wars with China were maybe a little problematic, and of course there’s the Fed raising rates… The fact that the gold price and inflows are still strong despite the rebound in shares is a clear indication the market isn’t fully buying this recovery. They want their hedge in place.

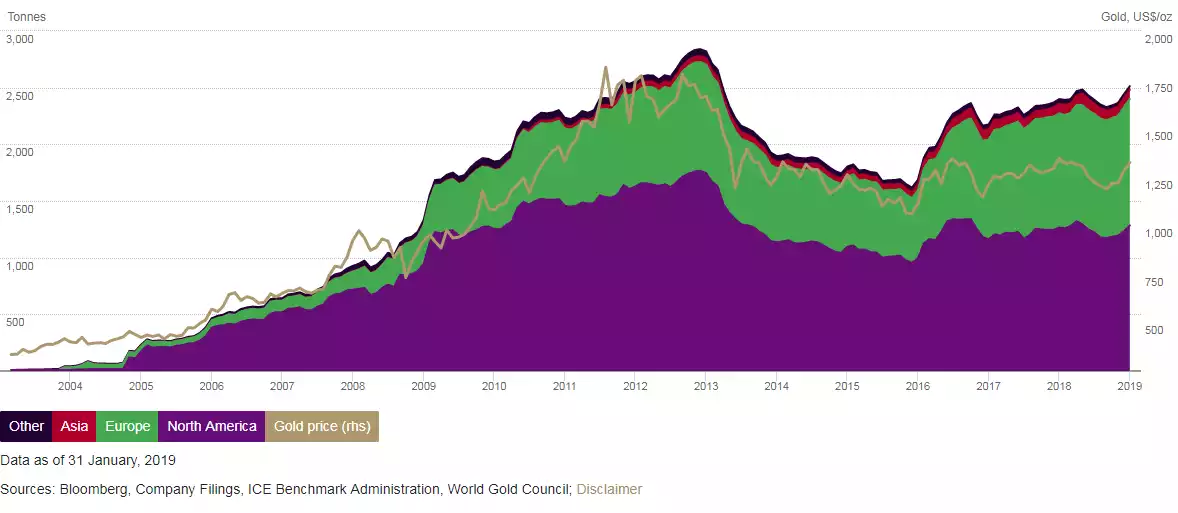

Another interesting observation from the latest WGC report is the current total holdings by region (chart below). You can see the extent to which Europe has grown relative to North America. As we’ve discussed previously, the Euro zone is struggling economically and clearly there is more concern playing out via gold holdings. The narrative of America being great again is clearly not playing out and hence the reversal you can see above. The second clear observation is the Asian markets prefer their gold in their hands not in a derivative like an ETF. They are likely thinking that gold is one of the only assets with no counterparty risk, so why introduce it by trusting those issuing you that ‘paper promise’? We discussed this in greater length here and showed the enormous difference between total ETF inflows and Chinese consumption. If you missed it, it’s worth a read.

The chart below shows a broader picture of total gold holdings which in addition to ETF’s includes COMEX and Mutual Funds as well. Again you can see the strong gains since October.

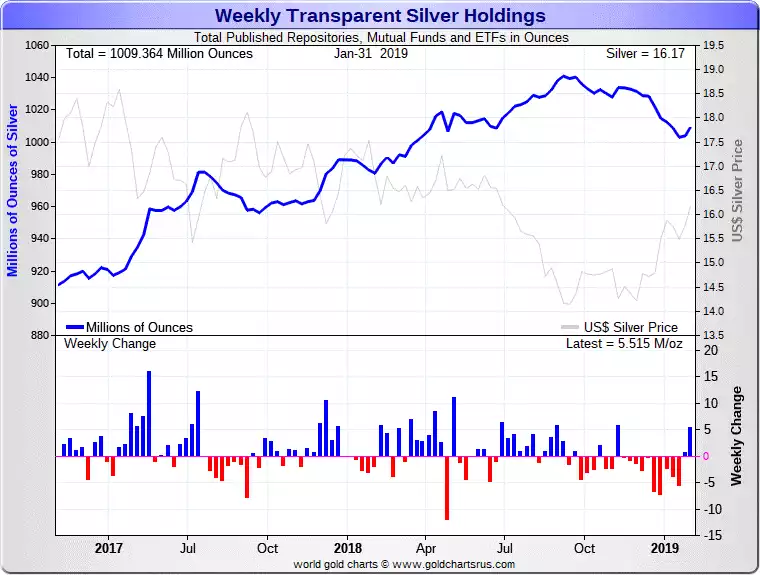

Curiously silver holdings dropped from October but have just recommenced increasing with 5.5m oz added last week.